Bed, Bath and Beyond 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

7

INFLATION

The Company does not believe that its operating results have been materially affected by inflation during the past

year. There can be no assurance, however, that the Company’s operating results will not be affected by inflation in

the future.

RECENT ACCOUNTING PRONOUNCEMENTS

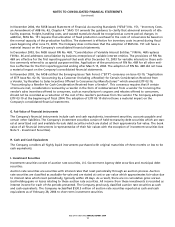

On December 16, 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting

Standards No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”). SFAS No. 123R will require companies

to measure all employee stock-based compensation awards using a fair value method and record such expense in

its consolidated financial statements. In addition, the adoption of SFAS No. 123R requires additional accounting and

disclosure related to income tax and cash flow effects resulting from share-based payment arrangements.

On April 14, 2005, the Securities and Exchange Commission delayed the effective date of adoption of SFAS No. 123R

to the beginning of the first annual period after June 15, 2005. The Company is currently evaluating the impact of

the delayed effective date in determining the timing of adopting SFAS No. 123R.

REVISED APPROACH TO COMPENSATION

On April 20, 2005, the Compensation Committee made awards to executive officers and other executives reporting

to the Company’s Chief Executive Officer consisting of a combination of restricted stock and stock option grants.

Consistent with past practice, the stock options granted to these executives will vest over time, subject, in general,

to the executive’s remaining in the Company’s employ on specified vesting dates. Vesting of the restricted stock

awarded to these executives will be dependent on (i) the Company’s achievement of a performance-based test

for the fiscal year of grant, and (ii) assuming achievement of the performance-based test, time vesting, subject, in

general, to the executive remaining in the Company’s employ on specified vesting dates.

The Company’s other employees who traditionally have received stock option grants have begun to receive awards

consisting solely of restricted stock. Vesting of the restricted stock awarded to these employees will be based solely

on time vesting with no performance test. The Company will record an expense related to the restricted stock

program in fiscal 2005 in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued

to Employees.”

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the

Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its

estimates on historical experience and on other assumptions that it believes to be relevant under the circumstances,

the results of which form the basis for making judgments about the carrying value of assets and liabilities that are

not readily apparent from other sources. In particular, judgment is used in areas such as the provision for sales

returns, inventory valuation, impairment of long-lived assets, goodwill and other indefinitely lived intangible assets,

income taxes and accruals for self insurance, litigation and store opening, expansion, relocation and closing costs.

Actual results could differ from these estimates.

Sales Returns: Sales returns, which are reserved for based on historical experience, are provided for in the period

that the related sales are recorded. Although the estimate for sales returns has not varied materially from historical

provisions, actual experience could vary from historical experience in the future if the level of sales return activity

changes materially. In the future, if the Company concludes that an adjustment to the sales returns accrual is

required, the reserve will be adjusted accordingly.