Abercrombie & Fitch 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

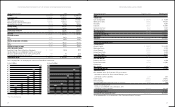

The following measurements are among the key business indicators

reviewed by various members of management to gauge the Company’s

results:

n

Comparable store sales by brand, by product and by store,

defined as year-over-year sales for a store that has been open as

the same brand at least one year and its square footage has not

been expanded or reduced by more than 20% within the past year;

n

Direct-to-consumer sales growth;

n International and flagship store performance;

n New store productivity;

n IMU;

n Selling margin, defined as sales price less original cost, by brand

and by product category;

n Stores and distribution expense as a percentage of net sales;

n Marketing, general and administrative expense as a percentage of

net sales;

n Store metrics such as sales per gross square foot, sales per selling

square foot, average unit retail, average number of transactions

per store, average transaction values, store contribution (defined

as store sales less direct costs of running the store), and average

units per transaction;

n Markdown rate;

n Gross profit rate;

n Operating income and operating income as a percentage of net sales;

n Net income;

n Inventory per gross square foot; and

n Cash flow and liquidity determined by the Company’s current

ratio and cash provided by operations.

While not all of these metrics are disclosed publicly by the Company due to

the proprietary nature of the information, the Company publicly discloses

and discusses several of these metrics as part of its financial summary and in

several sections within the Management’s Discussion and Analysis.

FISCAL 2007 COMPARED TO FISCAL 2006: FOURTH

QUARTER RESULTS: NET SALES Fourth quarter net sales

for the thirteen week period ended February 2, 2008 were $1.229 bil-

lion, up 7.9% versus net sales of $1.139 billion for the fourteen week

period ended February 3, 2007. The net sales increase was attributed

primarily to the net addition of 91 stores and a 46.8% increase in direct-

to-consumer business (including shipping and handling revenue),

partially offset by an extra selling week in the fourth quarter of Fiscal

2006 and the resulting impact of the calendar shift in Fiscal 2007 due

to Fiscal 2006 being a 53-week fiscal year, as well as a 1% decrease in

comparable store sales.

Comparable store sales by brand for the fourth quarter of Fiscal

2007 were as follows: Abercrombie & Fitch increased 1% with men’s

comparable store sales increasing by a low double-digit and women’s

decreasing by a mid single-digit; abercrombie decreased 3% with

boys’ increasing by a mid single-digit and girls’ decreasing by a mid

single-digit; Hollister decreased 2% with dudes’ increasing by a high

single-digit and bettys’ decreasing by a mid single-digit; and RUEHL

decreased 19% with men’s decreasing by a high single-digit and

women’s decreasing by the high twenties.

Comparable regional store sales ranged from increases in the high

teens to decreases in the mid single-digits. Stores located in Canada and

the Southwest and North Atlantic regions had the strongest comparable

store sales performance, while stores located in the South, Midwest

and West regions had the weakest comparable store sales performance

on a consolidated basis.

From a merchandise classification standpoint across all brands, stronger

performing masculine categories included graphic tees, fragrance and

fleece, while pants, jeans and knits posted negative comparable sales. In

the feminine businesses, across all brands, stronger performing categories

included graphics tees, jeans and sweaters, while knits and fleece

posted negative comparable sales.

Direct-to-consumer net merchandise sales, which are sold through

the Company’s websites and catalogue in the fourth quarter of Fiscal

2007, were $108.6 million, an increase of 45.2% versus last year’s

fourth quarter net merchandise sales of $74.8 million. Shipping and

handling revenue for the corresponding periods was $15.6 million in

Fiscal 2007 and $9.8 million in Fiscal 2006. The direct-to-consumer

business, including shipping and handling revenue, accounted for

10.1% of total net sales in the fourth quarter of Fiscal 2007 compared

to 7.4% in the fourth quarter of Fiscal 2006. The increase was driven

by store expansion, both domestically and internationally, improved

in-stock inventory availability, an improved targeted e-mail marketing

strategy and improved website functionality.

