Duke Energy 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DUKE ENERGY 2006 SUMMARY ANNUAL REPORT 7

Using a diverse mix of fuels and technologies at our

new plants to limit our future price, reliability and

environmental risks. One of the reasons our average

price for electricity is below the national average is that

98 percent of our energy is generated from coal and

nuclear power.

For our Cliffside Station, we proposed building two new

800-megawatt units using supercritical coal technology.

This is the most environmentally efficient pulverized coal

technology available today. Because of their increased

efficiencies, these plants typically burn 10 percent less

coal than conventional units and emit significantly less

sulfur dioxide and nitrogen oxide.

As I was finishing this letter, we received a notice of deci-

sion from the North Carolina Utilities Commission (NCUC),

which authorized building one of the two units. The com-

mission also accepted our commitment to invest 1 percent

of our revenues in the Carolinas for energy efficiency,

subject to appropriate regulatory treatment, and our

plan to retire older, less efficient units.

Our cost estimates were based on two units, and we still

need an air permit for this project. So as you read this,

we are studying the Cliffside project to determine how to

proceed. We won’t make a decision until we have a clearer

understanding of the overall costs as well as the conditions

of the air permit. We are also evaluating the possibility

of enhancing and accelerating natural gas-fired plants

in our portfolio.

In Indiana, we continue to explore development of a new

630-megawatt IGCC plant. IGCC technology is less proven,

but has the potential to significantly reduce emissions.

Additionally, the geology of the plant location is conducive

to underground storage of captured carbon emissions.

We believe that investing in this next generation of coal-

plant technology is an important part of meeting our

environmental commitments.

Because the Cliffside and IGCC projects use more

environmentally friendly technologies, they were authorized

for significant federal tax credits by the U.S. Department

of Energy upon their completion. This is further evidence

that Duke Energy is on the forefront of new cleaner

coal technology.

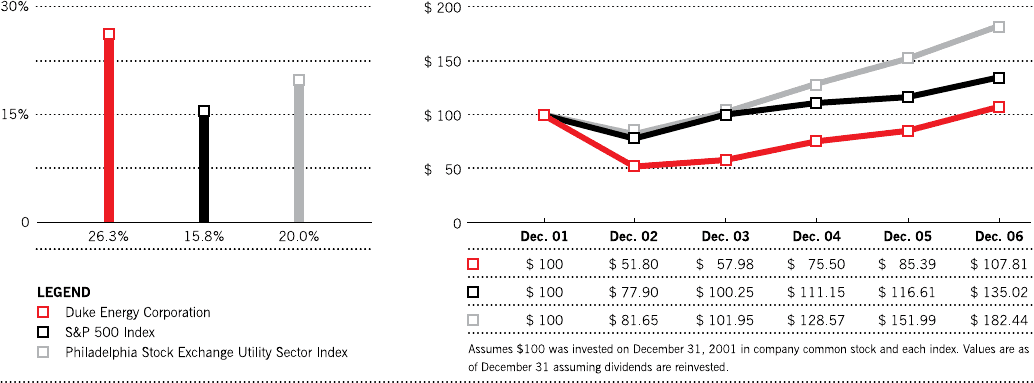

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

COMPARISON OF 2006 TOTAL RETURN

OVER A FIVE-YEAR PERIOD BEGINNING DECEMBER 31, 2001, DUKE ENERGY’S TOTAL SHAREHOLDER RETURN (TSR) HAS LAGGED BOTH

THE S&P 500 INDEX AND THE PHILADELPHIA STOCK EXCHANGE UTILITY INDEX. BUT, IN 2006, INVESTORS RESPONDED FAVORABLY TO THE

DECISIVE ACTIONS WE TOOK TO LOWER OUR RISK PROFILE AND REPOSITION DUKE ENERGY AS A LEADING PURE-PLAY ELECTRIC COMPANY.

DUKE ENERGY’S TSR FOR 2006 (PRE-SPINOFF OF SPECTRA ENERGY) WAS 26.3 PERCENT, WHICH EXCEEDED

THE PHILADELPHIA STOCK EXCHANGE UTILITY SECTOR INDEX (20 PERCENT) AND THE S&P 500 INDEX (15.8 PERCENT).