Duke Energy 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

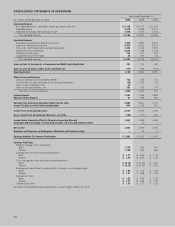

CONSOLIDATED STATEMENTS OF COMMON STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

Accumulated Other Comprehensive Income (Loss)

Net Gains Minimum

Common Additional Foreign (Losses) on Pension SFAS

Stock Common Paid-in Retained Currency Cash Flow Liability No. 158

(In millions) Shares Stock Capital Earnings Adjustments Hedges Adjustment Adjustment Other Total

Balance December 31, 2003 911 $ 9,513 $ — $ 4,066 $315 $ 298 $(444) $ — $ — $ 13,748

Net income — — — 1,490 — — — — — 1,490

Other Comprehensive Income

Foreign currency translation adjustments — — — — 279 — — — — 279

Foreign currency translation adjustments

reclassified into earnings as a result of

the sale of Asia-Pacific Business — — — — (54) — — — — (54)

Net unrealized gains on cash flow hedges b — — — — — 311 — — — 311

Reclassification into earnings from

cash flow hedges c — — — — — (83) — — — (83)

Minimum pension liability adjustment d — — — — — — 28 — — 28

Total comprehensive income 1,971

Dividend reinvestment and employee benefits 5 128 — — — — — — — 128

Equity offering 41 1,625 — — — — — — — 1,625

Common stock dividends — — — (1,018) — — — — — (1,018)

Preferred and preference stock dividends — — — (9) — — — — — (9)

Other capital stock transactions, net — — — (4) — — — — — (4)

Balance December 31, 2004 957 $11,266 $ — $ 4,525 $540 $ 526 $(416) $ — $ — $ 16,441

Net income — — — 1,824 — — — — — 1,824

Other Comprehensive Income

Foreign currency translation adjustments a — — — — 306 — — — — 306

Net unrealized gains on cash flow hedges b — — — — — 413 — — — 413

Reclassification into earnings from

cash flow hedges c — — — — — (1,026) — — — (1,026)

Minimum pension liability adjustment d — — — — — — 356 — — 356

Other f — — — — — — — — 17 17

Total comprehensive income 1,890

Dividend reinvestment and employee benefits 3 85 — — — — — — — 85

Stock repurchase (33) (933) — — — — — — — (933)

Conversion of debt 1 28 — — — — — — — 28

Common stock dividends — — — (1,093) — — — — — (1,093)

Preferred and preference stock dividends — — — (12) — — — — — (12)

Other capital stock transactions, net — — — 33 — — — — — 33

Balance December 31, 2005 928 $10,446 $ — $ 5,277 $846 $ (87) $ (60) $ — $ 17 $ 16,439

Net income — — — 1,863 — — — — — 1,863

Other Comprehensive Income

Foreign currency translation adjustments — — — — 103 — — — — 103

Net unrealized gains on cash flow hedges b — — — — — 6 — — — 6

Reclassification into earnings from

cash flow hedges c — — — — — 36 — — — 36

Minimum pension liability adjustment d — — — — — — (1) — — (1)

Other f — — — — — — — — (15) (15)

Total comprehensive income 1,992

Retirement of old Duke Energy shares (927) (10,399) — — — — — — — (10,399)

Issuance of new Duke Energy shares 927 1 10,398 — — — — — — 10,399

Common stock issued in connection

with Cinergy merger 313 — 8,993 — — — — — — 8,993

Conversion of Cinergy options to

Duke Energy options — — 59 — — — — — — 59

Dividend reinvestment and employee benefits 6 22 172 — — — — — — 194

Stock repurchase (17) (69) (431) — — — — — — (500)

Common stock dividends — — — (1,488) — — — — — (1,488)

Conversion of debt to equity 27 — 632 — — — — — — 632

Tax benefit due to conversion of debt to equity — — 34 — — — — — — 34

Adjustment due to SFAS No. 158 adoption e — — — — — — 61 (311) — (250)

Other capital stock transactions, net — — (3) — — — — — — (3)

Balance December 31, 2006 1,257 $ 1 $19,854 $ 5,652 $949 $ (45) $ — $(311) $ 2 $ 26,102

a Foreign currency translation adjustments, net of $62 tax benefit in 2005. The 2005 tax benefit related to the settled net investment hedges (see Note 8 to the Consolidated Financial Statements in

Duke Energy’s 2006 Form 10-K). Substantially all of the 2005 tax benefit is a correction of an immaterial accounting error related to prior periods.

b Net unrealized gains on cash flow hedges, net of $3 tax expense in 2006, $233 tax expense in 2005, and $170 tax expense in 2004.

c Reclassification into earnings from cash flow hedges, net of $19 tax expense in 2006, $583 tax benefit in 2005, and $45 tax benefit in 2004. Reclassification into earnings from cash flow hedges

in 2006, is due primarily to the recognition of Duke Energy North America’s (DENA) unrealized net gains related to hedges on forecasted transactions which will no longer occur as a result of the sale

to LS Power of substantially all of DENA’s assets and contracts outside of the Midwestern United States and certain contractual positions related to the Midwestern assets (see Notes 8 and 13 to the

Consolidated Financial Statements in Duke Energy’s 2006 Form 10-K).

d Minimum pension liability adjustment, net of $0 tax benefit in 2006, $228 tax expense in 2005, and $18 tax expense in 2004.

e Adjustment due to SFAS No. 158 adoption, net of $144 tax benefit in 2006. Excludes $595 recorded as a regulatory asset (see Note 22 to the Consolidated Financial Statements in Duke Energy’s

2006 Form 10-K).

f Net of $9 tax benefit in 2006, and $10 tax expense in 2005.

See Notes to Consolidated Financial Statements in Duke Energy’s 2006 Form 10-K.

DUKE ENERGY 2006 SUMMARY ANNUAL REPORT 33