Bed, Bath and Beyond 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

17

S. Cost of Sales

Cost of sales includes the cost of merchandise, buying costs and costs of our distribution network including inbound

freight charges, distribution facility costs, receiving costs and internal transfer costs.

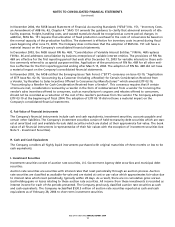

T. Vendor Allowances

The Company receives allowances from vendors in the normal course of business for various reasons including direct

cooperative advertising, purchase volume and reimbursement for other expenses. Annual terms for each allowance

include the basis for earning the allowance and payment terms which vary by agreement. Prior to the adoption of

EITF 02-16, allowances were recorded as either a reduction of inventory cost, an advertising expense or a sales

incentive. After adopting EITF 02-16, which was effective for all new vendor allowances, including modifications of

existing allowances, entered into after December 31, 2002, all vendor allowances are recorded as a reduction of

inventory cost, except for direct cooperative advertising allowances which are specific, incremental and identifiable.

The Company recognizes purchase volume allowances as a reduction of the cost of inventory in the quarter in

which milestones are achieved. Advertising costs were reduced by direct cooperative allowances of $8.7 million and

$9.5 million for fiscal 2004 and 2003, respectively.

U. Store Opening, Expansion, Relocation and Closing Costs

Store opening, expansion, relocation and closing costs, including estimates for markdowns, asset residual values and

projected occupancy costs, are charged to earnings as incurred. Prior to the adoption of SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities,” which was effective for any exit or disposal activity initiated

after December 31, 2002, costs related to store relocations and closings were provided for in the period in which

management approved the relocation or closing of a store. Actual costs related to store relocations and closings

could differ from these estimates.

V. Advertising Costs

Expenses associated with store advertising are charged to earnings as incurred. Net advertising costs amounted to

$134.5 million, $93.7 million and $58.8 million for fiscal 2004, 2003 and 2002, respectively.

W. Income Taxes

The Company files a consolidated Federal income tax return. Income tax returns are filed with each state and

territory in which the Company conducts business.

The Company accounts for its income taxes using the asset and liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to the differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryfor-

wards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in

the year in which those temporary differences are expected to be recovered or settled. The effect on deferred tax

assets and liabilities of a change in tax rates is recognized in earnings in the period that includes the enactment date.

Judgment is required in determining the provision for income taxes and related accruals, deferred tax assets and

liabilities. In the ordinary course of business, there are transactions and calculations where the ultimate tax outcome

is uncertain. Additionally, the Company’s tax returns are subject to audit by various tax authorities. Although the

Company believes that its estimates are reasonable, actual results could differ from these estimates.

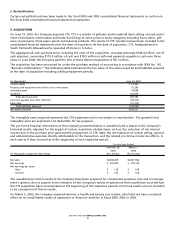

X. Earnings per Share

The Company presents earnings per share on a basic and diluted basis. Basic earnings per share has been computed

by dividing net earnings by the weighted average number of shares outstanding. Diluted earnings per share has been

computed by dividing net earnings by the weighted average number of shares outstanding including the dilutive

effect of stock options.

Options for which the exercise price was greater than the average market price of common shares as of the fiscal

years ended 2004, 2003 and 2002 were not included in the computation of diluted earnings per share as the effect

would be anti-dilutive. These consisted of options totaling 2,766,430, 543,750 and 158,925 shares, respectively.