Bed, Bath and Beyond 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2002

11

E. CASH AND CASH EQUIVALENTS

The Company considers all highly liquid instruments purchased

with original maturities of three months or less to be cash

equivalents.

F. INVENTORY VALUATION

Merchandise inventories are stated at the lower of cost or market,

using the retail inventory method. Under the retail inventory

method, the valuation of inventories at cost and the resulting

gross margins are calculated by applying a cost-to-retail ratio

to the retail value of inventories. At any one time, inventories

include items that have been marked down to the Company’s best

estimate of their fair market value. Actual markdowns required

could differ from this estimate.

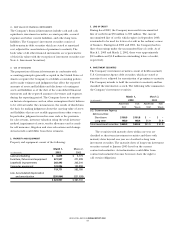

G. PROPERTY AND EQUIPMENT

Property and equipment are stated at cost. Depreciation is

computed primarily using the straight-line method over the

estimated useful lives of the assets (forty years for building; five

to ten years for furniture, fixtures and equipment; and three to

five years for computer equipment). Leasehold improvements

are amortized using the straight-line method over the lesser of

their estimated useful life or the life of the lease.

The cost of maintenance and repairs is charged to earnings

as incurred; significant renewals and betterments are capitalized.

Maintenance and repairs amounted to $34.7 million, $34.3

million and $28.4 million for fiscal 2002, 2001 and 2000,

respectively.

H. IMPAIRMENT OF LONG-LIVED ASSETS

The Company periodically reviews long-lived assets for

impairment by comparing the carrying value of the assets

with their estimated future undiscounted cash flows. If it is

determined that an impairment loss has occurred, the loss

would be recognized during that period. The impairment loss

is calculated as the difference between asset carrying values and

the present value of the estimated net cash flows. The Company

does not believe that any material impairment currently exists

related to its long-lived assets.

I. INVESTMENT SECURITIES

Investment securities consist of U.S. Government Agency debt

securities. Because the Company has the ability and intent to hold

the securities until maturity, it classifies its securities as held-to-

maturity. These investment securities are recorded at amortized

cost, adjusted for the amortization or accretion of premiums

or discounts.

Premiums and discounts are amortized or accreted over the

life of the related held-to-maturity securities as an adjustment to

interest using the effective interest method. Dividend and interest

income are recognized when earned.

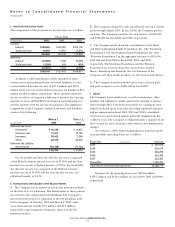

J. DEFERRED RENT

The Company accounts for scheduled rent increases contained

in its leases on a straight-line basis over the noncancelable lease

term. Deferred rent amounted to $29.1 million and $26.5 million

as of March 1, 2003 and March 2, 2002, respectively.

K. SELF INSURANCE

The Company uses self insurance for a number of risks including

worker’s compensation, general liability, automobile liability

and employee related health care benefits (a portion of which is

paid by our employees). Liabilities associated with these risks are

estimated in part by considering historical claims experience,

demographic factors, severity factors and other actuarial

assumptions.

L. LITIGATION

The Company records an estimated liability related to various

claims and legal actions arising in the ordinary course of business

which is based on available information and advice from outside

counsel, where appropriate. As additional information becomes

available, the Company reassesses the potential liability related to

its pending litigation and revises its estimates as appropriate.

M. REVENUE RECOGNITION

Sales are recognized upon purchase by customers at our retail

stores or when shipped for products purchased from our websites.

The value of point of sale coupons and point of sale rebates

that result in a reduction of the price paid by the customer are

recorded as a reduction of sales. Shipping and handling fees that

are billed to a customer in a sale transaction are recorded in

sales. Revenues from gift cards, gift certificates and store credits

are recognized when redeemed. Sales returns, which are reserved

for based on historical experience, are provided for in the period

that the related sales are recorded.

N. VENDOR ALLOWANCES

The Company receives various types of allowances from our

merchandise vendors, which are based on negotiated terms.

These allowances are recorded when earned as a reduction

of cost of sales or as a reduction of other costs in accordance

with the provisions of EITF 02-16.