Amgen 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

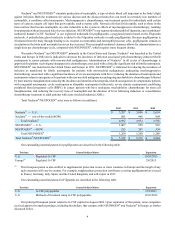

Total EPOGEN® sales were as follows (in millions):

2012 2011 2010

EPOGEN® — U.S. $ 1,941 $ 2,040 $ 2,524

Our outstanding material patents for epoetin alfa are described in the following table.

Territory General Subject Matter Expiration

U.S. Product claims to erythropoietin 8/20/2013

U.S. Pharmaceutical compositions of erythropoietin 8/20/2013

U.S. Pharmaceutical erythropoietin formulation with certain stabilizers 9/24/2014

U.S. Cells that make certain levels of erythropoietin 5/26/2015

Any products or technologies that are directly or indirectly successful in addressing anemia associated with renal failure

could negatively impact EPOGEN® sales. In the United States, as noted above, EPOGEN® and Aranesp® compete with each other,

primarily in the U.S. hospital dialysis clinic setting.

In March 2012, the FDA approved OMONTYS® (peginesatide), a synthetic, PEGylated peptidic compound that binds to

and stimulates the erythropoietin receptor and thus acts as an ESA. OMONTYS® was co-developed by Affymax, Inc. and Takeda

Pharmaceutical Company Limited (Takeda) and competes with EPOGEN® in the United States in the nephrology segment in

patients with CKD who are on dialysis. On February 23, 2013, Affymax, Inc. and Takeda announced that they had decided to

voluntarily recall all lots of OMONTYS® Injection to the user level as a result of new postmarketing reports regarding serious

hypersensitivity reactions, including anaphylaxis, which can be life-threatening or fatal.

XGEVA®/Prolia® (denosumab)

In 2010, we launched XGEVA® and Prolia®, both of which contain the same active ingredient but which are approved for

different indications, patient populations, doses and frequencies of administration. We have a collaboration agreement with Glaxo

Group Limited (Glaxo), a wholly owned subsidiary of GlaxoSmithKline plc (GSK), for the commercialization of denosumab in

certain countries. See Business Relationships — Glaxo Group Limited.

Total XGEVA® and Prolia® sales were as follows (in millions):

2012 2011 2010

XGEVA® — U.S. $ 644 $ 343 $ 8

XGEVA® — ROW 104 8 —

Total XGEVA®748 351 8

Prolia® — U.S. 292 130 26

Prolia® — ROW 180 73 7

Total Prolia®472 203 33

Total XGEVA®/Prolia®$ 1,220 $ 554 $ 41

XGEVA®

In November 2010, the FDA approved XGEVA® for the prevention of skeletal-related events (SREs) (pathological fracture,

radiation to bone, spinal cord compression or surgery to bone) in patients with bone metastases from solid tumors. XGEVA® is

not indicated for the prevention of SREs in patients with multiple myeloma.

In July 2011, we announced that the European Commission (EC) granted marketing authorization for XGEVA® for the

prevention of SREs in adults with bone metastases from solid tumors. The EC also granted XGEVA® an additional year of data

and market exclusivity in the EU since the indication was considered new for denosumab and based on the significant clinical

benefit of XGEVA® in comparison with existing therapies.

Any products or technologies that are directly or indirectly successful in treating for the prevention of SREs in patients with

bone metastases from solid tumors could negatively impact XGEVA® sales.