Bed, Bath and Beyond 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2002

6

Impairment of Assets: The Company periodically reviews long-

lived assets for impairment by comparing the carrying value of

the assets with their estimated future undiscounted cash flows.

If it is determined that an impairment loss has occurred, the loss

would be recognized during that period. The impairment loss is

calculated as the difference between asset carrying values and the

present value of the estimated net cash flows. The Company does

not believe that any material impairment currently exists related

to its long-lived assets.

Vendor Allowances: The Company receives various types of

allowances from our merchandise vendors, which are based on

negotiated terms. These allowances are recorded when earned

as a reduction of cost of sales or as a reduction of other costs in

accordance with the provisions of the FASB’s Emerging Issues

Task Force Issue No. 02-16 “Accounting by a Customer (Including

a Resale) for Certain Consideration Received from a Vendor.”

Self Insurance: The Company uses self insurance for a number

of risks including worker’s compensation, general liability,

automobile liability and employee related health care benefits

(a portion of which is paid by our employees). Liabilities

associated with these risks are estimated in part by considering

historical claims experience, demographic factors, severity factors

and other actuarial assumptions.

Litigation: The Company records an estimated liability related

to various claims and legal actions arising in the ordinary course

of business which is based on available information and advice

from outside counsel, where appropriate. As additional

information becomes available, the Company reassesses the

potential liability related to its pending litigation and revises its

estimates as appropriate.

Store Opening, Expansion, Relocation and Closing Costs: Store

opening, expansion, relocation and closing costs are charged to

earnings as incurred. Prior to the adoption of SFAS No. 146,

“Accounting for Costs Associated with Exit or Disposal Activities,”

which was effective for any exit or disposal activity initiated after

December 31, 2002, costs related to store relocations and closings

were provided for in the period in which management approved

the relocation or closing of a store.

ACQUISITION

On March 5, 2002, the Company acquired Harmon, a health

and beauty care retailer, which did not have a material effect

on its consolidated results of operations or financial condition

in fiscal 2002.

FORWARD LOOKING STATEMENTS

This Annual Report and, in particular, Management’s Discussion

and Analysis of Financial Condition and Results of Operations,

and the Shareholder Letter, contain forward looking statements

within the meaning of Section 21E of the Securities Exchange Act

of 1934, as amended. The Company’s actual results and future

financial condition may differ materially from those expressed

in any such forward looking statements as a result of many factors

that may be outside the Company’s control. Such factors include,

without limitation: general economic conditions, changes in

the retailing environment and consumer spending habits,

demographics and other macroeconomic factors that may impact

the level of spending for the types of merchandise sold by the

Company; unusual weather patterns; competition from existing

and potential competitors; competition from other channels

of distribution; pricing pressures; the ability to find suitable

locations at reasonable occupancy costs to support the Company’s

expansion program; and the cost of labor, merchandise and other

costs and expenses.

SEASONALITY

The Company exhibits less seasonality than many other retail

businesses, although sales levels are generally higher in August,

November and December, and generally lower in February

and March.

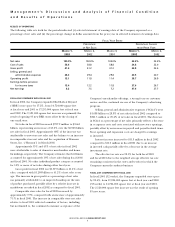

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

(Continued)