GROSS PROFIT Gross profit during the fourth quarter of Fiscal

2007 was $825.6 million compared to $755.6 million for the comparable

period in Fiscal 2006. The gross profit rate (gross profit divided by net

sales) for the fourth quarter of Fiscal 2007 was 67.2%, up 80 basis points

from last year’s fourth quarter rate of 66.4%. The increase in gross

profit rate can be attributed to both a higher IMU rate and a lower

shrink rate compared to the fourth quarter of Fiscal 2006, partially offset

by a higher markdown rate.

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for the fourth quarter of Fiscal 2007 was $388.4 million compared

to $349.8 million for the comparable period in Fiscal 2006. The stores and

distribution expense rate (stores and distribution expense divided by net

sales) for the fourth quarter of Fiscal 2007 was 31.6%, up 90 basis points

from 30.7% in the fourth quarter of Fiscal 2006. The increase in rate is

primarily related to the impact of minimum wage and management salary

increases and higher store fixed cost rates.

The DC productivity level, measured in units processed per labor hour

(“UPH”), was 16.1% higher in the fourth quarter of Fiscal 2007 versus the

fourth quarter of Fiscal 2006, reflecting the realization of increased efficiencies

due to the second DC being operational during Fiscal 2007.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during the fourth

quarter of Fiscal 2007 was $103.2 million compared to $101.6 million

during the same period in Fiscal 2006. For the fourth quarter of

Fiscal 2007, the marketing, general and administrative expense

rate (marketing, general and administrative expense divided by net

sales) was 8.4% compared to 8.9% in the fourth quarter of Fiscal

2006. The decrease in the marketing, general and administrative

expense rate was a result of lower travel, samples and outside ser-

vice expense rates, partially offset by an increase in the home office

payroll expense rate.

OTHER OPERATING INCOME, NET Fourth quarter net other

operating income for Fiscal 2007 was $3.0 million compared to $4.6

million for the fourth quarter of Fiscal 2006. The decrease was driven

primarily by losses on foreign currency transactions in the fourth quarter

of Fiscal 2007 as compared to gains on foreign currency transactions in

the fourth quarter of Fiscal 2006.

OPERATING INCOME Operating income during the fourth

quarter of Fiscal 2007 increased to $337.1 million from $308.8 million

for the comparable period in Fiscal 2006, an increase of 9.2%. The

operating income rate (operating income divided by net sales) for the

fourth quarter of Fiscal 2007 was 27.4% compared to 27.1% for the

fourth quarter of Fiscal 2006.

INTEREST INCOME, NET AND INCOME TAXES Fourth

quarter net interest income was $6.4 million in Fiscal 2007 compared

to $4.7 million during the comparable period in Fiscal 2006. The

increase in net interest income was due to higher interest rates and

higher available investment balances during the fourth quarter of

Fiscal 2007 when compared to the fourth quarter of Fiscal 2006.

The effective tax rate for the fourth quarter of 2007 was 36.9% as

compared to 36.8% for the Fiscal 2006 comparable period.

NET INCOME AND NET INCOME PER SHARE Net income

for the fourth quarter of Fiscal 2007 was $216.8 million versus $198.2

million for the fourth quarter of Fiscal 2006, an increase of 9.4%. Net

income per diluted weighted-average share outstanding for the fourth

quarter of Fiscal 2007 was $2.40, versus $2.14 for the Fiscal 2006 com-

parable period, an increase of 12.2%.

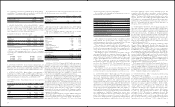

FISCAL 2007 RESULTS: NET SALES Net sales for Fiscal 2007 were

$3.750 billion, an increase of 13.0% versus Fiscal 2006 net sales of $3.318

billion. The net sales increase was attributed to the combination of the net

addition of 91 stores and a 50% increase in direct-to-consumer business

(including shipping and handling revenue), partially offset by a 1% compa-

rable store sales decrease and a fifty-three week year in Fiscal 2006 versus a

fifty-two week year in Fiscal 2007.

For Fiscal 2007, comparable store sales by brand were as follows:

Abercrombie & Fitch and abercrombie comparable sales were flat; Hollister

decreased 2%; and RUEHL decreased 9%. In addition, the women’s, girls’

and bettys’ businesses continued to be more significant than the men’s, boys’

and dudes’. During Fiscal 2007, women’s, girls and bettys represented at

least 60% of the net sales for each of their corresponding brands.

