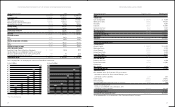

Abercrombie & Fitch 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

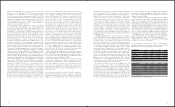

weeks ended February 3, 2007, all related to available-for-sale securities.

Net unrealized gains were approximately $.01 million as of February

2, 2008 and net unrealized losses were approximately $0.7 million as

of February 3, 2007, all related to available-for-sale securities.

The Company does not enter into financial instruments for trading

purposes.

As of February 2, 2008, the Company had no long-term debt out-

standing. Future borrowings would bear interest at negotiated rates

and would be subject to interest rate risk.

The Company has exposure to changes in currency exchange rates

associated with foreign currency transactions, including inter-company

transactions. Such foreign currency transactions are denominated in

Euros, Canadian Dollars, Japanese Yen, Danish Krones, Swiss Francs

and British Pounds. The Company has established a program that

primarily utilizes foreign currency forward contracts to partially offset

the risks associated with the effects of certain foreign currency exposures.

Under this program, increases or decreases in foreign currency exposures

are partially offset by gains or losses on forward contracts, to mitigate

the impact of foreign currency transaction gains or losses. The Company

does not use forward contracts to engage in currency speculation.

All outstanding foreign currency forward contracts are marked to

market at the end of each fiscal period. The Company’s ultimate realized

gain or loss with respect to foreign currency fluctuations will depend

on the foreign currency exchange rate changes and other factors in

effect as the contracts mature.

issued by state agencies which issue student loans.

Despite the underlying long-term maturity of ARS, such securities

were priced and subsequently traded as short-term investments

because of the interest rate reset feature. Interest rates reset through

a Dutch auction process at predetermined periods ranging from seven

to 35 days. If there are insufficient buyers, the auction is said to “fail”

and the holders are unable to liquidate the investments through auction.

A failed auction does not result in a default of the debt instrument.

The securities will continue to accrue interest and be auctioned until

the auction succeeds, the issuer calls the securities or the securities

mature. On February 13, 2008, the Company began to experience

failed auctions on some of its ARS. As of March 27, 2008, the

Company held approximately $365.9 million in ARS, of which $326.9

million were also held as of February 2, 2008.

As of February 2, 2008, approximately 99% of the Company’s ARS

were “AAA” rated by one or more major credit rating agencies. The

ratings take into account insurance policies guaranteeing both the

principal and accrued interest. Each investment in student loans is

substantially guaranteed by the U.S. government under the Federal

Family Education Loan Program.

The Company does not believe that failures in the auction market

will have a material impact on the Company’s liquidity. The

Company believes that it currently has adequate working capital to

fund operations based on access to cash and cash equivalents and

expected operating cash flows. In addition, the Company has $250

million available, less outstanding letters of credit, under its unsecured

credit agreement to support operations.

The current market for the ARS is uncertain and the Company will

continue to monitor and evaluate the market. If auctions continue

to fail, it may be necessary to reflect the securities as long-term invest-

ments on its consolidated balance sheet for the period ending May 3,

2008 or thereafter. If the Company sells any of the ARS, prior to

maturity, at an amount below original purchase value, or if it becomes

probable that the Company will not receive 100% of the principal and

interest from the issuer as to any of the ARS, the Company will be

required to recognize an other-than-temporary impairment charge

against net income.

The Company established an irrevocable rabbi trust (the “Rabbi

Trust”) during the third quarter of Fiscal 2006, the purpose of which

is to be a source of funds to match respective funding obligations to

participants in the Abercrombie & Fitch Nonqualified Savings and

Supplemental Retirement Plan and the Chief Executive Officer

Supplemental Executive Retirement Plan. As of February 2, 2008,

total assets held in the Rabbi Trust were $51.3 million, which

included $18.6 million of available-for-sale municipal notes and

bonds, trust-owned life insurance policies with a cash surrender value

of $31.3 million and $1.4 million held in money market accounts. As

of February 3, 2007, total assets held in the Rabbi Trust were $33.5

million, which included $18.3 million of available-for-sale municipal

notes and bonds and trust-owned life insurance policies with a cash

surrender value of $15.3 million. The Rabbi Trust assets are con-

solidated in accordance with Emerging Issues Task Force (“EITF”)

97-14, “Accounting for Deferred Compensation Agreements Where

Amounts Earned Are Held in a Rabbi Trust and Invested” (“EITF

97-14”) and recorded at fair value in other assets on the Consolidated

Balance Sheets and are restricted as to their use as noted above.

There were $0.4 million in realized losses for the fifty-two weeks

ended February 2, 2008 and no realized gains or losses for the fifty-three

23

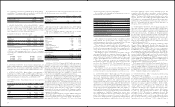

Effective January 29, 2006, the Company adopted the provisions of

SFAS No. 123(R) which requires stock options to be accounted for

under the fair value method and requires the use of an option-pricing

model for estimating fair value. Accordingly, share-based compensation

is measured at the grant date, based on the fair value of the award.

