Duke Energy 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

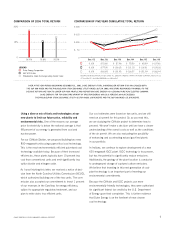

U.S. Franchised Electric and Gas

2007 EBIT

CONTRIBUTION

U.S. Franchised Electric and Gas,

which operates in North Carolina, South

Carolina, Indiana, Ohio and Kentucky,

is our largest business segment and

our primary source of earnings growth.

We expect this segment to represent

approximately 79 percent of forecasted 2007 ongoing

total segment earnings before interest and taxes (EBIT).*

It includes:

A $16 billion retail rate base

3.9 million electric customers

500,000 gas customers in Ohio and Kentucky

47,000 square miles of service territory

28,000 megawatts of regulated generation.

■

■

■

■

■

Commercial Power

2007 EBIT

CONTRIBUTION

Duke Energy’s Commercial Power

business owns and operates unregulated

power plants, primarily in the Midwest.

Almost all of the results for this business

come from sales to retail customers in

Ohio under that state’s Rate Stabilization

Plan. Also in this segment is Duke Energy Generation

Services (DEGS), which develops, owns and operates

electric generation sources that serve large energy

consumers, municipalities, utilities and industrial

facilities. We expect this segment to represent approxi-

mately 7 percent of forecasted 2007 ongoing total

segment EBIT.* It includes:

8,100 megawatts of unregulated generation, most

of which is dedicated to regulated customers.

■

Duke Energy International

2007 EBIT

CONTRIBUTION

Duke Energy’s international electric

generation operations are located in

Central and South America. We expect this

segment to represent approximately

11 percent of forecasted 2007 ongoing

total segment EBIT.* It includes:

Approximately 4,000 megawatts of generation,

primarily hydroelectric power, in six countries:

Argentina, Brazil, Ecuador, El Salvador,

Guatemala and Peru.

■

Crescent Resources

2007 EBIT

CONTRIBUTION

Formed more than 40 years ago by

Duke Energy, Crescent Resources

manages land holdings and develops

high-quality commercial, residential

and multi-family real estate projects.

We expect this segment to represent

approximately 3 percent of forecasted 2007 ongoing

total segment EBIT.* In 2006, Duke Energy worked

with Morgan Stanley Real Estate Fund to create an

effective 50/50 joint venture.

Crescent Resources is in 10 states, primarily in

the southeastern and southwestern United States.

■

Taking the U.S. Franchised Electric and Gas and Commercial Power segments together, we expect more than 85 percent of

Duke Energy’s forecasted 2007 ongoing total segment EBIT will come from sales to regulated customers.

*2007 forecasted ongoing total segment EBIT excludes results for the operations labeled Other.

DUKE ENERGY BUSINESS SEGMENTS