Bed, Bath and Beyond 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

23

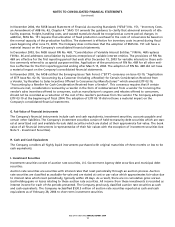

9. EMPLOYEE BENEFIT PLANS

Defined Contribution Plans

The Company has three defined contribution 401(k) savings plans (the “Bed Bath & Beyond Plan”, the “Harmon Plan”

and the “Christmas Tree Shops Plan”, collectively “the Plans”) covering all eligible Bed Bath & Beyond, Harmon and

CTS employees, respectively. Effective December 31, 2003, the Harmon Plan was frozen. Eligible employees of

Harmon can now participate in the Bed Bath & Beyond Plan. Participants of the Bed Bath & Beyond Plan and the

Christmas Tree Shops Plan may defer annual pre-tax compensation up to 30% and 60%, respectively, subject to statu-

tory and Plan limitations. The Company has an option to contribute an amount as determined by the Board of

Directors to the Plans. The Company has not made a material contribution to any plan for fiscal 2004, 2003 or 2002.

Defined Benefit Plan

The Company has a non-contributory defined benefit pension plan for the CTS employees who meet specified age

and length-of-service requirements. The benefits are based on years of service and the employee’s compensation near

retirement. The Company utilizes a December 31 measurement date for this plan. For the years ended February 26,

2005 and February 28, 2004, the net periodic pension cost was not material to the Company’s results of operations.

The Company has a $7.5 million and $8.3 million liability, which is included in deferred rent and other liabilities as of

February 26, 2005 and February 28, 2004, respectively.

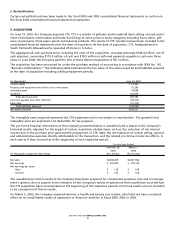

10. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its Co-Chairmen, which extend through 2007. The agreements

provide for a base salary (which may be increased by the Board of Directors), termination payments, post-retirement

benefits and other terms and conditions of employment. In addition, the Company maintains employment agree-

ments with other executives which provide for severance pay.

The Company is involved in various claims and legal actions arising in the ordinary course of business. In the opinion

of management, the ultimate disposition of these matters will not have a material adverse effect on the Company’s

consolidated financial position, results of operations or liquidity.

11. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $229.0 million, $226.7 million and $151.8 million in fiscal 2004, 2003 and 2002,

respectively.

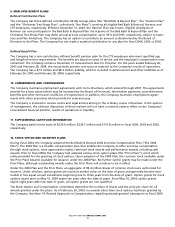

12. STOCK OPTION AND INCENTIVE PLANS

During fiscal 2004, the Company adopted the Bed Bath & Beyond 2004 Incentive Compensation Plan (“the 2004

Plan”). The 2004 Plan is a flexible compensation plan that enables the Company to offer incentive compensation

through stock options, stock appreciation rights, restricted stock awards and performance awards, including cash

awards. Prior to fiscal 2004, the Company had adopted various stock option plans (the “Prior Plans”), all of which

solely provided for the granting of stock options. Upon adoption of the 2004 Plan, the common stock available under

the Prior Plans became available for issuance under the 2004 Plan. No further option grants may be made under the

Prior Plans, although outstanding awards under the Prior Plans will continue to be in effect.

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock were authorized for

issuance. Under all plans, option grants are issued at market value on the date of grant and generally become exer-

cisable in five equal annual installments beginning one to three years from the date of grant. Option grants for stock

options issued prior to May 10, 2004 expire ten years after the date of grant. Since May 10, 2004, option grants

expire eight years after the date of grant. All option grants are non-qualified.

The Stock Option and Compensation committees determine the number of shares and the price per share for all

awards granted under the plans. As of February 26, 2005, no awards other than stock options had been granted by

the Company. See Note 14, Revised Approach to Compensation, regarding awards granted subsequent to fiscal 2004.