Acer 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

-35-

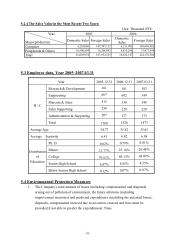

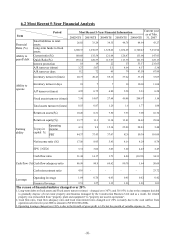

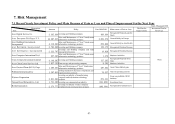

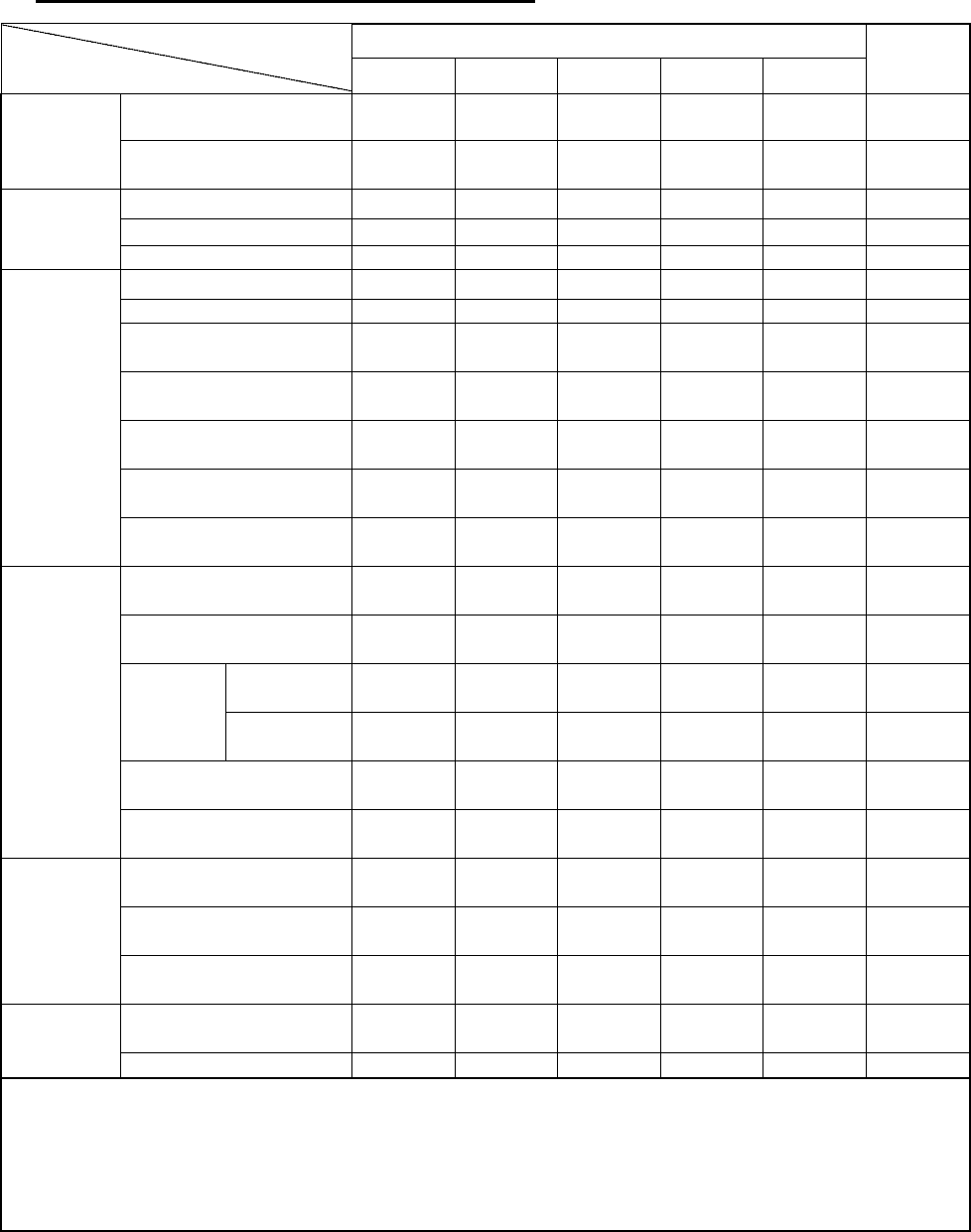

6.2 Most Recent 5-Year Financial Analysis

Most Recent 5-Year Financial Information

Period

Item 2002NT$ 2003NT$ 2004NT$ 2005NT$ 2006NT$

Current year

as of Mar.

31, 2007

Total liabilities to total

assets 26.02 33.24 39.35 48.76 44.94 43.27

Financial

Ratio (%) Long-term funds to fixed

assets 1,200.35 1,230.87 1,328.66 1,654.09 6,740.43 7,232.94

Current ratio(%) 169.68 135.59 121.64 126.47 133.90 147.93

Quick Ratio(%) 155.14 128.37 113.97 113.79 121.39 125.13

Ability to

payoff debt

Interest protection 18 19 22 53 53.37 235.65

A/R turnover (times) 3.27 5.07 5.3 4.94 4.37 5.38

A/R turnover days 112 72 69 74 83.58 67.89

Inventory turnover (times) 20.73 49.43 55.19 37.62 33.29 33.07

Inventory turnover days 18 7 7 10 10.96 11.04

A/P turnover (times) 4.95 6.75 6.80 5.58 5.33 6.28

Fixed assets turnover (times) 7.99 14.07 27.68 49.88 208.97 1.16

Ability to

operate

Total assets turnover (times) 0.55 0.87 1.29 1.6 1.77 1.88

Return on assets(%) 10.26 8.31 7.50 7.55 7.90 16.76

Return on equity(%) 13.77 11.3 11.34 13.41 14.62 29.86

Operating

income 4.31 9.9 15.34 25.89 28.83 2.48

To pay-in

capital % PBT 44.37 37.43 37.07 42.8 50.38 101.09

N

et income ratio (%) 17.56 8.95 5.43 4.14 4.29 8.79

Earning

ability

EPSNTD 3.31 3.02 3.03 3.69 4.45 2.47

Cash flow ratio 31.44 14.17 1.79 4.84 (18.93) 34.31

Cash flow adequacy ratio 86.98 80.9 69.62 80.78 1.64 50.69

Cash flow (%)

Cash reinvestment ratio 4.16 - - - - 23.72

Operating leverage 1.84 0.76 0.63 0.45 0.62 0.42

Leverage

Financial leverage 2.51 1.27 1.13 1.03 1.03 1.01

The reason of financial indictor changed over 20%

1. Long-term debts to fixed assets and Fixed assets turnover (times):changed over 307% and 318.95% is due to the company decided

to gradually dispose of real estate property and business managed by the Construction Business Unit and as a result, the related

property was reclassified from “property, plant and equipment” to “property not used in operations”.

2. Cash flow ratio, Cash flow adequacy ratio and Cash reinvestment ratio changed over 20% is mainly due to the cash outflow from

operation activities for year 2006 is amount to NTD 10,906,202K.

3. Operating leverage changed over 38% is due to the Growth of gross profit is 14% but the growth of variable expense is –7%.