Abercrombie & Fitch 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

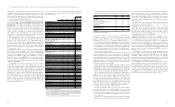

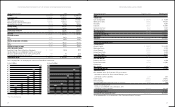

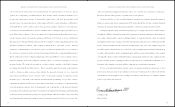

(Thousands) 2007 2006* 2005

OPERATING ACTIVITIES:

Net Income $475,697 $422,186 $333,986

IMPACT OF OTHER OPERATING ACTIVITIES ON CASH FLOWS:

Depreciation and Amortization 183,716 146,156 124,206

Amortization of Deferred Lease Credits (37,418) (34,485) (32,527)

Share-Based Compensation 31,170 35,119 24,124

Tax Benefit from Share-Based Compensation 17,600 5,472 52,709

Excess Tax Benefit from Share-Based Compensation (14,205) (3,382) –

Deferred Taxes 1,342 (11,638) (2,099)

Loss on Disposal of Assets and Charge for Impairment 9,517 6,559 7,658

Lessor Construction Allowances 43,391 49,387 42,336

Foreign Currency Gains 301 – –

CHANGES IN ASSETS AND LIABILITIES:

Inventories 87,657 (61,940) (146,314)

Accounts Payable and Accrued Expenses 22,375 24,579 (2,912)

Income Taxes (13,922) (12,805) 43,893

Other Assets and Liabilities 10,604 16,963 8,530

NET CASH PROVIDED BY OPERATING ACTIVITIES 817,825 582,171 453,590

INVESTING ACTIVITIES:

Capital Expenditures (403,345) (403,476) (256,422)

Purchases of Trust Owned Life Insurace Policies (15,000) (15,258) –

Purchases of Marketable Securities (1,444,736) (1,459,835) (1,016,986)

Proceeds of Sales of Marketable Securities

1,362,911 1,404,805 605,101

NET CASH USED FOR INVESTING ACTIVITIES (500,170) (473,764) (668,307)

FINANCING ACTIVITIES:

Dividends Paid (61,330) (61,623) (52,218)

Change in Outstanding Checks and Other 13,536 (31,770) 8,467

Proceeds from Share-Based Compensation 38,750 12,876 73,716

Excess Tax Benefit from Share-Based Compensation 14,205 3,382 –

Purchase of Treasury Stock (287,916) – (103,296)

NET CASH USED FOR FINANCING ACTIVITIES (282,755) (77,135) (73,331)

EFFECT OF EXCHANGE RATES ON CASH 1,185 – –

NET INCREASE (DECREASE) IN CASH AND EQUIVALENTS 36,085 31,272 (288,048)

Cash and Equivalents, Beginning of Year 81,959 50,687 338,735

CASH AND EQUIVALENTS, END OF YEAR $118,044 $ 81,959 $ 50,687

SIGNIFICANT NON-CASH INVESTING ACTIVITIES:

Change in Accrual for Construction in Progress $ 8,791 $ 28,455 $ 3,754

* Fiscal 2006 was a fifty-three week year.

The accompanying Notes are an integral part of these Consolidated Financial Statements.

