Bed, Bath and Beyond 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

20

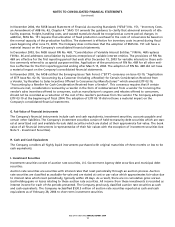

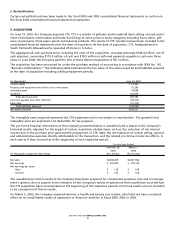

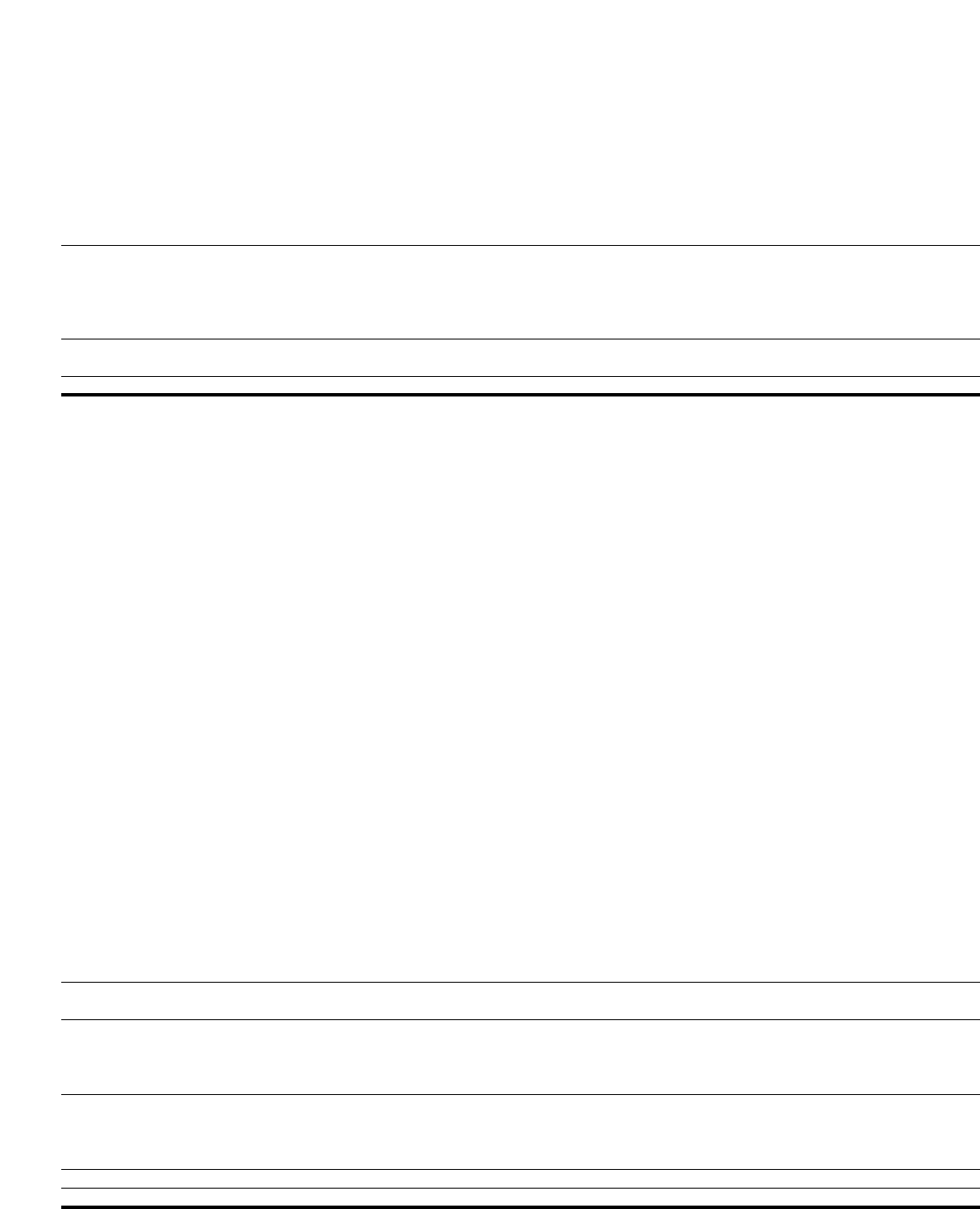

3. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

February 26, February 28,

(in thousands) 2005 2004

Land and buildings $ 43,165)$ 28,189)

Furniture, fixtures and equipment 452,919)387,517)

Leasehold improvements 405,928)333,502)

Computer equipment and software 184,626)146,999)

1,086,638)896,207)

Less: Accumulated depreciation and amortization (477,007) (380,043)

$ 609,631)$ 516,164)

4. LINES OF CREDIT

At February 26, 2005, the Company maintained two uncommitted lines of credit of $100 million and $50 million, with

expiration dates of September 3, 2005 and February 28, 2005, respectively. Subsequent to the end of fiscal 2004, the

Company increased the amount of the $50 million uncommitted line of credit to $75 million and extended the expi-

ration to February 28, 2006. These uncommitted lines of credit are currently used for letters of credit in the ordinary

course of business. It is the Company’s intent to maintain an uncommitted line of credit for this purpose. During fiscal

2004, the Company did not have any direct borrowings under the uncommitted lines of credit. As of February 26,

2005, there was approximately $13.4 million of outstanding letters of credit. In addition, under the above uncommit-

ted lines of credit, the Company can obtain unsecured standby letters of credit. As of February 26, 2005, there was

approximately $38.1 million of outstanding unsecured standby letters of credit, primarily for certain insurance pro-

grams.

The Company maintained two uncommitted lines of credit of $75 million and $50 million at February 28, 2004. These

uncommitted lines of credit were utilized for letters of credit in the ordinary course of business. During fiscal 2003,

the Company did not have any direct borrowings under the uncommitted lines of credits. As of February 28, 2004,

there was approximately $15.0 million of outstanding letters of credit. In addition, the Company maintained unse-

cured standby letters of credit of $40 million, primarily for certain insurance programs, of which approximately

$35.8 million was outstanding.

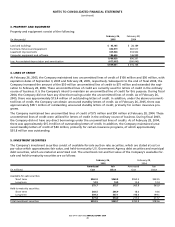

5. INVESTMENT SECURITIES

The Company’s investment securities consist of available-for-sale auction rate securities, which are stated at cost or

par value which approximates fair value, and held-to-maturity U.S. Government Agency debt securities and municipal

debt securities, which are stated at amortized cost. The amortized cost and fair value of the Company’s available-for-

sale and held-to-maturity securities are as follows:

February 26, February 28,

2005 2004

Amortized Fair Amortized Fair

(in millions) Cost Value Cost Value

Available-for-sale securities:

Short term $360.8 $360.8 $553.5 $553.5

Long term 14.9 14.9 12.4 12.4

375.7 375.7 565.9 565.9

Held-to-maturity securities:

Short term 268.5 266.9 18.6 18.6

Long term 309.3 307.1 198.4 199.1

577.8 574.0 217.0 217.7

Total investment securities $953.5 $949.7 $782.9 $783.6

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)