Abercrombie & Fitch 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

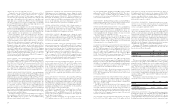

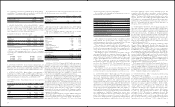

offset by a 3% decrease in comparable store sales.

Comparable store sales by brand for the fourth quarter of Fiscal

2006 versus the fourth quarter of Fiscal 2005 were as follows:

Abercrombie & Fitch decreased 6% with women’s comparable store

sales decreasing by a high single-digit and men’s decreasing by a mid

single-digit; abercrombie increased 2% with boys’ achieving a mid

single-digit increase and girls’ flat; Hollister was flat with bettys’ flat

and dudes’ posting a decrease in the low single-digits; and RUEHL

increased 6% with women’s realizing a mid single-digit increase and

men’s posting a low single-digit increase.

On a regional basis, comparable store sales for the Company ranged

from decreases in the high single-digits to increases in the low single-digits.

Stores located in the North Atlantic region had the strongest comparable

store sales performance and stores located in the West region had the

weakest comparable store sales performance on a consolidated basis.

From a merchandise classification standpoint across all brands,

stronger performing masculine categories included fleece, knit tops

and underwear, while jeans, pants and sweaters posted negative

comparable store sales. In the feminine businesses, across all brands,

stronger performing categories included knit tops, fleece and shorts,

while jeans, skirts and pants posted negative comparable store sales.

Direct-to-consumer net merchandise sales, sold through the

Company’s websites and catalogue, in the fourth quarter of Fiscal

2006 were $74.8 million, an increase of 57.5% versus net merchandise

sales of $47.5 million in the fourth quarter of Fiscal 2005. Shipping

and handling revenue for the corresponding periods was $9.8 million

in Fiscal 2006 and $6.2 million in Fiscal 2005. The direct-to-consumer

business, including shipping and handling revenue, accounted for

7.4% of total net sales in the fourth quarter of Fiscal 2006 compared to

5.6% in the fourth quarter of Fiscal 2005.

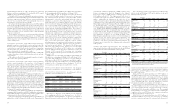

GROSS PROFIT Gross profit during the fourth quarter of Fiscal

2006 was $755.6 million compared to $639.4 million for the comparable

period in Fiscal 2005. The gross profit rate for the fourth quarter of

Fiscal 2006 was 66.4%, down 10 basis points from the Fiscal 2005

fourth quarter rate of 66.5%. The decrease in gross profit rate largely

resulted from a higher shrink rate and a slightly higher markdown

rate compared to the fourth quarter of Fiscal 2005. Abercrombie &

Fitch, abercrombie and Hollister all operated at similar IMU levels.

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for the fourth quarter of Fiscal 2006 was $349.8 million compared

to $293.5 million for the comparable period in Fiscal 2005. The stores and

distribution expense rate for the fourth quarter of Fiscal 2006 was 30.7%, up

20 basis points from 30.5% in the fourth quarter of Fiscal 2005. The increase

in rate is primarily related to additional DC expenses associated with the

second DC, which became fully operational in the fourth quarter, and

direct-to-consumer expenses, which increased due to higher internet sales

as a percentage of total sales. These increases were partially offset by

decreased store expenses as a percentage of sales. Selling payroll, driven by

management salary increases, state minimum wage increases and additional

floor coverage to address shrink concerns increased as a percentage of sales.

However, the increase in selling payroll was more than offset by leveraging

other store related controllable expenses.

The DC productivity level, measured in UPH, was 9% higher in

the fourth quarter of Fiscal 2006 versus the fourth quarter of Fiscal

2005. The UPH rate increase was due to the second DC becoming

fully operational during the fourth quarter.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during the fourth

quarter of Fiscal 2006 was $101.6 million compared to $80.8 million

during the fourth quarter of Fiscal 2005. For the fourth quarter of

Fiscal 2006, the marketing, general and administrative expense rate

was 8.9% compared to 8.4% in the fourth quarter of Fiscal 2005. The

increase in the marketing, general and administrative expense rate

was due to higher home office payroll and consulting expenses.

OTHER OPERATING INCOME, NET Fourth quarter net

other operating income for Fiscal 2006 was $4.6 million compared to

$2.3 million for the fourth quarter of Fiscal 2005. Other operating

income related primarily to gift cards for which the Company has

determined the likelihood of redemption to be remote.

