Abercrombie & Fitch 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

current taxes payable to other long-term liabilities.

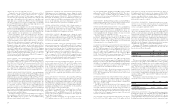

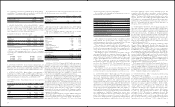

A reconciliation of the beginning and ending amounts of unrecog-

nized tax benefits was as follows:

2007

Unrecognized tax benefits, February 3, 2007 $ 29,613

Gross addition for tax positions of the current year 5,146

Gross addition for tax positions of prior years 12,789

Reductions for tax positions for prior years for:

Changes in judgement/excess reserve (4,726)

Settlements during the period (3,291)

Lapses of applicable statute of limitations (637)

Unrecognized tax benefits, February 2, 2008 $ 38,894

Gross additions for tax positions of prior years include an $11.9

million liability, offset by other balance sheet changes, related to a

transfer pricing matter that is subject to an ongoing Advanced Pricing

Agreement negotiation with the Internal Revenue Service.

These amounts, if recognized, would affect the Company’s effec-

tive tax rate. Pursuant to the accounting rules, the unrecognized tax

benefit for the transfer pricing matter will not have a significant effect

on the effective tax rate because it would be recognized in the provi-

sion for income taxes over a long-term period.

The Company recognizes accrued interest and penalties related to

unrecognized tax benefits as a component of income tax expense. The

Company’s policy did not change as a result of adopting FIN 48. Tax

expense for Fiscal 2007 includes $2.7 million of interest. Interest and

penalties of $10.5 million have been accrued as of the end of Fiscal 2007.

The statute of limitations for income tax examinations by the

Internal Revenue Service has expired for the fiscal years prior to the

fiscal year ended January 29, 2005. The Company files income tax

returns in various state, local and foreign jurisdictions with varying

statutes of limitations.

The Company does not expect material adjustments to the total

amount of unrecognized tax benefits within the next 12 months, but the

outcome of tax matters is uncertain and unforeseen results can occur.

11. LONG-TERM DEBT On December 15, 2004, the Company

entered into an amended and restated $250 million syndicated unse-

cured credit agreement (the “Amended Credit Agreement”), with

Abercrombie & Fitch Management Co., as borrower, and with A&F

and its subsidiaries, as guarantors. The primary purposes of the

Amended Credit Agreement are for financial support of trade and

stand-by letters of credit and working capital. The Amended Credit

Agreement has several borrowing options, including an option where

interest rates are based on the agent bank’s “Alternate Base Rate,” and

another using the London Interbank Offered Rate. The facility fees

payable under the Amended Credit Agreement are based on the ratio

of the Company’s leveraged total debt plus 600% of forward minimum

rent commitments to consolidated earnings before interest, taxes,

depreciation, amortization and rent for the trailing four fiscal quarter

periods. The facility fees are projected to accrue at either 0.15% or

0.175% on the committed amounts per annum. The Amended Credit

Agreement contains limitations on indebtedness, liens, sale-leaseback

transactions, significant corporate changes including mergers and

acquisitions with third parties, investments, restricted payments

(including dividends and stock repurchases) and transactions with

affiliates. The Amended Credit Agreement will mature on December

15, 2009. Letters of credit totaling approximately $76.1 million and

$53.7 million were outstanding under the Amended Credit Agreement

on February 2, 2008 and February 3, 2007, respectively. No borrow-

ings were outstanding under the Amended Credit Agreement on

February 2, 2008 or on February 3, 2007.

12. RETIREMENT BENEFITS The Company maintains the

Abercombie & Fitch Co. Savings & Retirement Plan, a qualified plan.

All U.S. associates are eligible to participate in this plan if they are at

least 21 years of age and have completed a year of employment with

1,000 or more hours of service. In addition, the Company maintains

the Abercrombie & Fitch Nonqualified Savings and Supplemental

Retirement Plan. Participation in this plan is based on service and

compensation. The Company’s contributions are based on a percent-

age of associates’ eligible annual compensation. The cost of these

plans was $21.0 million in Fiscal 2007, $15.0 million in Fiscal 2006

and $10.5 million in Fiscal 2005.

