Acer 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-88-

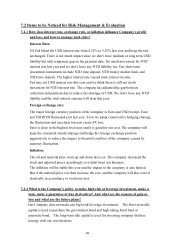

7.2 Items to be Noticed for Risk Management & Evaluation

7.2.1 How does interest rate, exchange rate, or inflation influence Company’s profit

and loss, and how to manage such risks?

Interest Rate:

US Fed hiked the USD interest rate from 4.25% to 5.25% last year and keep the rate

unchanged. There is not much impact since we don’ t have medium or long term USD

liability but only temporary gap on the payment date. No much movement for NTD

interest rate last year and we don’ t have any NTD liability too. Our short-term

investment instruments include NTD time deposit, NTD money market fund, and

USD time deposit. The higher interest rate caused more interest income.

Fed may cut USD interest rate this year and we think there is still not much

movement for NTD interest rate. The company has adjusted the gap between

collection and payment day to reduce the shortage of USD. We don’ t have any NTD

liability and the total interest expense will drop this year.

Foreign exchange rate:

The major foreign currency position of the company is Euro and USD receipt. Euro

and USDNTD fluctuated a lot last year. Even we adopt conservative hedging strategy,

the fluctuation and uncertain forecast create FX loss.

Euro is close to the highest level now and it is good for our cost. The company will

keep the consistent steady strategy and hedge the foreign exchange position

aggressively to reduce the impact to the profit and loss of the company caused by

currency fluctuation.

Inflation:

The oil and material price went up and down last year. The company increased the

stock and adjusted prices accordingly so it didn’ t hurt our business.

The inflation will be stable this year and the impact to the company is also limited.

But if the material price rise then increase the cost, and the company will also react it

elastically in accordance to avoid any loss.

7.2.2 What is the Company’s policy to make high risk or leverage investment, make a

loan, make a guarantee or buy derivatives? And what are the reasons of gain or

loss and what are the future plans?

Our Company does not make any high risk/leverage investment. The short-term idle

capital is used to purchase the government bond and high raking bond fund or

corporate bond. The long-term idle capital is used for investing company that has

synergy with our core business.