Bed, Bath and Beyond 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2000

10

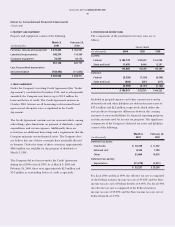

The Credit Agreement contains certain covenants which, among

other things, place limitations on payment of dividends, capital

expenditures and certain expenses. Additionally, there are

restrictions on additional borrowings and a requirement that the

Company maintain certain financial ratios. The Company does

not believe that any of these covenants will materially affect its

business or its expansion program as currently planned.

The Company did not borrow under the Credit Agreement

during fiscal 2000, fiscal 1999 or fiscal 1998. The Company

believes that during fiscal 2001, internally generated funds will

be sufficient to fund both its normal operations and its

expansion program.

As of March 30, 2001, the Company has leased sites for 62 new

superstores planned for opening in fiscal 2001, including one

new store already opened in Wilkes Barre, Pennsylvania.

Approximate aggregate costs for the 62 leased stores are

estimated at $91.8 million for merchandise inventories, $39.3

million for furniture and fixtures and leasehold improvements

and $16.5 million for preopening expenses (which will be

expensed as incurred). In addition to the 62 locations

already leased, the Company expects to open approximately

18 additional locations during fiscal 2001. The costs that the

Company is expected to incur in connection with the

anticipated opening of other superstores for which sites have not

yet been leased cannot presently be determined.

RECENT ACCOUNTING PRONOUNCEMENTS

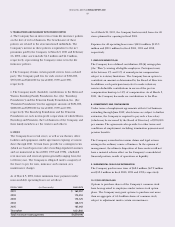

In the fourth quarter of fiscal 2000, the Company adopted the

provisions of the Financial Accounting Standards Board’s

Emerging Issues Task Force (“EITF”) Issue No. 00-14,

“Accounting for Certain Sales Incentives”, which provides that

the value of point of sale coupons and rebates that result in a

reduction of the price paid by the customer be recorded as a

reduction of sales, and that free merchandise incentives be

recorded as cost of sales. Prior to adoption, the Company

recorded its point of sale coupons and rebates in cost of sales.

Upon adoption, the Company has reclassified such sales

incentives as a reduction of sales in its consolidated statements

of earnings for fiscal 2000, 1999 and 1998. The reclassification

had no impact on gross profit, operating profit or net earnings.

In the fourth quarter of fiscal 2000, the Company also adopted

the provisions of EITF Issue No. 00-10, “Accounting for Shipping

and Handling Fees and Costs”, which provides that amounts

billed to a customer in a sale transaction related to shipping and

handling represent revenues. Prior to adoption, the Company

recorded such revenues and costs in selling, general and

administrative expense. Upon adoption, the Company has

reclassified such shipping and handling fees to sales and

shipping and handling costs to cost of sales in its consolidated

statements of earnings for fiscal 2000, 1999 and 1998.

The reclassification had no impact on operating profit or

net earnings.

As a result of these reclassifications, previously reported net sales

decreased by approximately $20.5 million and $14.9 million

and cost of sales decreased by approximately $20.4 million and

$14.9 million in fiscal 1999 and fiscal 1998, respectively.

FORWARD LOOKING STATEMENTS

This Annual Report and, in particular, Management’s Discussion

and Analysis of Financial Condition and Results of Operations,

and the Shareholder Letter, contain forward looking statements

within the meaning of Section 21E of the Securities Exchange

Act of 1934, as amended. The Company’s actual results of

operations and future financial condition may differ materially

from those expressed in any such forward looking statements as

a result of many factors that may be beyond the Company’s

control. Such factors include, without limitation: general

economic conditions, changes in the retailing environment and

consumer spending habits, demographics and other

macroeconomic factors that may impact the level of spending

for the types of merchandise sold by the Company; unusual

weather patterns; competition from existing and potential

competitors; competition from other channels of distribution;

pricing pressures; the ability to find suitable locations at

reasonable occupancy costs to support the Company’s expansion

program; the availability of trained qualified management

personnel to support the Company’s growth; and the cost of

labor, merchandise and other costs and expenses.

SEASONALITY

The Company’s business exhibits less seasonality than many

other retail businesses, although sales levels are generally higher

in August, November and December, and generally lower in

February and March.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Continued)