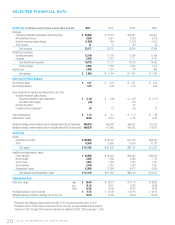

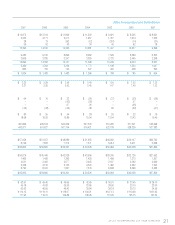

Aflac 2011 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AFLAC INCORPORATED 2011 YEAR IN REVIEW 23

Credit quality remains a central aspect of our investment approach. At year-end 2011, 94.4% of

our debt and perpetual securities were investment grade.

SHAREHOLDERS’ EQUITY

It’s worth noting that while we have been actively and successfully reducing the risk in our port-

folio, we have grown our shareholders’ equity from $8.8 billion at year-end 2007 to $13.5 billion

at December 31, 2011. We’ve also enhanced our risk management process while making invest-

ments in a new system to enable us to better evaluate market and credit risks in our portfolio.

INVESTMENT PORTFOLIO STRENGTH

Our overall portfolio is dominated by fixed-maturity securities. We have very limited exposure to residen-

tial, commercial and asset-backed securities. Excluding cash, perpetual securities comprised 6.9% of our

total investments and we are taking steps to continue to reduce our exposure in this asset class. At the

end of 2011, the percentage of our senior debt holdings increased from 79.5% at the end of 2010 to 86.2%.

GEOGRAPHIC INVESTMENT EXPOSURE

We diversify our large, fixed-income portfolio by geography and industry. The vast majority of

our investments in Japan are in Japanese Government Bonds (JGBs). As an insurance company,

we are mindful of the changing investment landscape and will invest in a way that is in the best

interest of our stakeholders.

INVESTMENT OUTLOOK

As we look ahead, our goal is to continue to enhance the quality of our portfolio by expanding

our portfolio’s diversity and ultimately improving our returns while reducing risks to certain

market cycles. For example, we plan on adding new asset classes to further diversify our port-

folio. In addition, we plan on hiring third-party investment advisors to manage a portion of our

overall assets and provide additional expertise to complement our asset strategies.

Our vision is to have a world-class investment organization that pays particular attention

to the needs of the insurance operation through eective asset/liability matching and capital

adequacy management, while also taking into account investment income needs. We will con-

tinue to invest in our human capital and technology, while improving our investment processes,

which is in the best interest of all our stakeholders, including our policyholders.

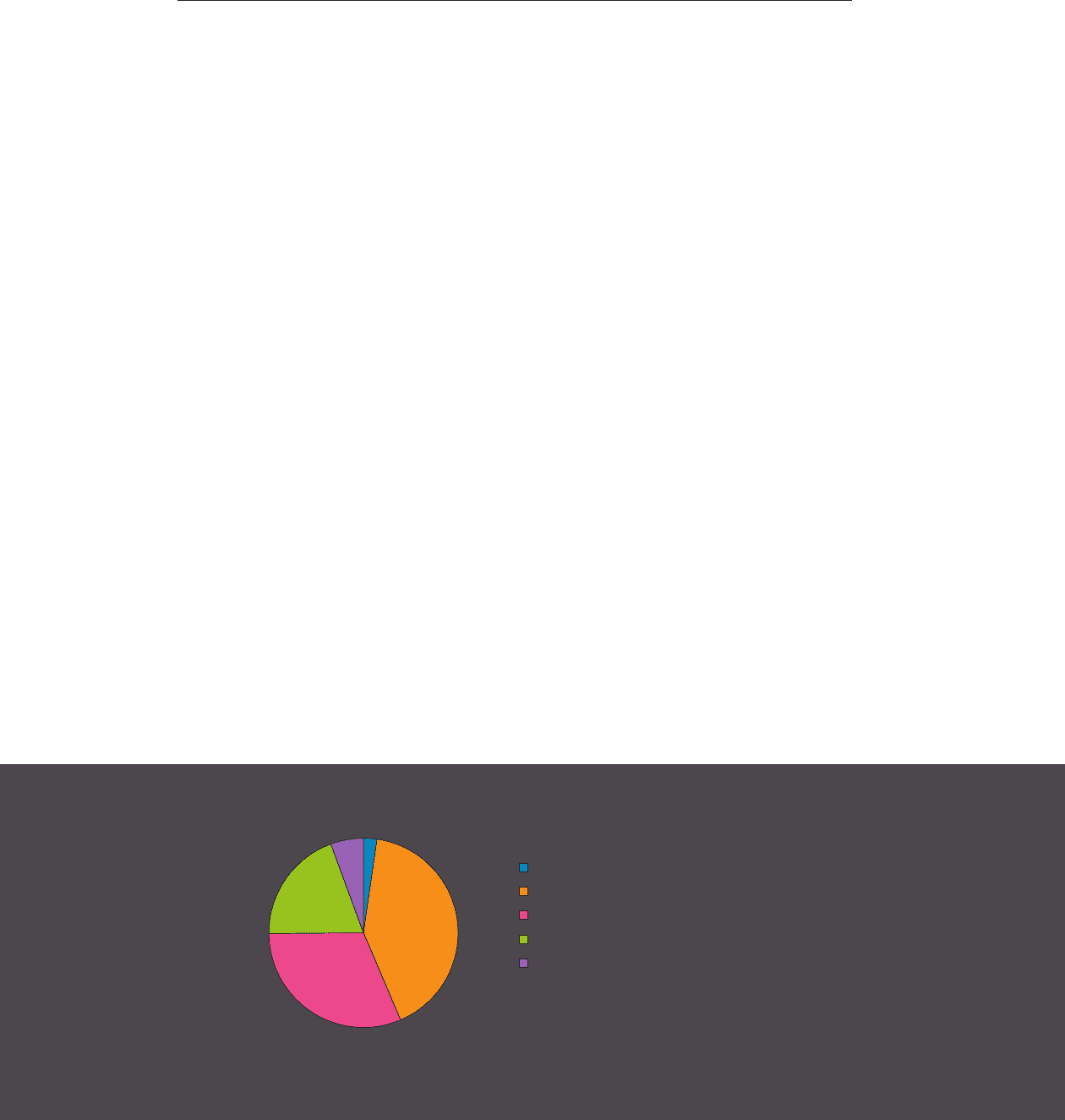

CREDIT RATINGS ON DEBT AND PERPETUAL SECURITIES*

(December 31, 2011, At Amortized Cost)

AAA

AA

A

BBB

BB or Lower

Total Debt Investment and Perpetual Securities - $99.3 Billion

2.3%

41.3%

31.3%

19.5%

5.6%

*Virtually all our securities are rated by S&P, Moody’s, and/or Fitch. For investment grade securities, our practice is to use the highest rating assigned by those agencies when the ratings

differ. For split-rated securities, we supplement this process with internal analysis to determine whether the security will be classified as investment grade or below investment grade.