Abercrombie & Fitch 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

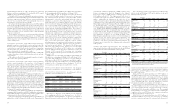

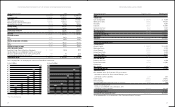

do not include common area maintenance (“CAM”), insurance, mar-

keting or tax payments for which the Company is also obligated.

Total expense related to CAM, insurance, marketing and taxes was

$129.6 million in Fiscal 2007. The obligations in the table above do

not include unrecognized tax benefits at February 2, 2008 of $38.9

million. Additionally, the obligations in the table above do not

include retirement benefits for the Company’s Chief Executive Officer

at February 2, 2008 of $14.0 million due under the Chief Executive

Officer Supplemental Executive Retirement Plan (the “SERP”). See Note

12, “Retirement Benefits”, of the Notes to Consolidated Financial

Statements, and the description of the SERP in the text under the cap-

tion “EXECUTIVE OFFICER COMPENSATION” in A&F’s

definitive Proxy Statement for the Annual Meeting of Stockholders to

be held on June 11, 2008. The purchase obligations category represents

purchase orders for merchandise to be delivered during Spring 2008

and commitments for fabric to be used during upcoming seasons.

Other obligations primarily represent letters of credit outstanding as of

February 2, 2008, lease deposits and preventive maintenance and

information technology contracts for Fiscal 2008. See Note 11, “Long-

Term Debt”, of the Notes to Consolidated Financial Statements. The

Company expects to fund all of these obligations with cash provided

from operations.

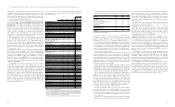

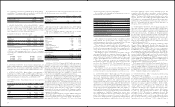

STORES AND GROSS SQUARE FEET Store count and gross

square footage by brand were as follows for the thirteen weeks ended February

2, 2008 and the fourteen weeks ended February 3, 2007 respectively:

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

November 3, 2007 362 198 434 20 – 1,014

New 2 4 17 2 3 28

Remodels/Conversions

(net activity) (3) (1) – – – (4)

Closed (2) – (1) – – (3)

February 2, 2008 359 201 450 22 3 1,035

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

November 3, 2007 3,197 900 2,906 185 – 7,188

New 17 21 116 19 34 207

Remodels/Conversions

(net activity) (29) (4) – – – (33)

Closed (18) – (7) – – (25)

February 2, 2008 3,167 917 3,015 204 34 7,337

Average Store Size 8,822 4,562 6,700 9,273 11,333 7,089

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

October 28, 2006 358 171 372 11 – 912

New 3 8 21 4 – 36

Remodels/Conversions

(net activity) 1 – – (1)(1) – –

Closed (2) (2) – – – (4)

February 3, 2007 360 177 393 14 – 944

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

October 28, 2006 3,138 753 2,450 100 – 6,441

New 29 41 152 39 – 261

Remodels/Conversions

(net activity) 19 – 2 (9)(1) – 12

Closed (15) (6) – – – (21)

February 3, 2007 3,171 788 2,604 130 – 6,693

Average Store Size 8,808 4,452 6,626 9,286 – 7,090

(1) Includes one RUEHL store temporarily closed due to fire damage.

Store count and gross square footage by brand were as follows for the

fifty-two weeks ended February 2, 2008 and the fifty-three weeks ended

February 3, 2007, respectively:

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

February 3, 2007 360 177 393 14 – 944

New 6 25 58 7 3 99

Remodels/Conversions

(net activity) (2) (1) – 1(2) – (2)

Closed (5) – (1) – – (6)

February 2, 2008 359 201 450 22 3 1,035

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

February 3, 2007 3,171 788 2,604 130 – 6,693

New 64 126 418 65 34 707

Remodels/Conversions

(net activity) (23) 3 – 9 – (11)

Closed (45) – (7) – – (52)

February 2, 2008 3,167 917 3,015 204 34 7,337

Average Store Size 8,822 4,562 6,700 9,273 11,333 7,089

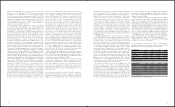

Abercrombie

Store Activity & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

January 29, 2006 361 164 318 8 – 851

New 8 19 70 7 – 104

Remodels/Conversions

(net activity) (2)(1) – 5(1) (1)(2) – 2

Closed (7) (6) – – – (13)

