Aflac 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AFLAC INCORPORATED 2011 YEAR IN REVIEW 5

Capital adequacy in Japan is principally

measured by our solvency margin ratio,

which was 547% at December 31, 2011, based

on the new calculation method that will

be eective March 31, 2012. Japan’s new

solvency margin calculation makes this

capital strength measure more comparable

with global measures of capital adequacy.

We are comfortable with this level of

solvency margin ratio, but continue to test

this capital adequacy ratio by applying

rigorous stress tests under extreme

scenarios. We are proud the rating agencies

have recognized the strength of our platform

and balance sheet. Our financial strength,

which exemplifies our ability to pay claims,

is rated A+ (Superior) by A.M. Best, Aa3 by

Moody’s, and AA- by S&P.

It is our longstanding belief that

when it comes to deploying capital for the

benefit of our shareholders, growing the

cash dividend and repurchasing our shares

are the most attractive means, and that is

something we will continue to pursue. We

repurchased 6.0 million shares of Aflac stock

in 2011. Additionally, we are very proud that

2011 marked the 29th consecutive year in

which Aflac has increased the cash dividend.

Our objective is to grow the dividend at a

rate that’s generally in line with operating

earnings-per-share growth before the impact

of the yen.

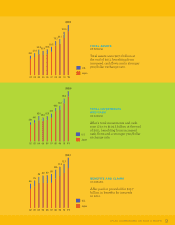

Despite our intense focus on the

balance sheet, we never lost sight of growing

our business. Combined, we generated more

than $3.5 billion in total new annualized

premium sales in the United States and

Japan in 2011. Total revenues rose 6.9%

to $22.2 billion, reflecting solid growth

in premium income and net investment

income, as well as the benefit of the stronger

yen/dollar exchange rate for the year.

Investments

Our vision is to have a world-class

investment organization that pays particular

attention to the needs of the insurance

operation through eective asset/liability

management and capital adequacy

management, while also taking into account

investment income needs. Without a

doubt, it is our investment portfolio that

fortifies what I believe is the most important

promise an insurance company makes to

policyholders—to protect them when they

need us most by paying claims promptly.

We continue to review our investments

to ensure that they best represent the

interests of our policyholders and all of our

stakeholders.

As we evaluate investment opportuni-

ties, it is a challenge to invest large cash

flows in a low-interest-rate environment. For

example, in Japan alone in 2011, we invested

$57 million each business day. We primarily

invest for the long term, and the strong cash

flows from our persistent book of business

give us the ability to continue to invest from

this perspective. Clearly, the world, and

particularly Europe, remains a very dynamic

and volatile macro-environment. As such,

we examined our traditional approach to

investing to determine how best to adapt to

the changing environment. One way we’ve

adapted over the last several years has been

through reducing our exposure to financial

holdings and investments in the peripheral

Eurozone. To eectively respond to this

environment, we brought on a global chief

investment ocer in November 2011. We are

also enhancing human capital, technology

and investment processes as we embark on

our goal to be best-in-class.

At Aflac, we do not just sell voluntary

insurance products. We sell a promise to

be there for our policyholders in their time

of need. Our employees are empowered to

honor and fulfill that promise every day.

The global financial challenges we’ve

all seen, especially with the changes in the

investment environment, have only served

to re-energize my enthusiasm as CEO

of this company. I wouldn’t trade places

with any other CEO in the world. I want to

personally thank you, our shareholders, for

supporting Aflac and helping establish

and maintain a strong foundation for

our company.

Daniel P. Amos

Chairman and

Chief Executive Ocer