Duke Energy 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DUKE ENERGY 2006 SUMMARY ANNUAL REPORT 5

We reduced our earnings volatility and business risk by

selling our commercial marketing and trading operations,

and effectively half of our real estate development company,

Crescent Resources. These transactions raised almost

$2 billion in after-tax cash, most of which will be invested

in our lower-risk, energy infrastructure businesses.

In customer satisfaction, we have consistently ranked in the

top quartile in several independent utility studies. Last year,

our utility companies in the South and Midwest finished in

the top 10 nationally in the Key Account Benchmark Study.

In addition, we ranked first in the South and best in the

nation among small and mid-sized business customers,

according to J.D. Power and Associates.

We provided leadership on industry issues. I currently serve

as chairman of Edison Electric Institute and I co-chair the

National Action Plan on Energy Efficiency and the Alliance

to Save Energy. Other members of the Duke Energy

leadership team also help to shape the state and federal

policy decisions that affect our business.

We continued to build a high-performance, sustainability-

focused culture characterized by diversity, inclusion,

employee development and leadership. And we established

new safety incentives for 2007 to reinforce our concern

for each other and our customers.

SO WHY DID WE CHOOSE TO GET LARGER

AND THEN GET SMALLER?

Very simply, scale and focus.

Our merger with Cinergy in April 2006 gave our electric

business the scale it needed to stand alone. To unlock even

greater value, three months later we announced that we

would separate our natural gas business and our electric

business into two strong pure-play companies: Spectra

Energy for gas and Duke Energy for electric power. We

completed the spinoff of Spectra Energy in January 2007.

Today Duke Energy is one of the top five electric companies

in the United States in market capitalization.

Having the strategic focus of a pure-play electric company

will help us meet the challenges and seize the opportuni-

ties to solve what we call the new energy equation.

In this equation, we must meet our customers’ needs

for affordable and reliable electric power while meeting

more stringent environmental rules that will inevitably

increase costs.

We must raise capital for long-term investments in more

environmentally friendly generation capacity, renewable

energy and energy efficiency. And we must reassure

investors who may be wary of long-term capital

construction programs.

Balancing these factors and solving the new energy equa-

tion will require a new approach to utility regulation. It

will require us to change minds and change habits. It will

require us to see and understand the goals of each of our

stakeholder groups. This letter and the rest of this report

will detail our plans to do that.

WHAT INVESTORS CAN EXPECT IN 2007

AND BEYOND

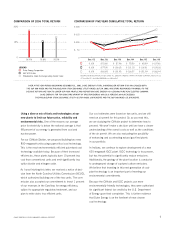

Our strategy to increase earnings and dividends in the

long term is straightforward:

Steadily improve our sales growth

Earn solid returns on our significant capital investments,

and

Continue achieving additional cost reductions from the

merger and from our continuous improvement efforts.

These three drivers — sales, investments and cost

savings — are essential to achieving both our 2007

financial objectives and long-term growth.

You can read all of our 2007 objectives in our Charter on

page 9. Our 2007 employee incentive target of $1.15 per

share is based on ongoing diluted earnings. The $1.15

serves as the basis for 4 to 6 percent annual earnings

growth through the end of 2009. We expect dividend

growth to be in line with earnings growth.

Our business plan projects a quarterly dividend increase

of $0.01 beginning in the third quarter of 2007. This

dividend increase — to be decided by the board of

directors — would be in line with our expectation to

increase dividends consistent with a 70 to 75 percent

payout target.

■

■

■