Abercrombie & Fitch 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

if there is a change of control as defined in the plans.

FAIR VALUE ESTIMATES The Company estimates the fair value

of stock options granted using the Black-Scholes option-pricing model,

which requires the Company to estimate the expected term of the stock

option grants and expected future stock price volatility over the expected

term. Estimates of the expected term, which represents the expected

period of time the Company believes the stock options will be outstand-

ing, are based on historical experience. Estimates of expected future

stock price volatility are based on the volatility of A&F’s Common Stock

price for the most recent historical period equal to the expected term of

the stock option. The Company calculates the volatility as the annual-

ized standard deviation of the differences in the natural logarithms of the

weekly stock closing price, adjusted for stock splits and dividends.

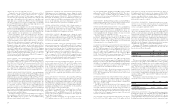

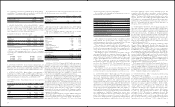

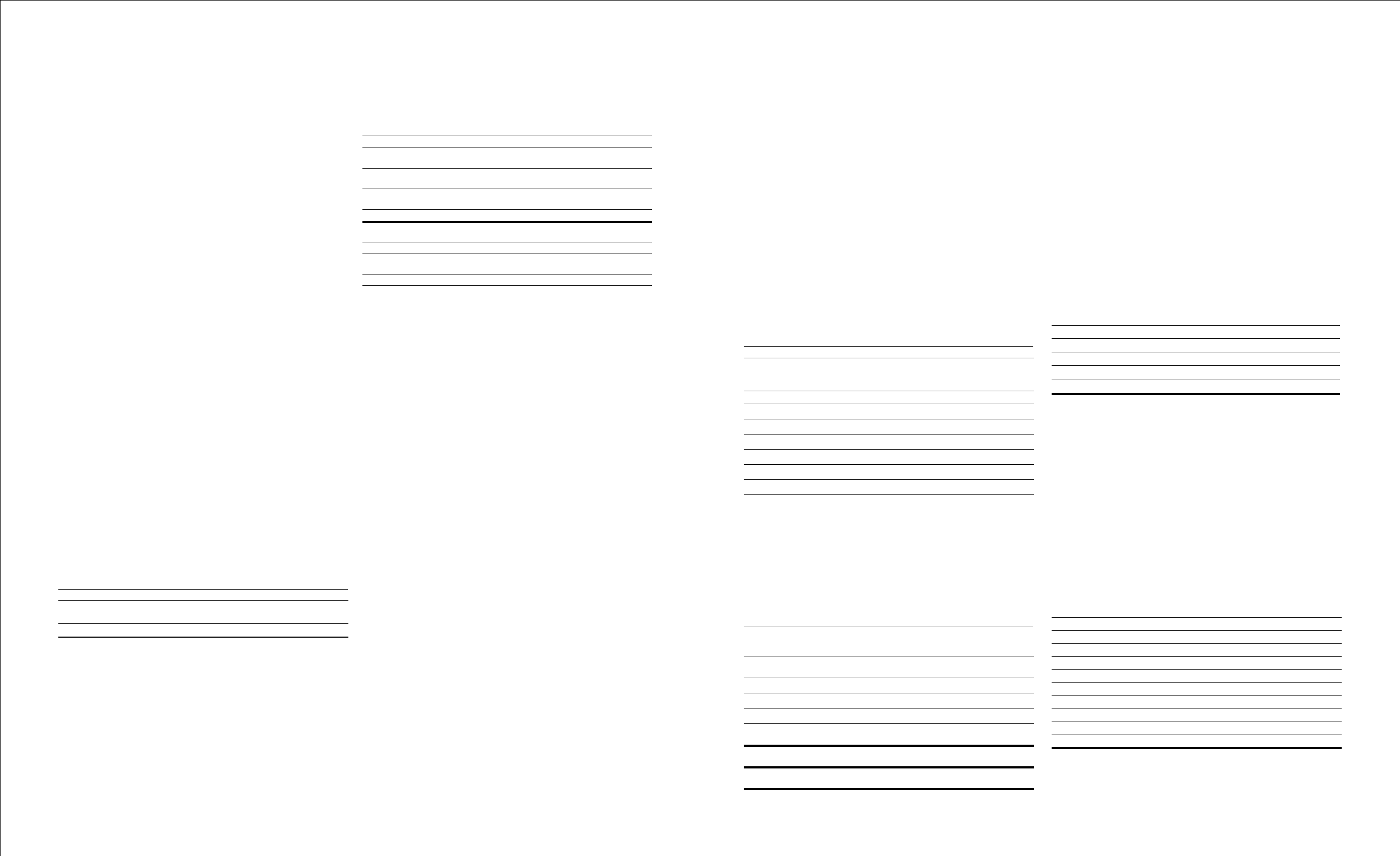

The weighted-average estimated fair values of stock options granted

during the fifty-two week period ended February 2, 2008, the fifty-three

week period ended February 3, 2007 and the fifty-two week period

ended January 28, 2006, as well as the weighted-average assumptions

used in calculating such values, on the date of grant, were as follows:

