Duke Energy 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

SOLVING THE NEW ENERGY EQUATION:

CHANGING MINDS AND CHANGING HABITS

Our actions in 2006 put us in a strong position to grow

as we address the variables of the new energy equation:

Building new power plants to meet steadily

increasing demand

Using a diverse mix of fuels and technologies at

our new plants to limit our future price, reliability

and environmental risks

Deploying new technologies to modernize our

transmission and distribution grids to boost

efficiency and reliability, and to support new

energy efficiency initiatives

Obtaining legislation and regulatory treatment that

will let us recover our financing costs as we build new

and more efficient power plants (megawatts) and as

we promote energy efficiency (“save-a-watts”) with

new initiatives on both sides of the meter

Realizing the efficiencies and cost savings from the

merger while maintaining our operational excellence, and

Shaping new federal rules that limit carbon emissions

to ensure our customers and other stakeholders are

fairly treated.

We will solve the new energy equation by challenging

conventional wisdom. We will invest in new technology.

We will balance the variables by working collaboratively

with all stakeholders to find the best and fairest solutions.

Let me briefly highlight each variable and spell out our

strategy for addressing it. This will also give you a good

overview of our near-term and long-term growth strategies.

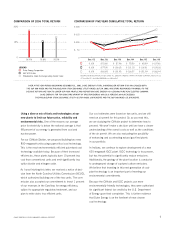

Building new power plants to meet steadily increasing

demand. In the Carolinas, we are adding between 40,000

and 60,000 new customers annually. In Indiana, Kentucky

and Ohio, we are adding 11,000 to 16,000 new custom-

ers each year. For the next three years, we expect annual

kilowatt-hour sales growth of about 1.5 percent in the

Carolinas and about 1 percent in the Midwest.

We are required by law to meet the electric power needs

of our customers as economically and reliably as possible.

Each year, we perform an extensive analysis to update our

■

■

■

■

■

■

forecasts for customer power demand and study all viable

and economical options to meet that demand. In the past,

we have been successful in meeting our customer growth

by operating our power plants efficiently, by purchasing

peaking power plants and by buying power on the whole-

sale market as needed.

Today’s growth projections suggest that we will need

to increase our generating capacity by approximately

6,400 megawatts over the next 10 years. Most of this

new capacity will be in the Carolinas, and the remainder

in Indiana.

Even now, we need nearly 1,500 megawatts of new gener-

ation in Ohio to meet existing demand. We plan to build or

buy new generation there if the state enacts legislation that

will allow utilities to own generation facilities.

Our newest base load plants — those designed to operate

around the clock — were completed in 1986 in the

Carolinas and in 1991 in the Midwest. It takes six to

10 years to plan, permit and construct such plants. We

are seeking permits now for plants that we’ll need in

2011, when we expect to have more than 250,000

additional customers.

We anticipate annual capital expenditures of approximately

$3.5 billion from 2007 through 2009 for expansion of our

generation capacity, environmental retrofits, nuclear fuel,

maintenance and other expenses. Included in this amount

is expansion capital for:

Expanding generation in North Carolina

Planning a new cleaner-coal integrated gasification

combined cycle (IGCC) plant in Indiana, and

Exploring the development of a new nuclear plant in

South Carolina.

We expect that new generation and other infrastructure

investments over the next three years will increase the

total rate base in our five states by about 25 percent from

the current $16 billion to $20 billion (less depreciation

and amortization). The returns generated from a growing

rate base will ultimately translate into long-term earnings

growth — and we expect our rates to remain below the

national average.

■

■

■