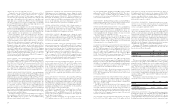

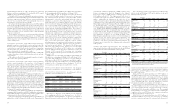

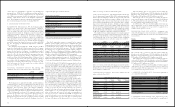

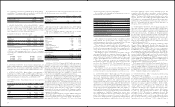

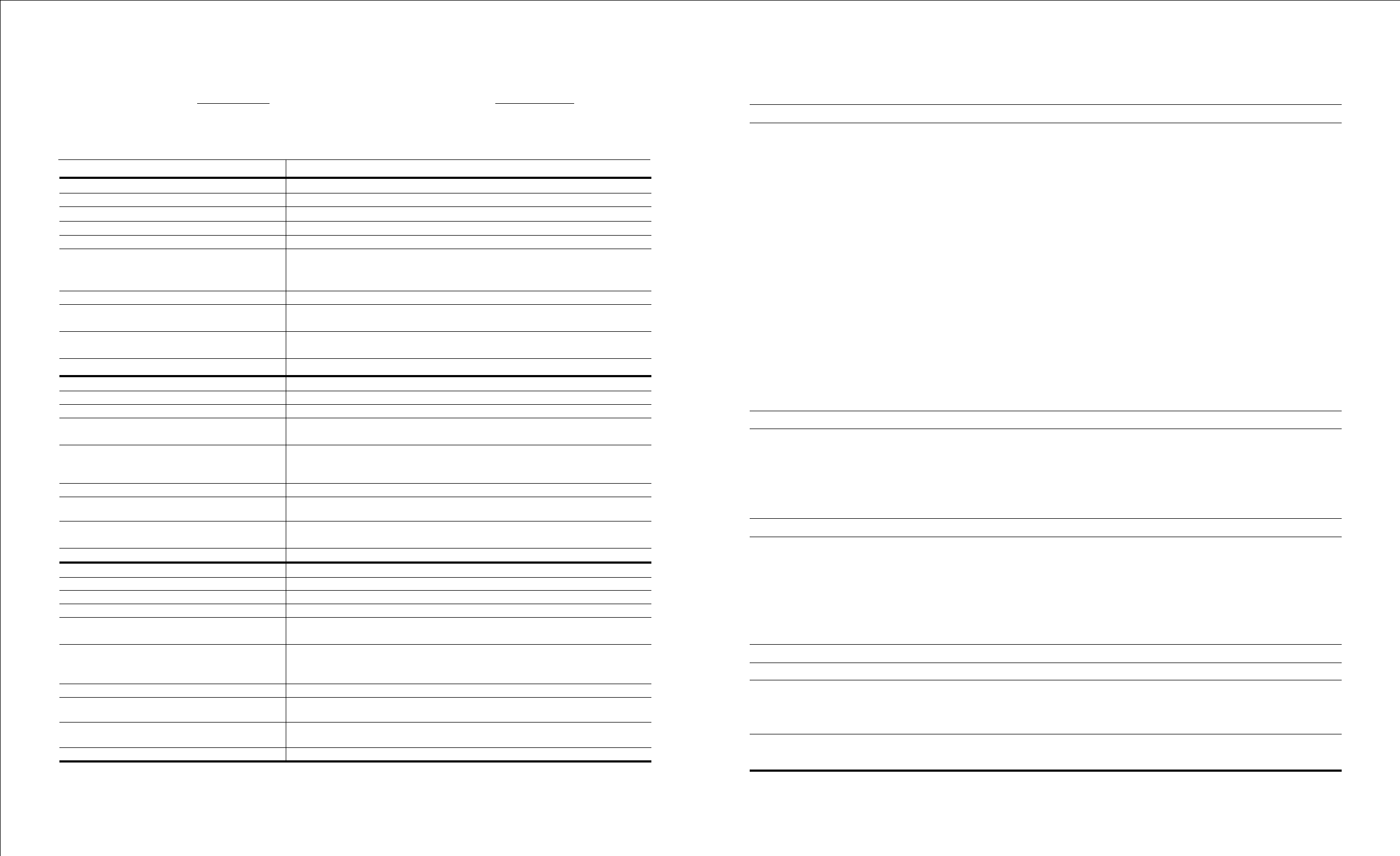

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Stock Treasury Stock

Other

Compre-

Deferred hensive Total

Shares Par Paid-In Retained Compen- Income At Average Shareholders’

(Thousands) Outstanding Value Capital Earnings sation (Loss) Shares Cost Equity

BALANCE, JANUARY 29, 2005 86,036 $1,033 $176,552 $1,039,722 $ 15,048 – 17,263 $(563,029) $ 669,326

Net Income – – – 333,986 – – – – 333,986

Purchase of Treasury Stock (1,765) – – – – – 1,765 (103,296) (103,296)

Dividends ($0.60 per share) – – – (52,218) – – – – (52,218)

Stock Option Exercises 3,289 – – (26,985) – – (3,289) 109,880 82,895

Restricted Stock Unit Issuance 166 – – (4,297) (12,966) – (166) 5,650 (11,613)

Tax Benefit from Excercise of

Stock Options and Issuance of

Restricted Stock Units – – 52,709 – – – – – 52,709

Restricted Stock Unit Expense – – – – 24,124 – – – 24,124

Unrealized Losses on

Marketable Securtities – – – – – (718) – – (718)

Cumulative Foreign Currency

Translation Adjustments – – – – – (78) – – (78)

BALANCE, JANUARY 28, 2006 87,726 $1,033 $229,261 $1,290,208 $ 26,206 $ (796) 15,574 $(550,795) $ 995,117

Deferred Compensation Reclassification – – 26,206 – (26,206) – – – –

Net Income – – – 422,186 – – – – 422,186

Dividends ($0.70 per share) – – – (61,623) – – – – (61,623)

Share-based Compensation

Issuances and Excersises 574 – (6,326) (4,481) – – (574) 20,031 9,224

Tax Benefit from Share-based

Compensation Issuances and

Exercises – – 5,472 – – – – – 5,472

Share-based Compensation Expense – – 35,119 – – – – – 35,119

Unrealized Gains on Marketable

Securities – – – – – 41 – – 41

Cumulative Foreign Currency

Translation Adjustments – – – – – (239) – – (239)

BALANCE, FEBRUARY 3, 2007 88,300 $1,033 $289,732 $1,646,290 – $ (994) 15,000 $(530,764) $1,405,297

FIN 48 Impact – – – (2,786) – – – – (2,786)

Net Income – – – 475,697 – – – – 475,697

Purchase of Treasury Stock (3,654) – – – – – 3,654 (287,916) (287,916)

Dividends ($0.70 per share) – – – (61,330) – – – – (61,330)

Share-based Compensation

Issuances and Excersises 1,513 – (19,052) (6,408) – – (1,513) 57,928 32,468

Tax Benefit from Share-based

Compensation Issuances and

Exercises – – 17,600 – – – – – 17,600

Share-based Compensation Expense – – 31,170 – – – – – 31,170

Unrealized Gains on

Marketable Securities – – – – – 784 – – 784

Cumulative Foreign Currency

Translation Adjustments – – – – – 7,328 – – 7,328

BALANCE, FEBRUARY 2, 2008 86,159 $1,033 $319,451 $2,051,463 – $ 7,118(1) 17,141 $(760,752) $ 1,618,313

(1) Accumulated Other Comprehensive Income includes cummulative foreign currency translation adjustments of $7.0 million and of unrealized gains on marketable securities, net of taxes of $0.1 million.

The accompanying Notes are an integral part of these Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

2726