The Company’s equity compensation expense related to stock

options is estimated using the Black-Scholes option-pricing model to

determine the fair value of the stock option grants, which requires the

Company to estimate the expected term of the stock option grants and

expected future stock price volatility over the expected term. Estimates

of the expected term, which represents the expected period of time the

Company believes the stock options will be outstanding, are based on

historical information. Estimates of the expected future stock price

volatility are based on the volatility of A&F’s Common Stock for the

most recent historical period equal to the expected term of the stock option.

The Company calculates the historic volatility as the annualized standard

deviation of the differences in the natural logarithms of the weekly stock

closing price, adjusted for stock splits.

The fair value calculation under the Black-Scholes valuation

model is particularly sensitive to changes in the expected term and

volatility assumptions. Increases in expected term or volatility will

result in a higher fair valuation of stock option grants. Assuming all

other assumptions disclosed in Note 4, “Share-Based Compensation”

of the Notes to Consolidated Financial Statements, being equal, a

10% increase in term will yield a 5% increase in the Black-Scholes

valuation, while a 10% increase in volatility will yield a 7% increase

in the Black-Scholes valuation. The Company believes that changes

in expected term and volatility would not have a material effect on

the Company’s results since the number of stock options granted

during the periods presented was not material.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In September 2006, the FASB released SFAS No. 157, “Fair Value

Measurements” (“SFAS 157”). SFAS 157 establishes a common defi-

nition for fair value under GAAP and also establishes a framework

for measuring fair value and expands disclosure requirements about

such fair value measurements. In February 2008, the FASB issued

FASB Staff Position (“FSP”) 157-1 that eliminates SFAS No. 13,

“Accounting for Leases”, from the scope of SFAS 157. In February

2008, the FASB issued FSP 157-2 that partially defers the effective

date of SFAS No. 157 for one year for non-financial assets and liabilities

that are recognized or disclosed at fair value in the financial statements

on a non-recurring basis. Consequently, SFAS No. 157 was effective for

the Company on February 3, 2008, for financial assets and liabilities

carried at fair value and non-financial assets and liabilities that are

recognized or disclosed at fair value on a recurring basis and will be

effective on February 1, 2009, for non-recurring non-financial assets

and liabilities that are recognized or disclosed at fair value. The Company

is currently evaluating the potential impact of adopting SFAS No.

157 and the related FSPs on the consolidated results of operations

and consolidated financial condition.

In February 2007, the FASB released SFAS No. 159, “The Fair

Value Option for Financial Assets and Financial Liabilities – Including

an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159

permits companies to measure many financial instruments and certain

other assets and liabilities at fair value on an instrument by instrument

basis. SFAS 159 also establishes presentation and disclosure requirements

to facilitate comparisons between companies that select different

measurement attributes for similar types of assets and liabilities.

SFAS 159 was effective for the Company on February 3, 2008. The

Company is currently evaluating the potential impact on the con-

solidated financial statements of adopting SFAS 159.

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

The Company cautions that any forward-looking statements (as such

term is defined in the Private Securities Litigation Reform Act of 1995)

contained in this Annual Report or made by the Company, its manage-

ment or spokespeople involve risks and uncertainties and are subject

to change based on various factors, many of which may be beyond

the Company’s control. Words such as “estimate,” “project,” “plan,”

“believe,” “expect,” “anticipate,” “intend,” and similar expressions may

identify forward-looking statements. Except as may be required by

applicable law, the Company assumes no obligation to publicly update

or revise its forward-looking statements.

The following factors could affect the Company’s financial perfor-

mance and could cause actual results to differ materially from those

expressed or implied in any of the forward-looking statements:

n

loss of services of skilled senior executive officers;

n

ability to hire, train and retain qualified associates;

n

changes in consumer spending patterns and consumer preferences;

n ability to develop innovative, high-quality new merchandise in

response to changing fashion trends;

n

effects on consumer purchases due to a general economic downturn;

n the impact of competition and pricing pressures;

n availability and market prices of key raw materials;

n ability of manufacturers to comply with applicable laws, regulations

and ethical business practices;

n availability of suitable store locations under appropriate terms;

n currency and exchange risks and changes in existing or potential

duties, tariffs or quotas;

n effects of political and economic events and conditions domestically

and in foreign jurisdictions in which the Company operates,

including, but not limited to, acts of terrorism or war;

n unseasonable weather conditions affecting consumer preferences;

n disruptive weather conditions affecting consumers’ ability to shop; and

n effects of capital market conditions.

Refer to Item 1A. Risk Factors of the Company’s Report on Form 10-K

filed March 28, 2008 for a description of certain risk factors that the

Company believes may be relevant to an understanding of the Company

and its business. These risk factors, in addition to the factors set forth

above, could cause actual results to differ materially from those expressed

or implied in any of the Company’s forward-looking statements.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK The Company maintains its cash

equivalents in financial instruments, primarily money market accounts,

with original maturities of 90 days or less. The Company also holds

investments in investment grade auction rate securities (“ARS”), all

classified as available-for-sale that have maturities ranging from eight

to 34 years. As of February 2, 2008, the Company held approximately

$530.5 million in ARS classified as marketable securities. Approximately

$272.1 million of these securities were invested in closed end municipal

bond funds and approximately $258.4 million were invested in securities

22