Acer 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-20-

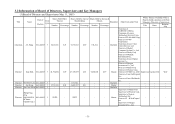

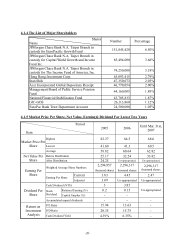

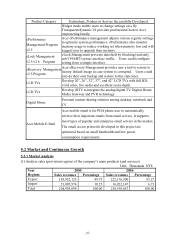

4.1.4 The List of Major Shareholders

Shares

Name Number Percentage

JPMorgan Chase Bank N.A. Taipei Branch in

custody for EuroPacific Growth Fund 151,845,420 6.50%

JPMorgan Chase Bank N.A. Taipei Branch in

custody for Capital World Growth and Income

Fund Inc.

85,494,000 3.66%

JPMorgan Chase Bank N.A. Taipei Branch in

custody for The Income Fund of America, Inc. 74,250,000 3.18%

Hong Rong Investment Corp. 65,093,415 2.79%

Stan Shih 47,350,073 2.03%

Acer Incorporated Global Depositary Receipt 46,770,054 2.00%

Management Board of Public Service Pension

Fund 44,160,005 1.89%

National Financial Stabilization Fund 43,705,833 1.87%

GIC-GOS 26,113,860 1.12%

SinoPac Bank Trust Department Account

24,500,000 1.05%

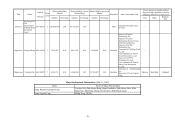

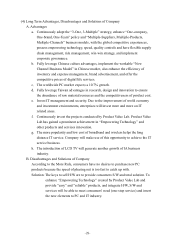

4.1.5 Market Price Per Share, Net Value, Earning& Dividend For Latest Two Years

Period

Item

2005 2006

Until Mar. 31st,

2007

Highest 82.37 84.5 68.6

Lowest 41.60 41.3 60.5

Market Price Per

Share

Average 58.82 60.64 62.82

Before Distribution 25.17 32.24 33.82

Net Value Per

Share After Distribution 24.25 Un-appropriated Un-appropriated

2,294,957 2,296,317

Weighted Average Share Numbers thousand shares thousand shares

2,296,317

thousand shares

Current 3.83 4.45 2.47

Earning Per

Share Earning Per Share Adjusted 3.69 Un-appropriated Un-appropriated

Cash Dividend (NT$) 3 3.85

Retained Earning (%) 0.2 0.15

Stock

Dividend Capital Surplus (%) - -

Un-appropriated

Dividend Per

Share

Accumulated unpaid dividends - - -

P/E Ratio 15.94 13.63 -

P/D Ratio 20.35 15.75 -

Return on

Investment

Analysis Cash Dividend Yield 4.91% 6.35% -