Aflac 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 AFLAC INCORPORATED 2011 YEAR IN REVIEW

THE AFLAC WAY: OUR PROMISE

As an insurance company, our product is intangible: We sell a promise to be there for our

policyholders and insureds when they need us most by paying claims fairly and promptly. Living

up to that promise is what really counts in delivering a positive consumer experience and building

a strong brand. It’s what we call The Aflac Way.

Our goal is to accomplish this while providing our customers with the best value in voluntary

insurance products in Japan and the United States by effectively and efficiently managing the

company’s assets. Our promise to be there for policyholders is at the foundation of every endeavor

we undertake.

HOW WE KEEP OUR PROMISE

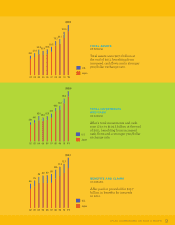

INCOME FROM PREMIUM – Our policy premiums are generated from two sources: policy renewals,

which represent the majority of premium received, and new policies issued. Policy premium is the

primary source of cash flow for our business operations. With these premium funds, we are able

to implement services that deliver on our promise to policyholders, including paying claims and

enhancing customer service and product development, thereby expanding Aflac’s overall value

proposition.

INCOME FROM INVESTMENTS – Our investment portfolio backs up the most important promise

an insurance company makes: to protect our policyholders when they need it most by paying cash

benefits in response to their claim. We invest premiums in various global assets. Earnings from

these investments provide additional income that allows us to charge lower premiums and return

value to the policyholder through more benefits than the premiums alone could provide.

An insurance company is in the business of managing risk, not avoiding risk. With that in mind, as

we evaluate potential investment opportunities, particular characteristics make certain investments

more appealing than others. First, we have to believe we will get our investment back for our

policyholders. Next, we look for investments that align with both the timing of claims we expect

to pay and the currency we expect to pay them in, whether yen or dollars. We strive to be good

stewards for our policyholders and those we insure, and we take great care to thoroughly evaluate

our investments to ensure it is an appealing investment. In doing so, when a policyholder becomes

a claimant, we deliver on our promise of paying claims fairly and promptly.

KEEPING OUR PROMISE THE AFLAC WAY

Since the founding of our company in 1955, we’ve put the customer first by reminding ourselves

daily about the promises we’ve made to those we insure. In living up to our promise, we’ve gained

the trust of more than 50 million people worldwide who count on us to pay claims promptly when

they need us most—The Aflac Way.