Direct-to-consumer merchandise net sales in Fiscal 2007 were $258.9

million, an increase of 49% versus Fiscal 2006 net merchandise sales of

$174.1 million. Shipping and handling revenue was $39.1 million in

Fiscal 2007 and $24.9 million in Fiscal 2006. The direct-to-consumer

business, including shipping and handling revenue, accounted for

8.0% of total net sales in Fiscal 2007 compared to 6.0% of total net

sales in Fiscal 2006. The increase was driven by store expansion, both

domestically and internationally, improved in-stock inventory avail-

ability, an improved targeted e-mail marketing strategy and improved

website functionality.

GROSS PROFIT For Fiscal 2007, gross profit increased to $2.511

billion from $2.209 billion in Fiscal 2006. The gross profit rate for

Fiscal 2007 was 67.0% versus 66.6% the previous year, an increase of 40

basis points. The increase in the gross profit rate was driven primarily

by a higher IMU rate and a lower shrink rate in the fourth quarter of

Fiscal 2007, partially offset by a higher markdown rate.

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for Fiscal 2007 was $1.387 billion compared to $1.187 billion

for Fiscal 2006. For Fiscal 2007, the stores and distribution expense rate

was 37.0% compared to 35.8% in the previous year. The increase in

rate resulted primarily from store payroll, including minimum wage

and store manager salary increases, higher store fixed cost rates and

store packaging and supply expenses.

The DCs’ UPH rate for Fiscal 2007 increased 9.1% as compared to

Fiscal 2006, reflecting the realization of efficiencies obtained during

Fiscal 2007 due to the second DC being operational. The Company

expects the overall UPH level to continue to improve during Fiscal

2008, however at a lower rate than Fiscal 2007.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during Fiscal 2007

was $395.8 million compared to $373.8 million in Fiscal 2006. For the

current year, the marketing, general and administrative expense rate

was 10.6%, a decrease of 70 basis points compared to last year’s rate

of 11.3%. The decrease in rate resulted from reductions in travel, sam-

ples and outside services expense rates, partially offset by the increase

in payroll expense rate.

OTHER OPERATING INCOME, NET Other operating income

for Fiscal 2007 was $11.7 million compared to $10.0 million for Fiscal 2006.

The increase was primarily related to gift cards for which the Company

has determined the likelihood of redemption to be remote, partially

offset by decreases in gains related to foreign currency transactions. The

comparable year-to-date period in Fiscal 2006 included other operating

income related to insurance reimbursements for a fire-damaged store

and a store damaged by Hurricane Katrina.

OPERATING INCOME Fiscal 2007 operating income was $740.5

million compared to $658.1 million for Fiscal 2006, an increase of 12.5%.

The operating income rate for Fiscal 2007 was 19.7% versus 19.8% in the

previous year.

INTEREST INCOME, NET AND INCOME TAXES Net interest

income for Fiscal 2007 was $18.8 million compared to $13.9 million

for Fiscal 2006. The increase in net interest income was due to higher

interest rates and higher available investment balances during Fiscal

2007 compared to Fiscal 2006.

The effective tax rate for Fiscal 2007 was 37.4% compared to 37.2%

for Fiscal 2006.

NET INCOME AND NET INCOME PER SHARE Net income

for Fiscal 2007 was $475.7 million versus $422.2 million in Fiscal 2006, an

increase of 12.7%. Net income per diluted weighted-average share was

$5.20 in Fiscal 2007 versus $4.59 in Fiscal 2006, an increase of 13.3%.

FISCAL 2006 COMPARED TO FISCAL 2005: FOURTH

QUARTER RESULTS: NET SALES Net sales for the fourth

quarter of Fiscal 2006 were $1.139 billion, up 18.5% versus net sales of

$961.4 million in the fourth quarter of Fiscal 2005. The net sales increase

was attributed primarily to the net addition of 93 stores, including the

full quarter impact of the Abercrombie & Fitch Fifth Avenue flagship

and six stores in Canada; a 58% increase in direct-to-consumer business

(including shipping and handling revenue); and a fourteen week quarter

in Fiscal 2006 versus a thirteen week quarter in Fiscal 2005, partially

14 15