OPERATING INCOME Operating income during the fourth

quarter of Fiscal 2006 increased to $308.8 million from $267.5 million

in the fourth quarter of Fiscal 2005, an increase of 15.4%. The operating

income rate for the fourth quarter of Fiscal 2006 was 27.1% compared

to 27.8% for the fourth quarter of Fiscal 2005.

INTEREST INCOME, NET AND INCOME TAXES Fourth

quarter net interest income was $4.7 million in Fiscal 2006 compared

to $2.4 million during the comparable period in Fiscal 2005. The

increase in net interest income was due to higher interest rates and

higher available investment balances during the fourth quarter of

Fiscal 2006 when compared to the fourth quarter of Fiscal 2005.

The effective tax rate for the fourth quarter of Fiscal 2006 was

36.8% as compared to 39.0% for the Fiscal 2005 comparable period.

The decrease in the effective tax rate was related primarily to favorable

settlements of tax audits during the fourth quarter and the change in

estimates of potential outcomes of certain state tax matters.

NET INCOME AND NET INCOME PER SHARE Net income

for the fourth quarter of Fiscal 2006 was $198.2 million versus

$164.6 million for the fourth quarter of Fiscal 2005, an increase of

20.4%. Net income per diluted weighted-average share outstanding

for the fourth quarter of Fiscal 2006 was $2.14, including $0.01

related to Statement of Financial Accounting Standards (“SFAS”)

No. 123 (Revised 2004), “Share-Based Payment” (“SFAS 123(R)”),

versus $1.80 for the comparable period in Fiscal 2005, an increase

of 18.9%.

FISCAL 2006 RESULTS: NET SALES Net sales for Fiscal 2006 were

$3.318 billion, an increase of 19.1% versus Fiscal 2005 net sales of $2.785

billion. The net sales increase was attributed to the combination of the

net addition of 93 stores, including the full year impact of the Abercrombie

& Fitch Fifth Avenue flagship and six stores in Canada; a 2% comparable

store sales increase; a 42% increase in direct-to-consumer business (includ-

ing shipping and handling revenue); and a fifty-three week year in Fiscal

2006 versus a fifty-two week year in Fiscal 2005.

For Fiscal 2006, comparable store sales by brand were as follows:

Abercrombie & Fitch decreased 4%; abercrombie increased 10%;

Hollister increased 5%; and RUEHL increased 14%. In addition, the

women’s, girls’ and bettys’ businesses continued to be more significant

than the men’s, boys’ and dudes’.

Direct-to-consumer merchandise net sales in Fiscal 2006 were

$174.1 million, an increase of 42.1% versus Fiscal 2005 net merchan-

dise sales of $122.5 million. Shipping and handling revenue was $24.9

million in Fiscal 2006 and $17.6 million in Fiscal 2005. The direct-

to-consumer business, including shipping and handling revenue,

accounted for 6.0% of total net sales in Fiscal 2006 compared to 5.0%

of net total sales in Fiscal 2005.

GROSS PROFIT For Fiscal 2006, gross profit increased to $2.209 billion

from $1.851 billion in Fiscal 2005. The gross profit rate for Fiscal 2006 was

66.6% versus 66.5% for Fiscal 2005, an increase of 10 basis points.

STORES AND DISTRIBUTION EXPENSE Stores and distribution

expense for Fiscal 2006 was $1.187 billion compared to $1.001 billion for

Fiscal 2005. For Fiscal 2006, the stores and distribution expense rate

was 35.8% compared to 35.9% in Fiscal 2005. The decrease in the rate

resulted primarily from the Company’s ability to leverage store-related

costs on a 2% increase in comparable store sales.

The DC’s UPH rate for the year was flat in Fiscal 2006 versus

Fiscal 2005. During Fiscal 2006, while the second DC was being

built, the overall DC’s UPH was impacted by the Company’s first DC

reaching near capacity, a result of the Company’s focus on strategically

flowing inventory to stores during Fiscal 2006.

MARKETING, GENERAL AND ADMINISTRATIVE EXPENSE

Marketing, general and administrative expense during Fiscal 2006

was $373.8 million compared to $313.5 million in Fiscal 2005. For

Fiscal 2006, the marketing, general and administrative expense rate

was 11.3%, which was flat compared to Fiscal 2005. Fiscal 2006

included a charge of $13.6 million related to the adoption of SFAS

123(R). Fiscal 2005 included a non-recurring charge of $13.5 million

related to a severance agreement with an executive officer.

