Frontier Airlines 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has recorded within accumulated other comprehensive loss settlements of derivative transactions from prior

periods. Such amounts are reclassified to interest expense over the term of the respective aircraft debt. During 2008, 2007 and 2006,

the Company reclassified $720, $761 and $299 to interest expense, respectively. The Company expects to reclassify $676 to interest

expense for the year ending December 31, 2009.

In March 2008, in anticipation of financing the purchase of E175 aircraft on firm order with the manufacturer, the Company

entered into 21 interest rate swap agreements for a notional amount of $420,000 and a weighted average interest rate of 4.3%. In April

2008, the Company terminated the interest rate swap agreements resulting in a gain and cash proceeds of $5,785, which is recorded in

interest and other income in its consolidated statements of income.

Cash and Cash Equivalents—Cash equivalents consist of money market funds and short-term, highly liquid investments

with maturities of three months or less when purchased. Substantially all of our cash is on hand with two banks.

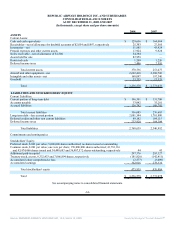

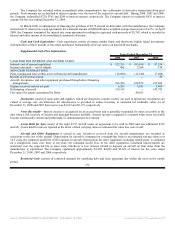

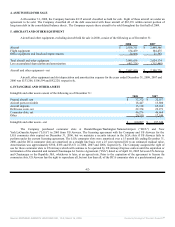

Supplemental Cash Flow Information:

Years Ended December 31,

2008 2007 2006

CASH PAID FOR INTEREST AND INCOME TAXES:

Interest—net of amount capitalized $ 122,355 $ 105,818 $ 87,254

Income taxes paid — net of refunds 483 1,388 518

NON-CASH TRANSACTIONS:

Parts, training and lease credits received from aircraft manufacturer (14,900) (12,540) (7,860)

Receipt of US Airways stock — — 50

Aircraft, inventories, and other equipment purchased through direct financing

arrangements 526,200 438,252 235,260

Engines received and not yet paid 6,283 3,281 3,464

Refinancing of aircraft 139,145 — 147,792

Fair value of warrants surrendered by Delta — 49,103 —

Inventories consist of spare parts and supplies, which are charged to expense as they are used in operations. Inventories are

valued at average cost. An allowance for obsolescence is provided to reduce inventory to estimated net realizable value. As of

December 31, 2008 and 2007 this reserve was $3,632 and $2,157, respectively.

Notes Receivable—Interest income is recognized on an accrual basis and is generally suspended for notes receivable at the

date when a full recovery of income and principal becomes doubtful. Interest income recognition is resumed when notes receivable

become contractually current and performance is demonstrated to be resumed.

Assets Held for Sale consist of the eight E135 aircraft under an agreement to be sold in 2009 and one additional E135

aircraft. Assets held for sale are reported at the lower of their carrying value or estimated fair value less costs to sell.

Aircraft and Other Equipment is carried at cost. Incentives received from the aircraft manufacturer are recorded as

reductions to the cost of the aircraft. Depreciation for aircraft is computed on a straight-line basis to an estimated salvage value over

16.5 years, the estimated useful life of the regional jet aircraft. Depreciation for other equipment, including rotable parts, is computed

on a straight-line basis over three to ten years, the estimated useful lives of the other equipment. Leasehold improvements are

amortized over the expected life or lease term, whichever is less. Interest related to deposits on aircraft on firm order from the

manufacturer is capitalized. The Company capitalized approximately $2,205, $4,056 and $2,021 of interest for the years ended

December 31, 2008, 2007 and 2006, respectively.

Restricted Cash consists of restricted amounts for satisfying debt and lease payments due within the next twelve month

period.

-39-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