Abercrombie & Fitch 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

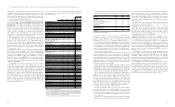

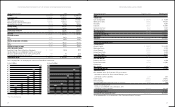

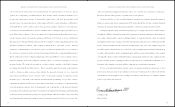

CONSOLIDATED BALANCE SHEETS

(Thousands, except share amounts) February 2, 2008 February 3, 2007

ASSETS

CURRENT ASSETS

Cash and Equivalents $ 118,044 $ 81,959

Marketable Securities 530,486 447,793

Receivables 53,801 43,240

Inventories 333,153 427,447

Deferred Income Taxes 36,128 33,170

Other Current Assets 68,643 58,469

TOTAL CURRENT ASSETS 1,140,255 1,092,078

PROPERTY AND EQUIPMENT, NET 1,318,291 1,092,282

OTHER ASSETS 109,052 63,707

TOTAL ASSETS $ 2,567,598 $ 2,248,067

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES

Accounts Payable $ 0 108,437 $ 100,919

Outstanding Checks 43,361 27,391

Accrued Expenses 280,910 260,219

Deferred Lease Credits 37,925 35,423

Income Taxes Payable 72,480 86,675

TOTAL CURRENT LIABILITIES 543,113 510,627

LONG-TERM LIABILITIES

Deferred Income Taxes 0 22,491 30,394

Deferred Lease Credits 213,739 203,943

Commitments – –

Other Liabilities 169,942 97,806

TOTAL LONG-TERM LIABILITIES 406,172 332,143

SHAREHOLDERS’ EQUITY

Class A Common Stock – $0.01 par value: 150,000,000 shares

authorized and 103,300,000 shares issued at February 2, 2008

and February 3, 2007, respectively 0 1,033 1,033

Paid-In Capital 319,451 289,732

Retained Earnings 2,051,463 1,646,290

Accumulated Other Comprehensive Income (Loss), net of tax 7,118 (994)

Treasury Stock, at Average Cost

17,141,116 and 14,999,945 shares at February 2, 2008

and February 3, 2007, respectively (760,752) (530,764)

TOTAL SHAREHOLDERS’ EQUITY 1,618,313 1,405,297

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 2,567,598 $2,248,067

The accompanying Notes are an integral part of these Consolidated Financial Statements.

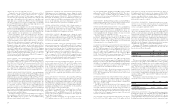

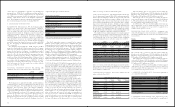

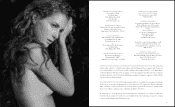

CONSOLIDATED STATEMENTS OF NET INCOME AND COMPREHENSIVE INCOME

2007

$3,749,847

1,238,480

2,511,367

1,386,846

395,758

(11,734)

740,497

(18,828)

759,325

283,628

$ 475,697

$5.45

$5.20

87,248

91,523

$0.70

$ 7,328

784

$ 8,112

$ 483,809

2006*

$3,318,158

1,109,152

2,209,006

1,187,071

373,828

(9,983)

658,090

(13,896)

671,986

249,800

$ 422,186

$4.79

$4.59

88,052

92,010

$0.70

($239)

41

($198)

$ 421,988

2005

$2,784,711

933,295

1,851,416

1,000,755

313,457

(5,534)

542,738

(6,674)

549,412

215,426

$ 333,986

$3.83

$3.66

87,161

91,221

$0.60

($78)

(718)

($796)

$ 333,190

(Thousands, except per share amounts)

NET SALES

Cost of Goods Sold

GROSS PROFIT

Stores and Distribution Expense

Marketing, General & Administrative Expense

Other Operating Income, Net

OPERATING INCOME

Interest Income, Net

INCOME BEFORE INCOME TAXES

Provision for Income Taxes

NET INCOME

NET INCOME PER SHARE:

Basic

Diluted

WEIGHTED-AVERAGE SHARES OUTSTANDING:

Basic

Diluted

DIVIDENDS DECLARED PER SHARE

OTHER COMPREHENSIVE INCOME

Cumulative Foreign Currency Translation Adjustments

Unrealized Gains (Losses) on Marketable Securities, net of taxes of

($502), $20 and $0 for Fiscal 2007, Fiscal 2006, and Fiscal 2005,

respectively Other Comprehensive Income (Loss)

COMPREHENSIVE INCOME

The accompanying Notes are an integral part of these Consolidated Financial Statements.

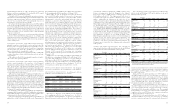

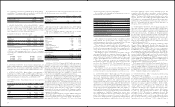

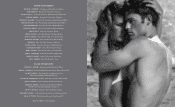

2003 2004 2005 2006* 2007

$110

$130

$150

$170

$190

$210

$230

$250

$270

$290

$310

$330

$350

$370

$390

$410

$430

$450

$470

$205

$216

$334

$422

$476

2003 2004 2005 2006* 2007

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

$2400

$2,800

$3,000

$3,200

$1,708

$2,785

$3,400

$3,600

$3,800

Net Sales ($ in Millions)

$2,600

$2,021

$3,750

* Fiscal 2006 was a fifty-three week year.

2524

$3,318

Net Income ($ in Millions)

$490