Effective February 2, 2003, the Company established a Chief

Executive Officer Supplemental Executive Retirement Plan (the

“SERP”) to provide additional retirement income to its Chairman and

Chief Executive Officer (“CEO”). Subject to service requirements,

the CEO will receive a monthly benefit equal to 50% of his final aver-

age compensation (as defined in the SERP) for life. The SERP has

been actuarially valued by an independent third party and the expense

associated with the SERP is being accrued over the stated term of the

Amended and Restated Employment Agreement, dated as of August

15, 2005, between the Company and its CEO. The expense associated

with the SERP was $1.4 million in Fiscal 2007, $6.6 million in Fiscal

2006 and $2.5 million in Fiscal 2005. The increase in Fiscal 2006 was

primarily related to a change in the discount rate.

The Company established the Rabbi Trust during the third quarter

of Fiscal 2006, the purpose of which is to be a source of funds to match

respective funding obligations to participants in the Abercrombie &

Fitch Nonqualified Savings and Supplemental Retirement Plan and

the SERP. Refer to further discussion regarding the Rabbi Trust in

Note 2, “Summary of Significant Accounting Policies”.

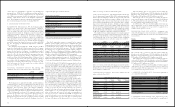

13. CONTINGENCIES A&F is a defendant in lawsuits arising

in the ordinary course of business.

On June 23, 2006, Lisa Hashimoto, et al. v. Abercrombie & Fitch

Co. and Abercrombie & Fitch Stores, Inc., was filed in the Superior

Court of the State of California for the County of Los Angeles. In

that action, three plaintiffs allege, on behalf of a putative class of

California store managers employed in Hollister and abercrombie

stores, that they were entitled to receive overtime pay as “non-

exempt” employees under California wage and hour laws. The

complaint seeks injunctive relief, equitable relief, unpaid overtime

compensation, unpaid benefits, penalties, interest and attorneys’

fees and costs. The defendants filed an answer to the complaint

on August 21, 2006. The parties are engaging in discovery. On

December 10, 2007, the defendants reached an agreement in prin-

ciple with plaintiffs’ counsel to settle certain claims in the action.

The agreement resulted in a written Stipulation and Settlement

Agreement, effective as of February 7, 2008, settling all claims of

34

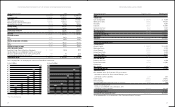

store construction costs and are reclassified between current and long-

term liabilities. The amounts, which are amortized over the life of the

related leases, consisted of the following (thousands):

2007 2006

Deferred lease credits $471,498 $423,390

Amortized deferred lease credits (219,834) (184,024)

Total deferred lease credits, net $251,664 $239,366

7. LEASED FACILITIES AND COMMITMENTS Annual

store rent is comprised of a fixed minimum amount, plus contingent

rent based on a percentage of sales exceeding a stipulated amount.

Store lease terms generally require additional payments covering

taxes, common area costs and certain other expenses.

A summary of rent expense follows (thousands):

2007 2006* 2005

Store rent:

Fixed minimum $231,653 $196,690 $170,009

Contingent 21,489 20,192 16,178

Total store rent $253,142 $216,882 $186,187

Buildings, equipment and other 6,096 5,646 3,241

Total rent expense $259,238 $222,528 $189,428

*Fiscal 2006 was a fifty-three week year.

At February 2, 2008, the Company was committed to non-can-

celable leases with remaining terms of one to 20 years. A summary

of operating lease commitments under non-cancelable leases follows

(thousands):

Fiscal 2008 $254,456 Fiscal 2011 $235,080

Fiscal 2009 $263,179 Fiscal 2012 $214,914

Fiscal 2010 $$252,749 Thereafter $953,417

8. ACCRUED EXPENSES Accrued expenses included gift card

liabilities of $68.8 million and construction in progress of $55.2 million at

February 2, 2008. Accrued expenses included gift card liabilities of $65.0

million and construction in progress of $48.0 million at February 3, 2007.

