Bed, Bath and Beyond 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

14

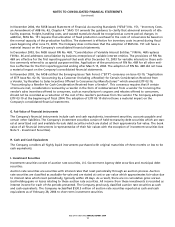

In November 2004, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 151, “Inventory Costs,

an Amendment of ARB No. 43, Chapter 4.” SFAS 151 amends the guidance to clarify that abnormal amounts of idle

facility expense, freight, handling costs, and wasted materials should be recognized as current period charges. In

addition, SFAS No. 151 requires that allocation of fixed production overhead to the costs of conversions be based on

the normal capacity of the production facilities. The statement is effective for inventory costs incurred during fiscal

years beginning after June 15, 2005. The Company does not believe that the adoption of SFAS No. 151 will have a

material impact on the Company’s consolidated financial statements.

In December 2003, the FASB issued FIN No. 46R, “Consolidation of Variable Interest Entities.” FIN No. 46R replaces

FIN No. 46 and addresses consolidation by business enterprises of variable interest entities. The provisions of FIN No.

46R are effective for the first reporting period that ends after December 15, 2003 for variable interests in those enti-

ties commonly referred to as special purpose entities. Application of the provisions of FIN No. 46R for all other enti-

ties is effective for the first reporting period ending after March 15, 2004. The adoption of FIN No. 46R did not have

a material impact on the Company’s consolidated financial statements.

In November 2003, the FASB ratified the Emerging Issues Task Force’s (“EITF”) consensus on Issue 03-10, “Application

of EITF Issue No. 02-16, ‘Accounting by a Customer (Including a Reseller) for Certain Consideration Received from

a Vendor,’ by Resellers to Sales Incentives Offered to Consumers by Manufacturers” which amends EITF 02-16,

“Accounting by a Reseller for Cash Consideration Received from a Vendor”. This consensus requires that if certain

criteria are met, consideration received by a reseller in the form of reimbursement from a vendor for honoring the

vendor’s sales incentives offered to consumers, such as manufacturer’s coupons and rebates offered to consumers,

should not be recorded as a reduction of the cost of the reseller’s purchases from the vendor. The Company adopted

EITF 03-10 at the beginning of fiscal 2004. The adoption of EITF 03-10 did not have a material impact on the

Company’s consolidated financial statements.

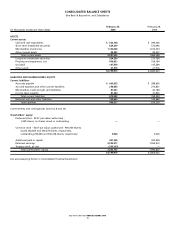

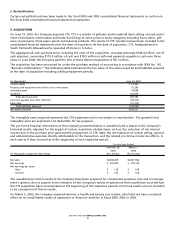

G. Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment securities, accounts payable and

certain other liabilities. The Company’s investment securities consist of held-to-maturity debt securities which are stat-

ed at amortized cost and available-for-sale debt securities which are stated at their approximate fair value. The book

value of all financial instruments is representative of their fair values with the exception of investment securities (see

Note 5 - Investment Securities).

H. Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with original maturities of three months or less to be

cash equivalents.

I. Investment Securities

Investment securities consist of auction rate securities, U.S. Government Agency debt securities and municipal debt

securities.

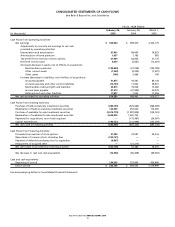

Auction rate securities are securities with interest rates that reset periodically through an auction process. Auction

rate securities are classified as available-for-sale and are stated at cost or par value which approximates fair value due

to interest rates which reset periodically, typically within 28 days. As a result, there are no cumulative gross unreal-

ized holding gains or losses relating to these auction rate securities. All income from these investments is recorded as

interest income for each of the periods presented. The Company previously classified auction rate securities as cash

and cash equivalents. The Company reclassified $530.5 million of auction rate securities reported as cash and cash

equivalents as of February 28, 2004 to short term investment securities.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)