Bed, Bath and Beyond 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2004

6

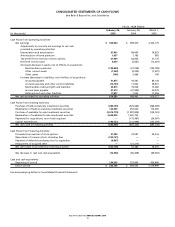

Net cash used in investing activities in fiscal 2004 was $363.0 million compared with $687.2 million in fiscal 2003.

The decrease in net cash used in investing activities was attributable to an increase in redemptions of investment

securities and the payment for the acquisition of CTS in the prior year, partially offset by an increase in purchases of

investment securities.

Net cash used in financing activities in fiscal 2004 was $325.7 million, compared with net cash provided by financing

activities of $53.4 million in fiscal 2003. The change in net cash resulting from financing activities was primarily attrib-

utable to the repurchase of common stock and a decrease in proceeds from the exercise of stock options.

At February 26, 2005, the Company maintained two uncommitted lines of credit of $100 million and $50 million,

with expiration dates of September 3, 2005 and February 28, 2005, respectively. Subsequent to the end of fiscal 2004,

the Company increased the amount of the $50 million uncommitted line of credit to $75 million and extended the

expiration to February 28, 2006. These uncommitted lines of credit are currently used for letters of credit in the

ordinary course of business. It is the Company’s intent to maintain an uncommitted line of credit for this purpose.

During fiscal 2004, the Company did not have any direct borrowings under the uncommitted lines of credit. As of

February 26, 2005, there was approximately $13.4 million of outstanding letters of credit. In addition, under the

above uncommitted lines of credit, the Company can obtain unsecured standby letters of credit. As of February 26,

2005, there was approximately $38.1 million of outstanding unsecured standby letters of credit, primarily for certain

insurance programs. The Company believes that during fiscal 2005, internally generated funds will be sufficient to

fund its operations, including its expansion program.

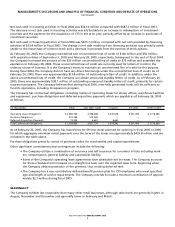

The Company has contractual obligations consisting mainly of operating leases for stores, offices, warehouse facilities

and equipment, purchase obligations and deferred acquisition payments which are payable as of February 26, 2005

as follows:

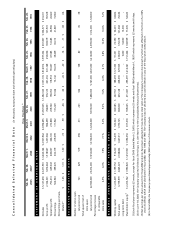

(in thousands) Total Less than 1 year 1-3 years 4-5 years After 5 years

Operating Lease Obligations $ 2,983,765 $ 308,698 $ 947,078 $ 551,409 $ 1,176,580

Purchase Obligations 512,369 512,369 — — —

Deferred Acquisition Payments 13,334 6,667 6,667 — —

Total Contractual Obligations $ 3,509,468 $ 827,734 $ 953,745 $ 551,409 $ 1,176,580

As of February 26, 2005, the Company has leased sites for 69 new stores planned for opening in fiscal 2005 or 2006,

for which aggregate minimum rental payments over the term of the leases are approximately $459.8 million and are

included in the table above.

Purchase obligations primarily consist of purchase orders for merchandise and capital expenditures.

Other significant commitments and contingencies include the following:

• The Company utilizes a combination of insurance and self insurance for a number of risks including work-

ers’ compensation, general liability and automobile liability.

• Some of the Company’s operating lease agreements have scheduled rent increases. The Company accounts

for these scheduled rent increases on a straight line basis over the expected lease term, beginning when

the Company obtains possession of the premises, thus creating deferred rent.

• The Company has a non-contributory defined benefit pension plan for CTS employees who meet specified

age and length of service requirements. The Company intends to make a minimum contribution of approxi-

mately $2.3 million during fiscal 2005.

SEASONALITY

The Company exhibits less seasonality than many other retail businesses, although sales levels are generally higher in

August, November and December and generally lower in February and March.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)