Bed, Bath and Beyond 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(Continued)

BED BATH & BEYOND ANNUAL REPORT 2000

16

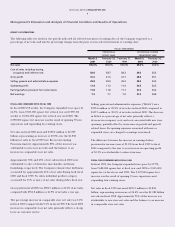

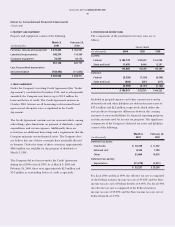

2. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

March 3, February 26,

(in thousands) 2001 2000

Furniture, fixtures and equipment $ 219,243)$ 162,061)

Leasehold improvements 168,370)114,549)

Computer equipment 73,535)44,143)

461,148)320,753)

Less: Accumulated depreciation

and amortization (158,492) (111,842)

$ 302,656)$ 208,911)

3. CREDIT AGREEMENT

Under the Company’s revolving Credit Agreement (the “Credit

Agreement”) concluded in November 1994, and as subsequently

amended, the Company may borrow up to $25.0 million for

loans and letters of credit. The Credit Agreement matures in

October 2001. Interest on all borrowings is determined based

upon several alternative rates as stipulated in the Credit

Agreement.

The Credit Agreement contains certain covenants which, among

other things, place limitations on payment of dividends, capital

expenditures and certain expenses. Additionally, there are

restrictions on additional borrowings and a requirement that the

Company maintain certain financial ratios. The Company does

not believe that any of these covenants have materially affected

its business. Under the terms of these covenants, approximately

$86.0 million was available for the payment of dividends at

March 3, 2001.

The Company did not borrow under the Credit Agreement

during fiscal 2000 or fiscal 1999. As of March 3, 2001 and

February 26, 2000, there were approximately $2.9 million and

$5.3 million in outstanding letters of credit, respectively.

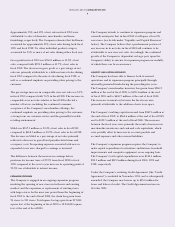

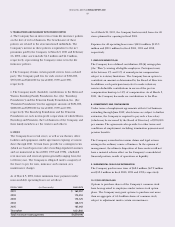

4. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as

follows:

FISCAL YEARS

(in thousands) 2000 1999 1998

Current:

Federal $ 102,178)$ 82,652)$ 61,098)

State and local 11,678)9,446)8,291)

113,856)92,098)69,389)

Deferred:

Federal (3,535) (7,356) (4,549)

State and local (404) (841) (617)

(3,939) (8,197) (5,166)

$ 109,917)$ 83,901)$ 64,223)

Included in prepaid expenses and other current assets and in

deferred rent and other liabilities are deferred income taxes of

$35.4 million and $2.2 million, respectively, which reflect the

net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes

and the amounts used for income tax purposes. The significant

components of the Company’s deferred tax assets and liabilities

consist of the following:

March 3, February 26,

(in thousands) 2001 2000

Deferred Tax Assets:

Inventories $ 13,729)$ 11,332)

Deferred rent 9,103)7,789)

Other 21,684)14,678)

Deferred Tax Liability:

Depreciation (11,279) (4,501)

$ 33,237)$ 29,298)

For fiscal 2000 and fiscal 1999, the effective tax rate is comprised

of the Federal statutory income tax rate of 35.00% and the State

income tax rate, net of Federal benefit, of 4.00%. For fiscal 1998,

the effective tax rate is comprised of the Federal statutory

income tax rate of 35.00% and the State income tax rate, net of

Federal benefit, of 4.75%.