Aflac 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 AFLAC INCORPORATED 2011 YEAR IN REVIEW

MESSAGE FROM MANAGEMENT

Daniel P. Amos, Chairman and CEO

A Year of Resilience—and Results

In the midst of a continually evolving

economic environment, 2011 was a

challenging year in many ways for many

companies, including Aflac. Despite facing

adversity, I am proud that 2011 was the

strongest year in the company’s history

from an operational perspective. This

achievement reflects our company’s ability

to remain focused on our growth strategy in

good times and bad: Aflac oers relevant

products that help protect consumers

against income and asset loss, reaching them

through expanded distribution channels.

In doing so, we have the privilege of

providing protection to more than 50 million

people in Japan and the United States.

Our operational success in 2011 also

highlights Aflac’s strength, resilience and

adaptability. But no matter how strong,

adaptable or prepared a company is, there

are certain situations that test a company’s

capacity to respond. That certainly was the

case for Aflac in 2011, especially in Japan.

We at Aflac, along with the rest of the

world, watched helplessly on March 11, 2011,

as the most destructive and devastating

natural disaster in Japan’s history wreaked

havoc upon the northeast coastline of Japan,

starting with the powerful earthquake

and tsunami. I am proud that through

it all, our operations in Tokyo remained

up and running, allowing us to deliver

on our promise of being there when our

policyholders need us most. I am also

pleased that through the U.S. media, we were

able to keep our U.S. employees, sales force

and investors, who were all very concerned

for the people of Japan, apprised of what was

going on. When I visited Japan in March

2011, I delivered messages of support and

hope from all over the U.S. The compassion

our stakeholders showed, particularly our

U.S. employees and sales force, makes

me proud and serves as a reminder that

what we do each day really matters to our

policyholders, investors and others who

count on us to provide value in other ways.

Overcoming Adversity

to Achieve Earnings Results

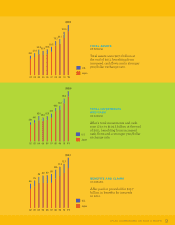

On an operating basis, we have a long

history of producing strong earnings growth.

In fact, 2011 marked the 22nd consecutive year

in which we met or exceeded our operating

earnings-per-share objective,* which is the

principal financial metric we use internally

to assess the growth of our business. We

believe that operating earnings, excluding

currency eects, continues to be the best

measure of our success. We achieved our

2011 operating earnings-per-share objective

of an 8.0% increase before the impact of the

yen. We believe that achieving our operating

earnings objective for more than two

decades has been a key driver of

shareholder value.

Net earnings in 2011 declined 16.2% over

2010 to $1.96 billion. Results for the full year

benefited from the stronger yen, but were

negatively impacted by larger investment

losses in 2011 compared with 2010. As a

result of aggressive investment portfolio

derisking, losses from securities transactions

and impairments reduced net earnings by

$850 million. In addition, net earnings were

reduced by $159 million, resulting from

foreign exchange and passive derivative

activities.

Strong Capital Profile

As we have communicated over the

past several years, maintaining a strong

risk-based capital, or RBC, ratio remains

a top priority for us. Our capital ratios

demonstrate our commitment to

maintaining financial strength on behalf

of our policyholders, bondholders and all

of our stakeholders. Our capital strength

is driven by huge, steady cash flows from

our operations, especially in Japan, and our

balance sheet is strong. Our goal was to end

2011 with an RBC ratio between 400% and

500%. Our RBC ratio was 493%, which was at

the upper end of our goal despite substantial

realized investment losses in 2011. As we

look ahead to 2012, our goal is to again end

the year with an RBC ratio between 400%

and 500%.

*Aac denes operating earnings as the prots derived from operations before realized investment gains

and losses from securities transactions, impairments, and derivative and hedging activities, as well as

nonrecurring items.

Following the Great Earthquake of Japan in

2011, Aflac was the first company to donate to

the victims of the devastation through the Red

Cross, giving ¥100 million—about $1.2 million.

Additionally, Aflac U.S. employees showed support

to their Japanese colleagues through the sale of $5

blue wristbands with the Aflac Duck and the word

“together” in English and in the Kanji character.

Through the sale of these wristbands, employees

raised more than $120,000 toward the relief

efforts in Japan. To encourage participation, Aflac

matched the first $100,000 in wristband sales,

bringing the combined amount of sales/donations

from this wristband effort to more than $220,000.