Bed, Bath and Beyond 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2002

13

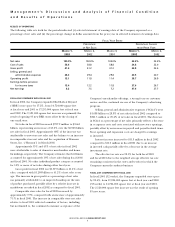

U. FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company’s financial instruments include cash and cash

equivalents, investment securities, accounts payable, accrued

expenses and other current liabilities, and other long term

liabilities. The Company’s investment securities consist of

held-to-maturity debt securities which are stated at amortized

cost, adjusted for amortization of premium to maturity. The

book value of all other financial instruments are representative

of their fair values with the exception of investment securities (see

Note 4 - Investment Securities).

V. USE OF ESTIMATES

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires the Company to establish accounting policies

and to make estimates and judgments that affect the reported

amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses

during the reporting period. The Company bases its estimates

on historical experience and on other assumptions that it believes

to be relevant under the circumstances, the results of which form

the basis for making judgments about the carrying value of assets

and liabilities that are not readily apparent from other sources.

In particular, judgment is used in areas such as the provision

for sales returns, inventory valuation using the retail inventory

method, impairment of assets, vendor allowances and accruals

for self insurance, litigation and store relocations and closings.

Actual results could differ from these estimates.

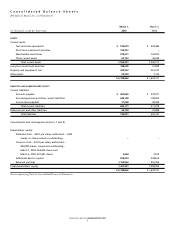

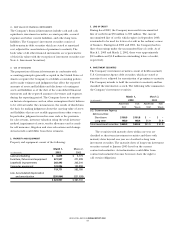

2. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

March 1, MARCH 2,

(in thousands) 2003 2002

Land and building $ 6,875)$ 5,173)

Furniture, fixtures and equipment 321,507)271,399)

Leasehold improvements 268,493)205,310)

Computer equipment 122,896)100,898)

719,771)582,780)

Less: Accumulated depreciation

and amortization (295,864) (221,039)

$ 423,907)$ 361,741)

3. LINE OF CREDIT

During fiscal 2002, the Company increased its uncommitted

line of credit from $50 million to $75 million. The current

uncommitted line of credit, which expires in September 2003,

is intended to be used for letters of credit in the ordinary course

of business. During fiscal 2002 and 2001, the Company had no

direct borrowings under the uncommitted line of credit. As of

March 1, 2003 and March 2, 2002, there were approximately

$8.5 million and $5.8 million in outstanding letters of credit,

respectively.

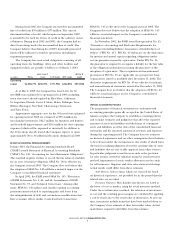

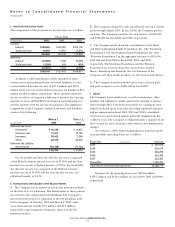

4. INVESTMENT SECURITIES

The Company’s investment securities consist of held-to-maturity

U.S. Government Agency debt securities, which are stated at

amortized cost, adjusted for amortization of premium to maturity.

The Company intends to hold the securities to maturity and has

classified the investments as such. The following table summarizes

the Company’s investment securities:

March 1, March 2,

(in thousands) 2003 2002

AMORTIZED FAIR AMORTIZED FAIR

COST VALUE COST VALUE

U.S. Government Agency

debt securities:

Short term $100.9 $101.8 $– $ –

Long term 148.0 148.4 51.9 51.9

Total investment securities $248.9 $250.2 $51.9 $ 51.9

The securities with maturity dates within one year are

classified as short term investment securities and those with

maturity dates beyond one year are classified as long term

investment securities. The maturity dates of long term investment

securities extend to January 2005 based on the current

contractual maturities. Actual maturities could differ from

contractual maturities because borrowers have the right to

call certain obligations.