Duke Energy 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

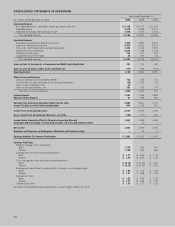

NON-GAAP FINANCIAL MEASURES

2006 AND 2005 ONGOING DILUTED EARNINGS

PER SHARE (“EPS”)

Duke Energy’s 2006 Summary Annual Report references

2006 and 2005 ongoing diluted EPS of $1.81 and $1.73,

respectively. Ongoing diluted EPS is a non-GAAP (generally

accepted accounting principles) financial measure, as it

represents diluted EPS from continuing operations plus the

per-share effect of any discontinued operations from our Crescent

Resources real estate development company (“Crescent”) prior to

the deconsolidation of Crescent in September 2006, adjusted for

the per-share impact of special items. Special items represent

certain charges and credits which management believes will not

be recurring on a regular basis. The following is a reconciliation

of reported diluted EPS from continuing operations to ongoing

diluted EPS for 2006 and 2005:

2006 2005

Diluted EPS from continuing operations, as reported $ 1.70 $ 2.60

Diluted EPS from discontinued operations, as reported (0.13) (0.72)

Diluted EPS, as reported 1.57 1.88

Adjustments to reported EPS:

Diluted EPS from discontinued operations

excluding Crescent Resources,

and cumulative effect of change

in accounting principle 0.13 0.73

Diluted EPS impact of special items

(see detail below) 0.11 (0.88)

Diluted EPS, ongoing $1.81 $1.73

The following is the detail of the $(0.11) in special items impact-

ing diluted EPS for 2006:

2006

Diluted

Pre-Tax Tax EPS

(In millions, except per-share amounts) Amount Effect Impact

Natural Gas Transmission gain on

contract settlement $ 24 $ (8) $ 0.01

Duke Energy portion of gain on

Duke Energy Field Services’

(“DEFS”) asset sale 14 (5) 0.01

Costs to achieve the Cinergy merger (128) 45 (0.07)

Costs to achieve the spinoff of Spectra Energy (60) 7 (0.05)

Impairment of Campeche investment (50) — (0.04)

Gain on sale of interest in Crescent 246 (124) 0.10

Gain related to the issuance of units

of Natural Gas Transmission’s Canadian

income fund 15 (5) 0.01

Settlement reserves (165) 58 (0.09)

Impairment of Bolivia investment (28) 31 —

Tax adjustment — 8 0.01

Total Diluted EPS impact $(0.11)

The following is the detail of the $0.88 in special items impacting

diluted EPS for 2005:

2005

Diluted

Pre-Tax Tax EPS

(In millions, except per-share amounts) Amount Effect Impact

Gain on sale of TEPPCO GP

(net of minority interest of

$343 million) $791 $(293) $ 0.51

Gain on sale of TEPPCO LP units 97 (36) 0.06

Loss on de-designation of Field Services’

hedges, net of settlements on

2005 positions (23) 9 (0.01)

Additional liabilities related to

mutual insurance companies (28) 10 (0.02)

Gain on transfer of 19.7 percent

interest in DEFS to ConocoPhillips 576 (213) 0.37

Impairment of Campeche investment (20) 6 (0.01)

Initial and subsequent net mark-to-market

gains on de-designating Southeast

Duke Energy North America

(“DENA”) hedges 21 (8) 0.01

Loss on Southeast DENA contract

termination (75) 28 (0.04)

Tax adjustments — 12 0.01

Total Diluted EPS impact $ 0.88

PROCEEDS FROM CERTAIN SIGNIFICANT 2006

DISPOSITION TRANSACTIONS

Duke Energy’s 2006 Summary Annual Report references the

nearly $2 billion in after-tax proceeds raised from selling the

commercial marketing and trading (“CMT”) operations and

effectively half of Crescent. The following represents the

components of the after-tax proceeds from these transactions:

(In millions)

Proceeds related to Creation of Crescent Joint Venture

Net proceeds from issuance of debt by Crescent $1,190

Proceeds received from sale of equity interest 415

Estimated income tax payments resulting from transaction (135)

Reduction in reported cash due to deconsolidation of Crescent (30)

Net after-tax proceeds $1,440

Proceeds on Sale of CMT

Net proceeds received (including working capital and base price) $700

Estimated income tax payments resulting from transaction (145)

Net after-tax proceeds $555

Total combined net after-tax proceeds $1,995