BT 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview

Overview

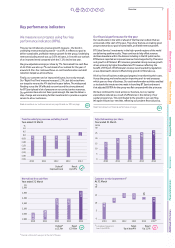

Key performance indicators

e measure our progress using four key

performance indicators (Is).

This year we introduced a revenue growth measure the trend in

underlying revenue excluding transit as a I. It reects our goal to

deliver sustainable, protable revenue growth for the group. Underlying

revenue excluding transit was up . this year, in line with our outlook

of an improved trend compared with the . decline last year.

e grew adjusted earnings per share by . ormalised free cash ow

of 2.bn was also up and ahead of our outlook for the year of

around 2.bn. Our continued focus on cost transformation and debt

reduction helped us achieve these.

Finally, our customer service improved this year, but not by enough.

OurRight First Time measure increased ., but did not achieve

our target to reverse the decline the year before. The widespread

ooding across the U aected our service and the strong demand

for BT port placed a lot of pressure on our contact centre resources.

Ourprocesses have also not been good enough. e need to deliver a

step-change and are making further investments to provide a superior

service to all our customers.

5eaG more about our customer serYice on paJe 16 anG our .3,s on paJe

60

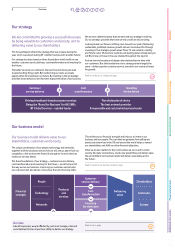

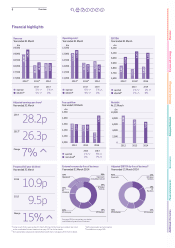

Our Ƭnancial performance for the year

Our results were in line with or ahead of the nancial outlook that we

announced at the start of the year. They show that we are making good

progress towards our goal of sustainable, protable revenue growth.

BT lobal ervices investments in the high-growth regions of the world

are delivering positive results. These continue to help oset revenue

declines elsewhere within the division including in the U public sector.

BT Business reported an improved revenue trend supported by IT services

and growth in BT Ireland. BT onsumer generated strong revenue growth

driven primarily by higher broadband and T revenue reecting the

benet of BT port. BT holesales revenue was impacted by regulation

as was Openreachs where it oset strong growth in bre take-up.

All of our lines of business made good progress in transforming their costs.

Across the group, we have focused on improving end-to-end processes

which span our lines of business. Our cost transformation activities enabled

us to absorb the investment we made in launching BT port and meant

that adjusted EBITDA for the group was at compared with the prior year.

e have continued to invest across our business, but our capital

expenditure reduced as a result of eciencies in the delivery of our

capital programmes. This contributed to the growth in our cash ow.

eagain reduced our net debt, reecting our prudent nancial policy.

5eaG more about our ƬnanciaO performance on paJe

59

a FinanciaO outOook which was JiYen at the start of the \ear

%

2011 20122010 2013 2014

Trend in underlying revenue excluding transit

Year ended 31 March

(3.5)

(3.0)

(2.5)

(2.0)

(1.5)

(1.0)

(0.5)

0.0

0.5

1.0

(1.9)

(3.0)

(2.9)

0.5

(3.1)

OutlookaResult

Improved trend Up 0.5%

£m

2011 20122010 2013 2014

Normalised free cash Ʈow

Year ended 31 March

1,900

2,000

2,100

2,200

2,300

2,400

2,500

2,307

2,076

2,032

2,450

2,300

OutlookaResult

c.£2.3bn £2.45bn

pence

2011 20122010 2013 2014

Adjusted earnings per share

Year ended 31 March

23.4

20.7

17.1

28.2

26.3

0

5

10

15

20

25

30

10

5

15

20

%

2011 20122010 2013 2014 2014b

Customer service improvementb

At 31 March

0

10.5

3.0

3.0

(4.0)

14.0

1.5

Target Result

Up at least 4% Up 1.5%

b &umuOatiYe improYement

from 1 $priO 200