Bed, Bath and Beyond 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2000

14

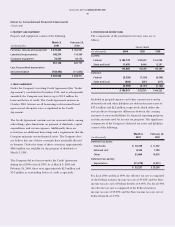

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AND RELATED MATTERS

A. NATURE OF OPERATIONS

Bed Bath & Beyond Inc. (the “Company”) is a nationwide chain

of “superstores” selling predominantly better quality domestics

merchandise and home furnishings. As the Company operates

in the retail industry, its results of operations are affected by

general economic conditions and consumer spending habits.

B. PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements include the

accounts of the Company and its subsidiaries, all of which are

wholly owned.

All significant intercompany balances and transactions have

been eliminated in consolidation.

C. FISCAL YEAR

The Company’s fiscal year is comprised of the 52 or 53 week

period ending on the Saturday nearest February 28. Accordingly,

fiscal 2000 represented 53 weeks and ended on March 3, 2001;

fiscal 1999 and fiscal 1998 represented 52 weeks and ended on

February 26, 2000 and February 27, 1999, respectively.

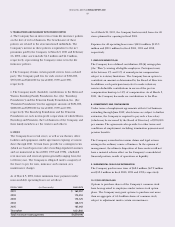

D. RECENT ACCOUNTING PRONOUNCEMENTS

In the fourth quarter of fiscal 2000, the Company adopted the

provisions of the Financial Accounting Standards Board’s

Emerging Issues Task Force (“EITF”) Issue No. 00-14,

“Accounting for Certain Sales Incentives”, which provides that

the value of point of sale coupons and rebates that result in a

reduction of the price paid by the customer be recorded as a

reduction of sales, and that free merchandise incentives be

recorded as cost of sales. Prior to adoption, the Company

recorded its point of sale coupons and rebates in cost of sales.

Upon adoption, the Company has reclassified such sales

incentives as a reduction of sales in its consolidated statements

of earnings for fiscal 2000, 1999 and 1998. The reclassification

had no impact on gross profit, operating profit or net earnings.

In the fourth quarter of fiscal 2000, the Company also adopted

the provisions of EITF Issue No. 00-10, “Accounting for Shipping

and Handling Fees and Costs”, which provides that amounts

billed to a customer in a sale transaction related to shipping and

handling represent revenues. Prior to adoption, the Company

recorded such revenues and costs in selling, general and

administrative expense. Upon adoption, the Company has

reclassified such shipping and handling fees to sales and

shipping and handling costs to cost of sales in its consolidated

statements of earnings for fiscal 2000, 1999 and 1998.

The reclassification had no impact on operating profit or

net earnings.

As a result of these reclassifications, previously reported net sales

decreased by approximately $20.5 million and $14.9 million

and cost of sales decreased by approximately $20.4 million and

$14.9 million in fiscal 1999 and fiscal 1998, respectively.

E. EARNINGS PER SHARE

The Company presents earnings per share on a basic and

diluted basis. Basic earnings per share has been computed by

dividing net earnings by the weighted average number of shares

outstanding. Diluted earnings per share has been computed by

dividing net earnings by the weighted average number of shares

outstanding including the dilutive effect of stock options.

F. STOCK-BASED COMPENSATION

As permitted under Statement of Financial Accounting

Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation”, the Company has elected not to adopt the fair

value based method of accounting for its stock-based

compensation plans, but continues to apply the provisions of

Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (“APB No. 25”). The Company has

complied with the disclosure requirements of SFAS No. 123.

G. CASH AND CASH EQUIVALENTS

The Company considers all highly liquid instruments purchased

with maturities of three months or less to be cash equivalents.

H. MERCHANDISE INVENTORIES

Merchandise inventories are stated at the lower of cost or

market, determined by the retail inventory method

of accounting.

Notes to Consolidated Financial Statements