Bed, Bath and Beyond 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

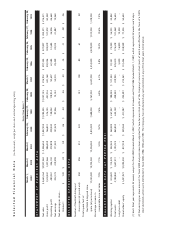

BED BATH & BEYOND ANNUAL REPORT 2002

10

Notes to Consolidated Financial Statements

Bed Bath & Beyond Inc. and Subsidiaries

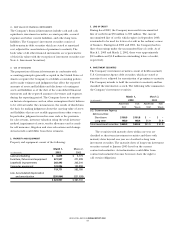

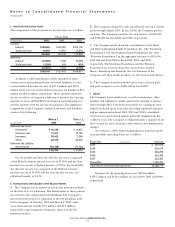

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AND RELATED MATTERS

A. NATURE OF OPERATIONS

Bed Bath & Beyond Inc. (the “Company”) is a nationwide

chain of stores selling predominantly better quality domestics

merchandise and home furnishings. As the Company operates

in the retail industry, its results of operations are affected by

general economic conditions and consumer spending habits.

B. PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements include

the accounts of the Company and its subsidiaries, all of which

are wholly owned.

All significant intercompany balances and transactions have

been eliminated in consolidation.

C. FISCAL YEAR

The Company’s fiscal year is comprised of the 52 or 53 week

period ending on the Saturday nearest February 28. Accordingly,

fiscal 2002 and 2001 represented 52 weeks and ended on

March 1, 2003 and March 2, 2002, respectively; and fiscal 2000

represented 53 weeks and ended March 3, 2001.

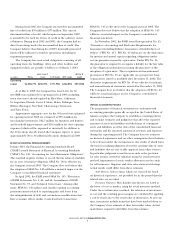

D. RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

During fiscal 2002, the Company adopted the following

pronouncements:

Statement of Financial Accounting Standards (“SFAS”)

No. 141, “Business Combinations.” SFAS No. 141 requires that

the purchase method of accounting be used for all business

combinations initiated after June 30, 2001, and establishes

specific criteria for the recognition of goodwill separate from

other intangible assets. The Company adopted SFAS No. 141 in

fiscal 2002. The adoption of SFAS No. 141 did not have a material

impact on the Company’s consolidated financial statements.

SFAS No. 142, “Goodwill and Other Intangible Assets.”

SFAS No. 142 discontinued the amortization of goodwill and

other intangible assets with indefinite useful lives and requires

periodic goodwill impairment testing. The Company’s only

goodwill arose from the March 2002 acquisition of Harmon

Stores, Inc. (“Harmon”). The Company did not amortize any

goodwill recognized as a result of the acquisition of Harmon

(see Note 13 – Acquisition) and performed impairment testing

as of the Company’s fiscal year end date. The Company adopted

SFAS No. 142 in fiscal 2002. The adoption of SFAS No. 142 did

not have a material impact on the Company’s consolidated

financial statements.

SFAS No. 144, “Accounting for the Impairment or Disposal

of Long-Lived Assets.” This statement supersedes SFAS No. 121,

“Accounting for the Impairment of Long-Lived Assets and for

Long-Lived Assets to be Disposed Of,” while retaining many of the

fundamental provisions covered by that statement. SFAS No. 144

differs fundamentally from SFAS No. 121 in that goodwill and

other intangible assets, that are not amortized, are excluded

from the scope of SFAS No. 144. SFAS No. 144 also expands

the scope of discontinued operations to include more types of

disposal transactions. The Company adopted SFAS No. 144 in

fiscal 2002. The adoption of SFAS No. 144 did not have a material

impact on the Company’s consolidated financial statements.

SFAS No. 146, “Accounting for Costs Associated with Exit

or Disposal Activities.” This statement requires companies to

recognize costs associated with exit or disposal activities when

they are incurred. The provisions of SFAS No. 146 were effective

for any exit or disposal activities initiated after December 31,

2002. The Company adopted SFAS No. 146 in fiscal 2002. The

adoption of SFAS No. 146 did not have a material impact on

the Company’s consolidated financial statements.

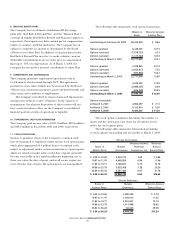

SFAS No. 148, “Accounting for Stock-Based Compensation-

Transition and Disclosure.” SFAS No. 148 is an amendment of

SFAS No. 123, “Accounting for Stock-Based Compensation,” and

provides alternative methods of transition for a voluntary change

to the fair value method of accounting for stock-based employee

compensation. In addition, the statement amends the disclosure

requirements of SFAS No. 123 to require prominent disclosures

in both annual and interim financial statements about the

method of accounting for stock-based compensation and the

effect of the method used. For the fiscal years ended 2002, 2001

and 2000, the Company accounted for stock options using the

intrinsic value method prescribed under Accounting Principles

Board (“APB”) No. 25, and accordingly, the Company did not

recognize compensation expense for stock options. The Company

continues to account for stock-based compensation using APB

No. 25 and has not adopted the recognition provisions of SFAS

No. 123, as amended by SFAS No. 148. However, the Company

has adopted the disclosure provisions for the current fiscal year

and has included this information in Note 1(T.) – Stock-Based

Compensation.

In November 2002, the Emerging Issues Task Force (EITF)

of the FASB reached a consensus on EITF 02-16, “Accounting

by a Customer (including a Reseller) for Certain Consideration

Received from a Vendor.” EITF 02-16 addresses the accounting

treatment for vendor allowances. As clarified by the EITF in

January 2003, this issue is effective for arrangements with vendors

initiated on or after January 1, 2003. The provisions of this

consensus are consistent with the Company’s existing accounting

policy and the application of EITF 02-16 is not expected to have

a material impact on the Company’s consolidated financial

statements.