OTHER OPERATING INCOME, NET Other operating income

for Fiscal 2006 was $10.0 million compared to $5.5 million for Fiscal 2005.

The increase was related to gift cards for which the Company has determined

the likelihood of redemption to be remote and insurance reimbursements

received during the first and second quarters of Fiscal 2006 related to

stores damaged by fire and Hurricane Katrina, respectively.

OPERATING INCOME Fiscal 2006 operating income was $658.1

million compared to $542.7 million for Fiscal 2005, an increase of

21.3%. The operating income rate for Fiscal 2006 was 19.8% versus

19.5% in Fiscal 2005.

INTEREST INCOME, NET AND INCOME TAXES Net interest

income for Fiscal 2006 was $13.9 million compared to $6.7 million for

Fiscal 2005. The increase in net interest income was due to higher

interest rates and higher available investment balances during Fiscal

2006 compared to Fiscal 2005.

The effective tax rate for Fiscal 2006 was 37.2% compared to 39.2%

for Fiscal 2005. The decrease in the effective tax rate primarily related

to favorable settlements of tax audits, favorable changes in estimates of

potential outcomes of certain state tax matters and an increase in tax

exempt income during Fiscal 2006. Fiscal 2005 tax expense reflected

a charge related to the Company’s change in estimate of the potential

outcome of certain state tax matters.

NET INCOME AND NET INCOME PER SHARE Net income

for Fiscal 2006 was $422.2 million versus $334.0 million in Fiscal

2005, an increase of 26.4%. Net income included after-tax charges of

$9.9 million in Fiscal 2006 related to the adoption of SFAS 123(R),

and non-recurring charges of $8.2 million in Fiscal 2005 related to a

severance agreement with an executive officer. Net income per

diluted weighted-average share was $4.59 in Fiscal 2006 versus $3.66

in Fiscal 2005, an increase of 25.4%.

FINANCIAL CONDITION Continued growth in net income

and decreases in inventory resulted in increased cash provided by

operating activities. A more detailed discussion of liquidity, capital

resources and capital requirements follows.

LIQUIDITY AND CAPITAL RESOURCES The Company

expects that substantially all future operations, including projected

growth, seasonal requirements and capital expenditures will be funded

with cash from operations. In addition, the Company has $250 million

available, less outstanding letters of credit, under its unsecured credit

agreement to support operations. Furthermore, the Company expects

that cash from operating activities will fund dividends currently being

paid at a rate of $0.175 per share per quarter. The Board of Directors of

A&F will review the Company’s cash position and results of operations

and address the appropriateness of future dividend amounts.

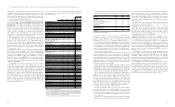

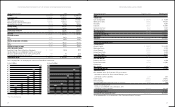

A summary of the Company’s working capital (current assets less

current liabilities) position and capitalization at the end of the last

three fiscal years follows (thousands):

2007 2006 2005

Working capital $ 597,142 $ 581,451 $455,530

Capitalization:

Shareholders’ equity $1,618,313 $1,405,297 $995,117

The increase in working capital during Fiscal 2007 versus Fiscal

2006 was the result of higher cash and marketable securities, resulting

primarily from the Company’s increases in earnings, partially offset

by capital expenditures for expansion, share repurchases and dividends

paid. The increase in working capital in Fiscal 2006 versus Fiscal

2005 was the result of higher cash and marketable securities, resulting

primarily from the increase in the Company’s net income and

decreases in income taxes payable, partially offset by an increase in

accrued expenses. Additionally, the Company did not make any share

repurchases in Fiscal 2006 compared to $103.3 million of repurchases

made in Fiscal 2005.

The Company considers the following to be measures of its liquidity

and capital resources for the last three fiscal years:

2007 2006 2005

Current ratio

(current assets divided by current liabilities) 2.10 2.14 1.93

Net cash provided by

operating activities (in thousands) $817,825 $582,171* $453,590

*Fiscal 2006 was a fifty-three week year.

OPERATING ACTIVITIES Net cash provided by operating activities,

the Company’s primary source of liquidity, increased to $817.8 million for

Fiscal 2007 from $582.2 million in Fiscal 2006. In Fiscal 2007, cash was

provided primarily by current year net income, adjusted for non-cash items

including depreciation and amortization, share-based compensation charges

16 17