Bed, Bath and Beyond 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2000

18

Option grants have been at market value, non-qualified and

generally exercisable in five equal annual installments beginning

one to three years after the date of grant and expire ten years

from the date of grant.

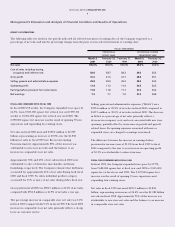

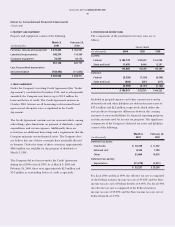

The following table summarizes stock option transactions:

WEIGHTED-

NUMBER OF AVERAGE

SHARES EXERCISE PRICE

Outstanding at February 28, 1998 21,209,796)$ 4.81

Options granted 5,540,400)11.77

Options exercised (2,660,298) 2.55

Options canceled (617,360) 6.10

Outstanding at February 27, 1999 23,472,538)6.67

Options granted 5,533,900)15.49

Options exercised (1,975,374) 3.94

Options canceled (807,064) 9.67

Outstanding at February 26, 2000 26,224,000)8.65

Options granted 6,149,700)12.73

Options exercised (7,078,153) 5.33

Options canceled (1,123,562) 12.02

Outstanding at March 3, 2001 24,171,985)$10.51

Options exercisable:

At February 27, 1999 5,077,618)$ 3.84

At February 26, 2000 7,240,180)$ 4.81

At March 3, 2001 4,904,297)$ 7.12

The stock option committees determine the number of shares

and the option price per share for all options issued under the

stock option plans.

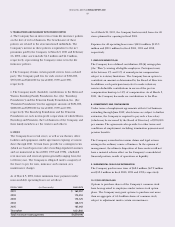

The following tables summarize information pertaining to stock

options outstanding and exercisable at March 3, 2001:

OPTIONS OUTSTANDING

WEIGHTED-AVERAGE WEIGHTED-

RANGE OF NUMBER REMAINING AVERAGE

EXERCISE PRICES OUTSTANDING CONTRACTUAL LIFE EXERCISE PRICE

$ 1.06 to 6.12 4,295,046 4.35 $ 3.69

6.19 to 10.38 4,601,534 6.39 7.33

10.69 to 11.47 5,093,820 8.95 11.45

11.83 to 14.19 4,159,315 7.28 11.92

14.77 to 26.78 6,022,270 8.54 16.01

$ 1.06 to 26.78 24,171,985 7.26 $10.51

OPTIONS EXERCISABLE

WEIGHTED-

RANGE OF NUMBER AVERAGE

EXERCISE PRICES EXERCISABLE EXERCISE PRICE

$ 1.06 to 6.12 2,609,526 $ 3.40

6.19 to 10.38 832,974 7.27

10.69 to 11.47 73,300 11.15

11.83 to 14.19 554,555 12.03

14.77 to 26.78 833,942 14.98

$ 1.06 to 26.78 4,904,297 $ 7.12

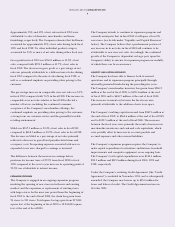

The Company applies APB No. 25 and related interpretations

in accounting for its stock option plans. Accordingly, no

compensation cost has been recognized in connection with the

stock option plans. Set forth below are the Company’s net

earnings and net earnings per share “as reported”, and as if

compensation cost had been recognized in accordance with the

fair value provisions of SFAS No. 123:

FISCAL YEARS

(in thousands, except per share data) 2000 1999 1998

NET EARNINGS:

As reported $171,922 $131,229 $97,346

Pro forma $154,540 $119,158 $89,519

NET EARNINGS PER SHARE:

Basic:

As reported $ 0.61 $ 0.47 $ 0.35

Pro forma $ 0.54 $ 0.43 $ 0.32

Diluted:

As reported $ 0.59 $ 0.46 $ 0.34

Pro forma $ 0.53 $ 0.41 $ 0.31

The fair value of each option grant is estimated on the date of

grant using the Black-Scholes option-pricing model with the

following assumptions used for grants for fiscal 2000, 1999 and

1998, respectively: dividend yield of 0% for all years; expected

volatility of 45%, 42% and 42%; risk free interest rates of 6.58%,

5.95% and 5.58%; and expected lives of seven years, seven years

and six years. The weighted-average fair value of options granted

during the year is $7.25, $8.34 and $6.06 for fiscal 2000, 1999

and 1998, respectively.

Notes to Consolidated Financial Statements

(Continued)