Aflac 2011 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

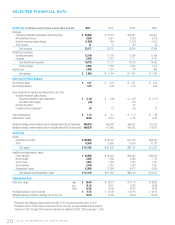

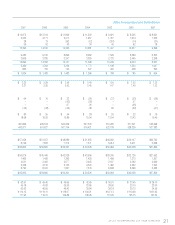

AFLAC INCORPORATED INVESTMENT SUMMARY

22 AFLAC INCORPORATED 2011 YEAR IN REVIEW

INVESTMENT PORTFOLIO BACKGROUND

Our investment portfolio fortifies the most important promise Aflac makes to policyholders—to

protect them when they need us most by paying claims, and paying them promptly.

We primarily invest for the long term, and the strong cash flows from our persistent book of

business give us the ability to continue to invest from this perspective. Historically, our product

needs and liability profile have been key drivers to our asset strategy. Our goal is to have a port-

folio matched by duration and currency.

• In Japan, our products are yen-denominated, long-dated and have high persistency,

thus yielding long-duration liabilities.

• Our U.S. investments and policy liabilities are dollar-denominated and have shorter

durations.

CHANGING GLOBAL INVESTMENT ENVIRONMENT

Because the vast majority of our policies are in Japan, we’re predominantly invested in

yen-denominated assets around the world, including Europe. Virtually all of our investments in

Europe are yen-denominated. As the financial crisis that began at the end of 2008 transformed

the investment landscape for all insurers around the world, we began to take action to reduce our

exposure to Europe to enhance the credit quality of our investment portfolio.

ENHANCING CREDIT QUALITY

Over the last several years, we have been reducing our exposure to Europe, especially the periph-

eral Eurozone countries of Portugal, Italy, Ireland, Greece and Spain.

From January 2008 to the end of 2011 we:

• Dramatically reduced our exposure to sovereign and nancial investments in the peripheral

Eurozone countries from 5.9% to 2.2% of total investments and cash.

• Lowered our investments in perpetual securities by more than half, going from 14.7% to

6.8% of total investments and cash. None of the perpetual securities we currently own are in

peripheral Eurozone countries.

• We are not presently making any new investments in Europe and will continue to take

actions to reduce our exposure to European debt as we pursue investment transactions that

make financial sense in the evolving environment.

Total Investments and Cash - $101.5 Billion

34.4%

7.9%

15.3%

4.8%

5.0%

6.0%

13.4%

11.0%

2.2% Japan

Other Asia

US

Germany

UK

Peripheral Eurozone

Other Europe

Other

Cash

GEOGRAPHIC INVESTMENT EXPOSURE

(December 31, 2011, At Amortized Cost)