Bed, Bath and Beyond 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND ANNUAL REPORT 2000

17

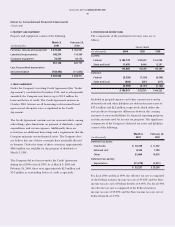

5. TRANSACTIONS AND BALANCES WITH RELATED PARTIES

A. The Company has an interest in certain life insurance policies

on the lives of its Co-Chairmen. The beneficiaries of these

policies are related to the aforementioned individuals. The

Company’s interest in these policies is equivalent to the net

premiums paid by the Company. At March 3, 2001 and February

26, 2000, other assets include $4.5 million and $4.0 million,

respectively, representing the Company’s interest in the life

insurance policies.

B. The Company obtains certain payroll services from a related

party. The Company paid fees for such services of $366,000,

$557,000 and $424,000 for fiscal 2000, 1999 and 1998,

respectively.

C. The Company made charitable contributions to the Mitzi and

Warren Eisenberg Family Foundation, Inc. (the “Eisenberg

Foundation”) and the Feinstein Family Foundation, Inc. (the

“Feinstein Foundation”) in the aggregate amounts of $634,000,

$488,000 and $390,000 for fiscal 2000, 1999 and 1998,

respectively. The Eisenberg Foundation and the Feinstein

Foundation are each not-for-profit corporations of which Messrs.

Eisenberg and Feinstein, the Co-Chairmen of the Company, and

their family members are the trustees and officers.

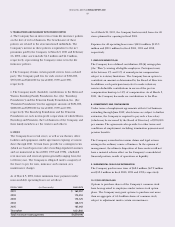

6. LEASES

The Company leases retail stores, as well as warehouses, office

facilities and equipment, under agreements expiring at various

dates through 2021. Certain leases provide for contingent rents

(which are based upon store sales exceeding stipulated amounts

and are immaterial in fiscal 2000, 1999 and 1998), scheduled

rent increases and renewal options generally ranging from five

to fifteen years. The Company is obligated under a majority of

the leases to pay for taxes, insurance and common area

maintenance charges.

As of March 3, 2001, future minimum lease payments under

noncancelable operating leases are as follows:

FISCAL YEAR (in thousands) AMOUNTS

2001 $ 165,057

2002 175,353

2003 173,125

2004 168,773

2005 165,042

Thereafter 1,031,840

Total minimum lease payments $1,879,190

As of March 30, 2001, the Company had executed leases for 62

stores planned for opening in fiscal 2001.

Expenses for all operating leases were $142.6 million, $113.3

million and $89.5 million for fiscal 2000, 1999 and 1998,

respectively.

7. EMPLOYEE BENEFIT PLAN

The Company has a defined contribution 401(k) savings plan

(the “Plan”) covering all eligible employees. Participants may

defer between 1% and 15% of annual pre-tax compensation

subject to statutory limitations. The Company has an option to

contribute an amount as determined by the Board of Directors.

In addition, each participant may elect to make voluntary,

non-tax deductible contributions in excess of the pre-tax

compensation limit up to 15% of compensation. As of March 3,

2001, the Company has made no contributions to the Plan.

8. COMMITMENTS AND CONTINGENCIES

Under terms of employment agreements with its Co-Chairmen

extending through June 2002, which terms are subject to further

extension, the Company is required to pay each a base salary

(which may be increased by the Board of Directors) of $750,000

per annum. The agreements also provide for other terms and

conditions of employment, including termination payments and

pension benefits.

The Company is involved in various claims and legal actions

arising in the ordinary course of business. In the opinion of

management, the ultimate disposition of these matters will not

have a material adverse effect on the Company’s consolidated

financial position, results of operations or liquidity.

9. SUPPLEMENTAL CASH FLOW INFORMATION

The Company paid income taxes of $68.0 million, $67.2 million

and $53.5 million in fiscal 2000, 1999 and 1998, respectively.

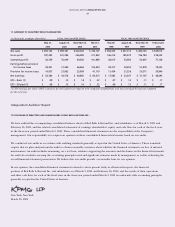

10. STOCK OPTION PLANS

Options to purchase shares of the Company’s common stock

have been granted to employees under various stock option

plans. The Company may grant options to purchase not more

than an aggregate of 64.4 million shares of common stock,

subject to adjustment under certain circumstances.