Bed, Bath and Beyond 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

13

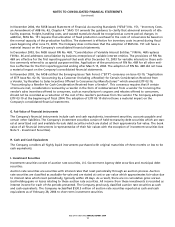

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND RELATED MATTERS

A. Nature of Operations

Bed Bath & Beyond Inc. and subsidiaries (the “Company”) operate specialty retail stores nationwide, including stores

of Bed Bath & Beyond (“BBB”), Harmon Stores, Inc. (“Harmon”) and Christmas Tree Shops, Inc. (“CTS”) primarily sell-

ing predominantly better quality domestics merchandise and home furnishings. As the Company operates in the

retail industry, its results of operations are affected by general economic conditions and consumer spending habits.

B. Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries, all of

which are wholly owned.

All significant intercompany balances and transactions have been eliminated in consolidation.

C. Fiscal Year

The Company’s fiscal year is comprised of the 52 or 53 week period ending on the Saturday nearest February 28.

Accordingly, fiscal 2004, 2003 and 2002 represented 52 weeks and ended on February 26, 2005, February 28, 2004 and

March 1, 2003, respectively.

D. Segments

The Company accounts for its operations as one operating segment.

E. Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the

Company to establish accounting policies and to make estimates and judgments that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its

estimates on historical experience and on other assumptions that it believes to be relevant under the circumstances,

the results of which form the basis for making judgments about the carrying value of assets and liabilities that are

not readily apparent from other sources. In particular, judgment is used in areas such as the provision for sales

returns, inventory valuation, impairment of long-lived assets, goodwill and other indefinitely lived intangible assets,

vendor allowances, income taxes and accruals for self insurance, litigation and store opening, expansion, relocation

and closing costs. Actual results could differ from these estimates.

F. Recent Accounting Pronouncements

In March 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation (“FIN”) No. 47,

“Accounting for Conditional Asset Retirement Obligations.” FIN No. 47 clarifies the term “conditional asset retire-

ment obligation” as used in FASB Statement No. 143, “Accounting for Asset Retirement Obligations.” This interpreta-

tion requires companies to recognize a liability for the fair value of a legal obligation to perform asset-retirement

activities that are conditional on a future event if the amount can be reasonably estimated. FIN No. 47 also clarifies

when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement

obligation. FIN No. 47 is effective no later than the end of fiscal years ending after December 15, 2005. The Company

does not believe that the adoption of FIN No. 47 will have a material impact on the Company’s consolidated financial

statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Bed Bath & Beyond Inc. and Subsidiaries