Fifty-Two Fifty-Three Fifty-Two

Weeks Ended Weeks Ended Weeks Ended

February 2, 2008 February 3, 2007 January 28, 2006

Executive Executive

Officers and Executive Other Officers and

Other Associates Officers Associates Other Associates

Exercise price $74.05 $58.22 $58.12 $60.10

Fair Value $22.56 $24.92 $20.69 $23.01

Assumptions:

Price volatility 34% 47% 42% 47%

Expected term (Years) 4 5 4 4

Risk-free interest rate 4.5% 4.9% 4.9% 4.0%

Dividend yield 1.0% 1.2% 1.2% 1.1%

In the case of restricted stock units, the Company calculates the fair value

of the restricted stock units granted as the market price of the underlying

Common Stock on the date of grant, adjusted for expected dividend pay-

ments during the vesting period.

STOCK OPTION ACTIVITY Below is the summary of stock

option activity for Fiscal 2007:

Fifty-Two Weeks Ended February 2, 2008

Number Weighted- Aggregate Weighted-Average

Stock of Average Intristic Remaining

Options Shares Exercise Price Value Contractual Life

Outstanding at

February 3, 2007 8,804,724 $38.07

Granted 341,750 74.05

Exercised (1,323,937) 29.27

Forfeited or expired (84,425) 60.78

Outstanding at

February 2, 2008 7,738,112 $41.03 $284,082,728 2.9

Stock options expected to

vest at February 2, 2008 585,670 $66.11 $ 6,814,891 8.4

Stock options exercisable

at February 2, 2008 7,018,762 $38.61 $274,659,247 2.4

The total intrinsic value of stock options exercised during the

fifty-two weeks ended February 2, 2008, the fifty-three weeks ended

February 3, 2007, and the fifty-two weeks ended January 28, 2006 was

$64.2 million, $15.2 million and $139.9 million, respectively.

The total fair value of stock options vested during the fifty-two

weeks ended February 2, 2008, the fifty-three weeks ended February

3, 2007 and the fifty-two weeks ended January 28, 2006 was $5.1 mil-

lion, $29.5 million and $31.4 million, respectively.

As of February 2, 2008, there was $11.9 million of total unrecog-

nized compensation cost, net of estimated forfeitures, related to stock

options. The unrecognized cost is expected to be recognized over a

weighted-average period of 1.3 years.

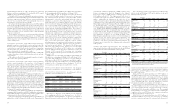

RESTRICTED STOCK UNIT ACTIVITY A summary of the

status of the Company’s restricted stock units as of February 2, 2008

and changes during the fifty-two week period ended February 2, 2008

were as follows:

Weighted-Average

Restricted Number of Grant Date

Stock Units Shares Fair Value

Non-vested at February 3, 2007 2,043,456 $40.65

Granted 741,000 $72.69

Vested (284,200) $49.99

Forfeited (145,385) $60.44

Non-vested at February 2, 2008 2,354,871 $48.02

The total fair value of restricted stock units granted during the

fifty-two weeks ended February 2, 2008, the fifty-three weeks ended

February 3, 2007 and the fifty-two weeks ended January 28, 2006 was

$53.9 million, $35.5 million and $36.3 million, respectively.

The total fair value of restricted stock units vested during the fifty-two

weeks ended February 2, 2008, the fifty-three weeks ended February

3, 2007 and the fifty-two weeks ended January 28, 2006 was $14.2 million,

$8.6 million and $5.0 million, respectively.

As of February 2, 2008, there was $65.1 million of total unrecognized

compensation cost, net of estimated forfeitures, related to non-vested

restricted stock units. The unrecognized cost is expected to be recognized

over a weighted-average period of 1.4 years.

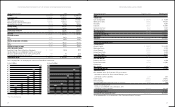

5. PROPERTY AND EQUIPMENT Property and equipment, at

cost, consisted of (thousands):

2007 2006

Land $ 32,302 $ 32,291

Building 193,344 181,111

Furniture, fixtures and equipment 540,114 520,391

Information technology 81,110 48,173

Leasehold improvements 977,947 754,224

Construction in progress 177,887 122,695

Other 51,571 10,168

Total $2,054,275 $ 1,669,053

Less: Accumulated depreciation and amortization (735,984) (576,771)

Property and equipment, net $1,318,291 $ 1,092,282

6. DEFERRED LEASE CREDITS, NET Deferred lease credits

are derived from payments received from landlords to partially offset

32

certain other assets and liabilities at fair value on an instrument by

instrument basis. SFAS 159 also establishes presentation and disclo-

sure requirements to facilitate comparisons between companies that

select different measurement attributes for similar types of assets and

liabilities. SFAS 159 was effective for the Company on February 3,

2008. The Company is currently evaluating the potential impact on

the consolidated financial statements of adopting SFAS 159.

4. SHARE-BASED COMPENSATION

BACKGROUND On January 29, 2006, the Company adopted

SFAS No. 123 (Revised 2004), “Share-Based Payment” (“SFAS No.

