Aflac 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AFLAC INCORPORATED 2011 YEAR IN REVIEW 7

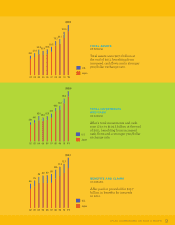

02 03 04 05 06 07 08 09 10 11

Net Earnings Per Diluted Share

Operating Earnings Per Diluted Share

1.51

1.78

2.15

2.56

2.93

3.29

3.76

4.59

$5.97

5.34

*

EARNINGS PER DILUTED SHARE

Net and operating earnings per diluted share

benefited from record operating results. In 2011,

we achieved our primary financial target, growth

in operating earnings per diluted share, excluding

the impact of the yen, for the 22nd consecutive

year. Operating earnings is an internal financial

measure we use to assess management’s

performance. Aflac defines operating earnings as

the profits derived from operations before realized

investment gains and losses from securities

transactions, impairments, and derivative and

hedging activities, as well as nonrecurring items.

*Excludes impact of the yen

to examine our business from an increasingly international

perspective. For example, take the financial crisis in Europe.

We do have European investment holdings, but even if we

didn’t, we would have still been affected because the world

is increasingly interconnected. Also, it’s stunning how fast

things are changing, between the duration of the life of a

particular product to technology. Our ability to exchange

information faster has changed everything we do, and

we’ve moved from a totally paper company when I came in,

to an almost paperless company.

Q

As CEO, what has been your biggest

accomplishment?

A

My biggest accomplishment has been being part of

something bigger than me, through Aflac: helping

people in their time of need. First and foremost, Aflac is in

the business of paying claims to our policyholders. Each

year, we pay billions of dollars in claims to policyholders

when they need it most, and at the same time, provide

long-term value to shareholders. The opportunity we

provide for our employees and sales distribution system to

make a good living is very satisfying. From a philanthropic

standpoint, Aflac has been able to help so many children

and their families through the Aflac Cancer Center and

Blood Disorders Service of Children’s Healthcare of Atlanta

and Aflac Japan’s Parents House. So the chance to make the

world a better place is truly the best part of what I do.

Q

Having achieved long-term success, how do you

take Aflac’s success to the next level?

A

First, never get complacent; I want to keep reaching

in every category. We will also continue to focus on

being more efficient. Keeping your operating expense

ratio very low allows you to give the best return to

customers, which should ultimately drive profits

for you, our shareholders.

Q

What are a few of the things that being CEO has

taught you?

A

Patience. Sometimes things don’t happen as fast as

one would like, but as CEO it’s important that I remain

focused and in tune with what’s going on, and continue

to maintain a level of patience and perseverance in the

process.