Bed, Bath and Beyond 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2002

15

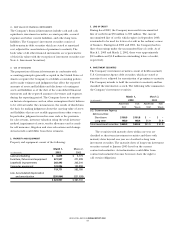

8. EMPLOYEE BENEFIT PLANS

The Company has two defined contribution 401(k) savings

plans (the “Bed Bath & Beyond Plan” and the “Harmon Plan”)

covering all eligible Bed Bath & Beyond and Harmon employees,

respectively. Participants may defer annual pretax compensation

subject to statutory and Plan limitations. The Company has an

option to contribute an amount as determined by the Board

of Directors to either Plan. In addition, each participant in the

Bed Bath & Beyond Plan may elect to make voluntary, non-tax

deductible contributions in excess of the pre-tax compensation

limit up to 15% of compensation. As of March 1, 2003, the

Company has not made a material contribution to either Plan.

9. COMMITMENTS AND CONTINGENCIES

The Company maintains employment agreements with its

Co-Chairmen, which extend through 2007. The agreements

provide for a base salary (which may be increased by the Board

of Directors), termination payments, post-retirement benefits and

other terms and conditions of employment.

The Company is involved in various claims and legal actions

arising in the ordinary course of business. In the opinion of

management, the ultimate disposition of these matters will not

have a material adverse effect on the Company’s consolidated

financial position, results of operations or liquidity.

10. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $151.8 million, $89.8 million

and $68.0 million in fiscal 2002, 2001 and 2000, respectively.

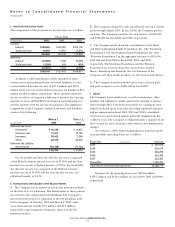

11. STOCK OPTION PLANS

Options to purchase shares of the Company’s common stock

have been granted to employees under various stock option plans,

which plans aggregated 64.4 million shares of common stock,

subject to adjustment under certain circumstances. Option grants,

which are issued at market value on the date of grant, generally

become exercisable in five equal installments beginning one to

three years after the date of grant, and in all events, expire ten

years after the date of grant. All option grants are non-qualified.

The following table summarizes stock option transactions:

NUMBER OF WEIGHTED-AVERAGE

SHARES EXERCISE PRICE

Outstanding at February 26, 2000 26,224,000)$8.65

Options granted 6,149,700)12.73

Options exercised (7,078,153) 5.33

Options canceled (1,123,562) 12.02

Outstanding at March 3, 2001 24,171,985)10.51

Options granted 3,439,800)23.73

Options exercised (3,550,917) 7.25

Options canceled (943,860) 14.41

Outstanding at March 2, 2002 23,117,008)12.80

Options granted 4,335,000)31.95

Options exercised (2,989,255) 8.09

Options canceled (626,008) 20.45

Outstanding at March 1, 2003 23,836,745)$ 16.66

Options exercisable:

At March 3, 2001 4,904,297)$7.12

At March 2, 2002 6,155,914)$9.30

At March 1, 2003 8,404,205)$ 11.20

The stock option committees determine the number of

shares and the option price per share for all options issued

under the stock option plans.

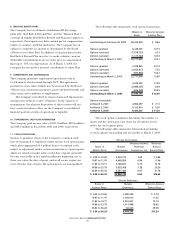

The following tables summarize information pertaining

to stock options outstanding and exercisable at March 1, 2003:

OPTIONS OUTSTANDING

WEIGHTED-AVERAGE WEIGHTED-

RANGE OF NUMBER REMAINING AVERAGE

EXERCISE PRICES OUTSTANDING CONTRACTUAL LIFE EXERCISE PRICE

$ 2.04 to 10.69 4,029,310 3.69 $ 5.84

10.97 to 11.47 4,649,850 6.99 11.46

11.83 to 14.77 5,160,637 5.79 13.16

14.86 to 23.78 5,635,508 7.38 20.20

23.84 to 36.24 4,361,440 9.07 31.78

$ 2.04 to 36.24 23,836,745 6.65 $16.66

OPTIONS EXERCISABLE

RANGE OF NUMBER WEIGHTED-AVERAGE

EXERCISE PRICES EXERCISABLE EXERCISE PRICE

$ 2.04 to 10.69 3,080,590 $ 5.70

10.97 to 11.47 1,200,010 11.45

11.83 to 14.77 3,051,637 13.74

14.86 to 23.78 1,011,948 18.95

23.84 to 36.24 60,020 29.38

$ 2.04 to 36.24 8,404,205 $11.20