9. OTHER LIABILITIES Other liabilities consist primarily of

straight-line rent of $56.1 million and $45.8 million at February 2,

2008 and February 3, 2007, respectively and a FIN 48 liability of $49.4

million, including interest and penalties, as of February 2, 2008.

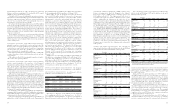

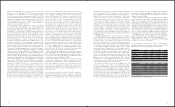

10. INCOME TAXES The provision for income taxes consisted of

(thousands):

2007 2006* 2005

Currently payable:

Federal $245,845 $236,553 $184,884

State 36,441 24,885 32,641

$282,286 $261,438 $ 217,525

Deferred:

Federal $ 1,039 $ (10,271) $ (5,980)

State 303 (1,367) 3,881

$ 1,342 $ (11,638) $ (2,099)

Total provision $283,628 $ 249,800 $215,426

*Fiscal 2006 was a fifty-three week year.

Reconciliation between the statutory federal income tax rate and

the effective income tax rate is as follows:

2007 2006 2005

Federal income tax rate 35.0% 35.0% 35.0%

State income tax, net of federal

income tax effect 3.1 2.3 4.3

Other items, net (0.7) (0.1) (0.1)

Total 37.4% 37.2% 39.2%

Amounts paid directly to taxing authorities were $259.0 million,

$272.0 million and $122.0 million in Fiscal 2007, Fiscal 2006, and

Fiscal 2005, respectively.

The effect of temporary differences which give rise to deferred

income tax assets (liabilities) were as follows (thousands):

2007 2006*

Deferred tax assets:

Deferred compensation $ 45,984 $ 37,725

Rent 67,024 76,890

Accrued expenses 14,571 15,003

Inventory 6,691 5,642

FIN 48 Liabilities 12,416 –

Foreign net operation losses 2,595 2,709

Valuation allowance on foreign net

operation losses (905) (2,709)

Total deferred tax assets $ 148,376 $ 135,260

Deferred tax liabilities:

Store supplies $ (12,266) $ (11,578)

Property and equipment (122,473) (120,906)

Total deferred tax liabilities $(134,739) $ (132,484)

Net deferred income tax liabilities $ 13,637 $ 2,776

*Fiscal 2006 was a fifty-three week year

At February 2, 2008, the Company had $2.6 million in foreign net

operating loss carryovers that could be utilized to reduce future years’ tax

liabilities. A portion of these net operating loss carryovers begin expir-

ing in the year 2012 and some have an indefinite carryforward period.

During Fiscal 2007, $2.2 million of the valuation allowance established

in prior years was reversed because the Company believed that it was

more likely than not that these net operating loss carryovers would

reduce future years’ tax liabilities in certain foreign jurisdictions.

In June 2006, the FASB issued FIN 48, “Accounting for Uncertainty

in Income Tax – An Interpretation of FASB Statement No. 109.” FIN

48 clarifies the accounting for uncertainty in income taxes recognized

in a company’s financial statements in accordance with SFAS No. 109,

“Accounting for Income Taxes.” This interpretation prescribes a recog-

nition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to

be taken in a tax return. This interpretation also provides guidance

on derecognition, classification, interest and penalties, accounting in

interim periods, disclosure and transition. The Company recognizes

accrued interest and penalties related to unrecognized tax benefits as a

component of tax expense.

In connection with the Company’s adoption of FIN 48 on February

4, 2007, a $2.8 million cumulative effect adjustment was recorded as a

reduction to beginning of the year retained earnings. The Company’s

unrecognized tax benefits as of February 4, 2007 were reclassed from