Bed, Bath and Beyond 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2002

5

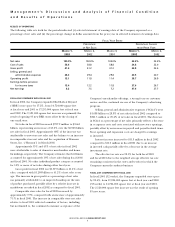

During fiscal 2002, the Company increased its uncommitted

line of credit from $50 million to $75 million. The current

uncommitted line of credit, which expires in September 2003,

is intended to be used for letters of credit in the ordinary course

of business. During fiscal 2002 and 2001, the Company had no

direct borrowings under the uncommitted line of credit. The

Company believes that during fiscal 2003, internally generated

funds will be sufficient to fund its operations, including its

expansion program.

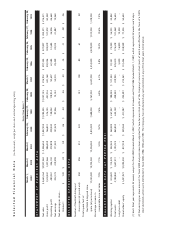

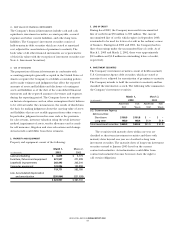

The Company has contractual obligations consisting of all

operating leases for buildings, office and other facilities and

equipment which are payable as follows as of March 1, 2003:

LESS THAN 1AFTER 5

(in 000’s) TOTAL YEAR 1-3 YEARS 4-5 YEARS YEARS

Operating

Leases $2,358,770 $230,974 $711,956 $442,894 $972,946

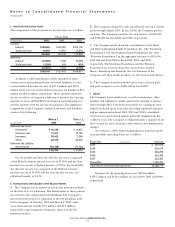

As of May 2, 2003, the Company has leased sites for 60

new BBB stores planned for opening in fiscal 2003, including

seven new stores already opened in Mira Mesa, California;

St. Augustine, Florida; Coeur d’Alene, Idaho; Dubuque, Iowa;

Wilton (Saratoga), New York; Chattanooga, Tennessee;

and Tyler, Texas.

Approximate aggregate costs for the 60 leased stores planned

for opening in fiscal 2003 are estimated at $79.4 million for

merchandise inventories, $32.5 million for furniture and fixtures

and leasehold improvements and $10.9 million for store opening

expenses (which will be expensed as incurred). In addition to

the 60 locations already leased, the Company expects to open

approximately 20 to 30 additional locations during fiscal 2003.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 143, “Accounting for Asset Retirement Obligations.”

The standard requires entities to record the fair value of a liability

for an asset retirement obligation. SFAS No. 143 is effective for

the Company in fiscal 2003. The Company does not believe that

the adoption of SFAS No. 143 will have a material impact on the

Company’s consolidated financial statements.

In April 2002, the FASB issued SFAS No. 145, “Rescission

of FASB Statements No. 4, 44, and 64, Amendment of FASB

Statement No. 13, and Technical Corrections.” Among other

items, SFAS No. 145 updates and clarifies existing accounting

pronouncements related to reporting gains and losses from

the extinguishment of debt and certain lease modifications that

have economic effects similar to sale-leaseback transactions.

SFAS No. 145 is effective for the Company in fiscal 2003. The

Company does not believe that the adoption of SFAS No. 145

will have a material impact on the Company’s consolidated

financial statements.

In November 2002, the FASB issued Interpretation No. 45,

“Guarantor’s Accounting and Disclosure Requirements for

Guarantees Including Indirect Guarantees of Indebtedness of

Others” (“FIN No. 45”). FIN No. 45 elaborates on the disclosures

for interim and annual reports regarding obligations under

certain guarantees issued by a guarantor. Under FIN No. 45,

the guarantor is required to recognize a liability for the fair value

of the obligation undertaken in issuing the guarantee at the

inception of a guarantee. The recognition and measurement

provisions of FIN No. 45 are applicable on a prospective basis

to guarantees issued or modified after December 31, 2002. The

disclosure requirements for FIN No. 45 are effective for interim

and annual financial statements issued after December 15, 2002.

The Company does not believe that the adoption of FIN No. 45

will have a material impact on the Company’s consolidated

financial statements.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires the Company to establish accounting policies

and to make estimates and judgments that affect the reported

amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the consolidated financial

statements and the reported amounts of revenues and expenses

during the reporting period. The Company bases its estimates

on historical experience and on other assumptions that it believes

to be relevant under the circumstances, the results of which form

the basis for making judgments about the carrying value of assets

and liabilities that are not readily apparent from other sources.

In particular, judgment is used in areas such as the provision

for sales returns, inventory valuation using the retail inventory

method, impairment of assets, vendor allowances and accruals

for self insurance, litigation and store relocations and closings.

Actual results could differ from these estimates.

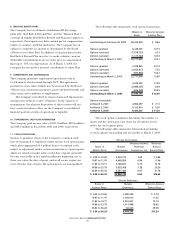

Sales Returns: Sales returns, which are reserved for based

on historical experience, are provided for in the period that the

related sales are recorded.

Inventory Valuation: Merchandise inventories are stated at

the lower of cost or market, using the retail inventory method.

Under the retail inventory method, the valuation of inventories

at cost and the resulting gross margins are calculated by applying

a cost-to-retail ratio to the retail value of inventories. At any one

time, inventories include items that have been marked down to

the Company’s best estimate of their fair market value. Actual

markdowns required could differ from this estimate.