123(R)”), which requires share-based compensation to be measured

based on estimated fair values at the date of grant using an option-

pricing model. Previously, the Company accounted for share-based

compensation using the intrinsic value method in accordance with

APB Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related interpretations, for which no expense was recognized for

stock options if the exercise price was equal to the market value of the

underlying common stock on the date of grant, and if the Company

provided the required pro forma disclosures in accordance with SFAS

No. 123, “Accounting for Stock-Based Compensation” (“SFAS No.

123”), as amended.

The Company adopted SFAS No. 123(R) using the modified

prospective transition method, which requires share-based compen-

sation to be recognized for all unvested share-based awards begin-

ning in the first quarter of adoption. Accordingly, prior period

information presented in these financial statements has not been

restated to reflect the fair value method of expensing stock options.

Under the modified prospective method, compensation expense

includes a) all share-based awards granted prior to, but not yet vested

as of, January 29, 2006, based on the grant-date fair value estimated

in accordance with the original provisions of SFAS No. 123 and b)

all share-based awards granted subsequent to January 29, 2006,

based on the grant-date fair value estimated in accordance with the

provisions of SFAS No. 123(R).

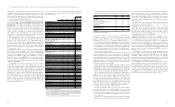

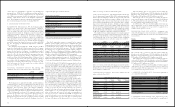

FINANCIAL STATEMENT IMPACT The following table

summarizes share-based compensation expense (in thousands):

Fifty-Two Fifty-Three

Weeks Ended Weeks Ended

February 2, 2008 February 3, 2007

Stores and distribution expense $ 1,628 $ 2,419

Marketing, general and administrative expense 29,542 32,700

Operating income $31,170 $35,119

The Company also recognized $11.5 million and $12.2 million in

tax benefits related to share-based compensation for the fifty-two week

period ended February 2, 2008 and the fifty-three week period ended

February 3, 2007, respectively. Prior to the adoption of SFAS No.

123(R), the Company recognized $1.4 million in tax benefits related to

restricted stock units for the fifty-two week period ended January 28, 2006.

The following table is presented for comparative purposes and

illustrates the pro forma effect on net income and net income per

share for the fifty-two weeks ended January 28, 2006, as if the

Company had applied the fair value recognition provisions of SFAS

No. 123 to stock options granted under the Company’s share-based

compensation plans prior to January 29, 2006:

(Thousands, except per share amounts) Fifty-Two

Weeks Ended

January 28, 2006

Net income:

As reported $333,986

Share-based compensation expense included

in reported net income, net of tax(1) 14,716

Share-based compensation expense determined

under fair value based method, net of tax (36,689)

Pro forma $312,013

Net income per basic share:

As reported $3.83

Pro forma $3.58

Net income per diluted share:

As reported $3.66

Pro forma $3.38

(1)Includes share-based compensation expense related to restricted stock unit awards actually recognized

in net income in each period presented using the intrinsic value method.

Share-based compensation expense is recognized, net of estimated

forfeitures, over the requisite service period on a straight line basis. The

Company adjusts share-based compensation expense on a quarterly basis

for actual forfeitures and for changes to the estimate of expected award

forfeitures based on actual forfeiture experience. The effect of adjusting

the forfeiture rate is recognized in the period the forfeiture estimate is

changed. The effect of adjustments for forfeitures during the thirteen

and fifty-two week periods ended February 2, 2008 and the fourteen and

fifty-three week periods ended February 3, 2007 was immaterial.

A&F issues shares of Common Stock for stock option exercises and

restricted stock unit vestings from treasury stock. As of February 2, 2008,

A&F had enough treasury stock available to cover stock options and restrict-

ed stock units outstanding without having to repurchase additional shares.

PLANS As of February 2, 2008, A&F had two primary share-based com-

pensation plans including the following: the 2005 Long-Term Incentive

Plan (the “2005 LTIP”), under which A&F grants stock options and

restricted stock units to associates of the Company and non-associate

members of the A&F Board of Directors, and the 2007 Long-Term

Incentive Plan (the “2007 LTIP”), under which A&F grants stock options

and restricted stock units to associates of the Company. A&F also has

four other share-based compensation plans under which it granted stock

options and restricted stock units to associates of the Company and non-

associate members of the A&F Board of Directors in prior years.

The 2007 LTIP, a shareholder approved plan, permits A&F to

grant up to 5.0 million shares of A&F’s Common Stock to any associ-

ate of the Company eligible to receive awards under the 2007 LTIP.

The 2005 LTIP, a shareholder approved plan, permits A&F to grant

up to approximately 2.0 million shares of A&F’s Common Stock to

any associate of the Company (other than Michael S. Jeffries) who

is subject to Section 16 of the Securities Exchange Act of 1934, as

amended, at the time of the grant and any non-associate director of

A&F is eligible to receive awards under the 2005 LTIP. Under both

plans, stock options and restricted stock units vest primarily over

four years for associates. Under the 2005 LTIP, stock options and

restricted stock units vest over one year for non-associate directors of

A&F. Stock options have a ten-year term, subject to forfeiture under

the terms of the plans, and the plans provide for accelerated vesting