Bed, Bath and Beyond 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

18

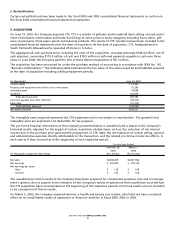

Y. Stock-Based Compensation

As permitted under SFAS No. 148, “Accounting for Stock Based Compensation - Transition and Disclosure - an amend-

ment of FASB Statement No. 123,” the Company has elected not to adopt the fair value based method of accounting

for its stock-based compensation plans, but continues to apply the provisions of Accounting Principles Board Opinion

(“APB”) No. 25, “Accounting for Stock Issued to Employees.” The Company has complied with the disclosure require-

ments of SFAS No. 148.

Accordingly, no compensation cost has been recognized in connection with the Company’s stock option plans. Set

forth below are the Company’s net earnings and net earnings per share “as reported,” and as if compensation cost

had been recognized (“pro forma”) in accordance with the fair value provisions of SFAS No. 148:

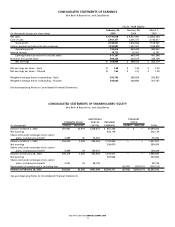

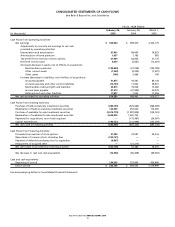

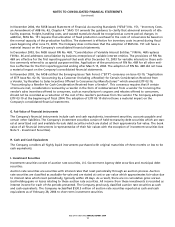

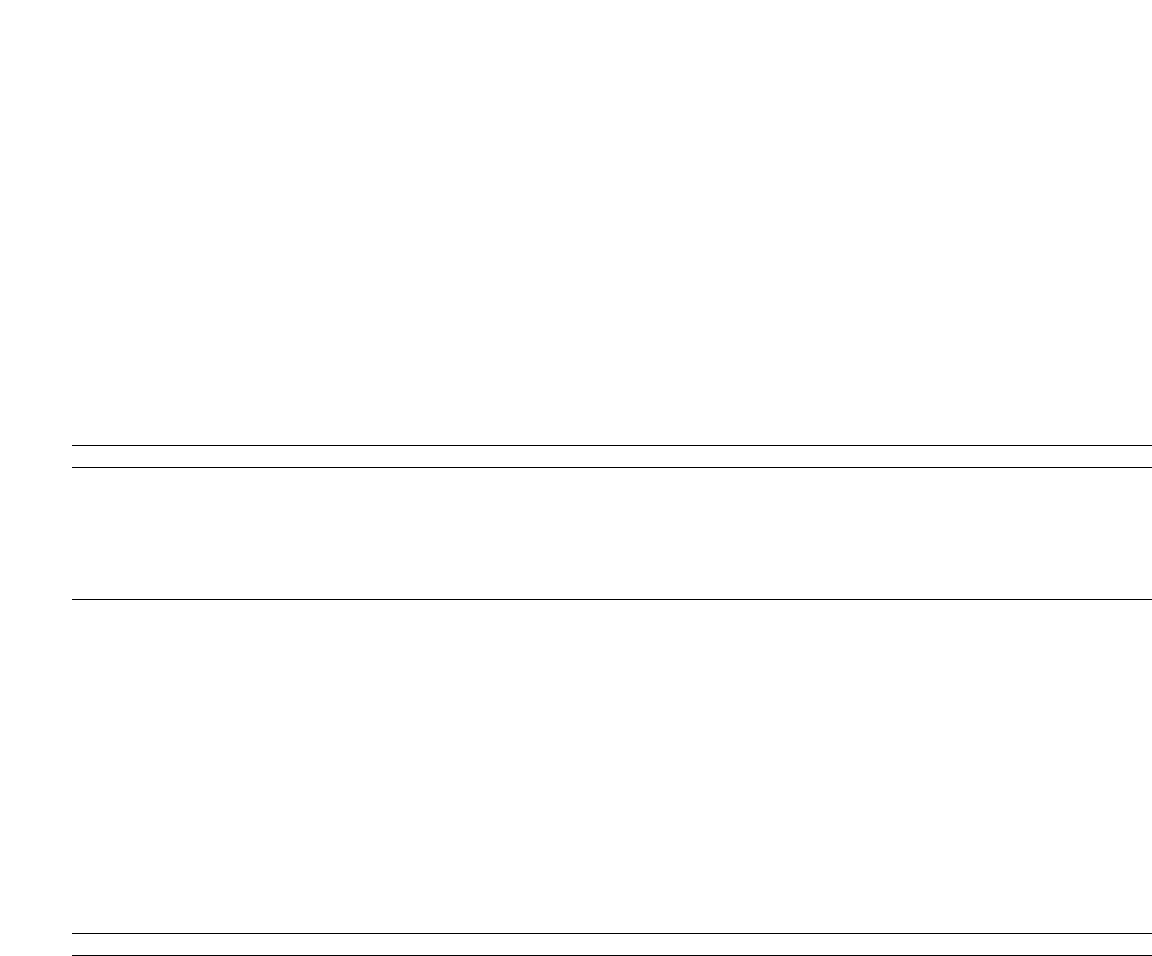

FISCAL YEAR

(in thousands) 2004 2003 2002

NET EARNINGS:

As reported $504,964)$399,470)$302,179)

Deduct: Total stock-based employee compensation expense determined

under fair value based method, net of related tax effects (34,686) (29,372) (25,443)

Pro forma $470,278)$370,098)$276,736)

NET EARNINGS PER SHARE:

Basic:

As reported $ 1.68)$ 1.35)$1.03)

Pro forma $ 1.56)$ 1.25)$0.94)

Diluted:

As reported $ 1.65)$ 1.31)$1.00)

Pro forma $ 1.55)$ 1.23)$0.92)

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model

with the following assumptions:

FISCAL YEAR

2004 2003 2002

Expected lives (years) 6.1 5.9 7.0

Expected volatility 42.00% 45.00% 45.00%

Risk free interest rates 3.89% 2.96% 4.72%

Dividend yield ———

Weighted average fair value of options granted during the year $17.16 $16.29 $17.15

On December 16, 2004, the FASB issued Statement of Financial Accounting Standards No. 123 (revised 2004),

“Share-Based Payment” (“SFAS No. 123R”). SFAS No. 123R will require companies to measure all employee stock-

based compensation awards using a fair value method and record such expense in its consolidated financial state-

ments. In addition, the adoption of SFAS No. 123R requires additional accounting and disclosure related to income

tax and cash flow effects resulting from share-based payment arrangements.

On April 14, 2005, the Securities and Exchange Commission delayed the effective date of adoption of SFAS No. 123R

to the beginning of the first annual period after June 15, 2005. The Company is currently evaluating the impact of

the delayed effective date in determining the timing of adopting SFAS No. 123R.

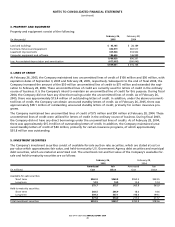

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)