February 3, 2007 360 177 393 14 – 944

Gross Square Feet Abercrombie

(thousands) & Fitch abercrombie Hollister RUEHL Gilly Hicks Total

January 29, 2006 3,157 716 2,083 69 – 6,025

New 66 94 482 70 – 712

Remodels/Conversions

(net activity) 3

(1) – 39(1) (9)(2) – 33

Closed (55) (22) – – – (77)

February 3, 2007 3,171 788 2,604 130 – 6,693

Average Store Size 8,808 4,452 6,626 9,286 – 7,090

(1) Includes one Abercrombie & Fitch store and one Hollister store reopened after repair from hurricane damage.

(2) Includes one RUEHL store temporarily closed due to fire damage.

CAPITAL EXPENDITURES AND LESSOR CONSTRUCTION

ALLOWANCES Capital expenditures totaled $403.3 million,

$403.5 million and $256.4 million for Fiscal 2007, Fiscal 2006 and

Fiscal 2005, respectively.

In Fiscal 2007, total capital expenditures were $403.3 million, of

which $252.8 million was used for store related projects related to new

construction and remodels, conversions and refreshes of existing

Abercrombie & Fitch, abercrombie and Hollister stores. The remaining

$150.5 million was used for projects at the home office and the distribution

centers, including home office expansion, information technology

investments, the purchase of an airplane and other projects.

In Fiscal 2006, total capital expenditures were $403.5 million, of

which $253.7 million was used for store related projects related to new

store construction and remodels, conversions, and refreshes of existing

Abercrombie & Fitch, abercrombie and Hollister stores. The remaining

$149.8 million was used for projects at the home office, including the

completion of the second DC, home office expansion, information

technology investments and other projects.

In Fiscal 2005, total capital expenditures were $256.4 million, of

which $204.7 million was used for store related projects, including

new store construction and remodels, conversions and other projects.

and amortization of deferred lease credits, collection of lessor construction

allowances and decreases in inventory. Uses of cash in Fiscal 2007 consisted

primarily of a decrease in income taxes payable.

Cash in Fiscal 2006 was provided primarily by current year net income,

adjusted for non-cash items including, depreciation and amortization and

share-based compensation charges, and lessor construction allowances

collected. Uses of cash in Fiscal 2006 consisted primarily of increases in

inventory and a decrease in income taxes payable.

Net cash provided by operating activities increased to $582.2 million

for Fiscal 2006 from $453.6 million in Fiscal 2005. Cash in Fiscal 2005

was provided primarily by net income adjusted for non-cash items

including depreciation and amortization and share-based compensation

charges, collection of lessor construction allowances and an increase in

income taxes payable. Uses of cash in Fiscal 2005 consisted primarily

of increases in inventory.

The Company’s operations are seasonal and typically peak during

the Back-to-School and Holiday selling periods. Accordingly, cash

requirements for inventory expenditures are highest in the second and

third fiscal quarters as the Company builds inventory in anticipation

of these selling periods.

INVESTING ACTIVITIES Cash outflows for Fiscal 2007 were

primarily for purchases of marketable securities and trust-owned life

insurance policies and capital expenditures related primarily to new store

construction, store remodels and refreshes, the purchase of an airplane

and other various store, home office and DC projects, partially offset

by proceeds from the sale of marketable securities.

Cash outflows for Fiscal 2006 were primarily for purchases of marketable

securities, the purchase of trust-owned life insurance policies and capi-

tal expenditures.

Cash outflows for Fiscal 2005 were primarily for purchases of market-

able securities and capital expenditures.

FINANCING ACTIVITIES Cash outflows related to financing

activities consisted primarily of the repurchase of the Company’s

Common Stock and the payment of dividends in Fiscal 2007 and Fiscal

2005. In Fiscal 2006, cash outflows for financing activities related

primarily to the payment of dividends and a change in outstanding checks.

Cash inflows in Fiscal 2007, Fiscal 2006 and Fiscal 2005 consisted primarily

of stock option exercises and excess tax benefits related to stock option

exercises and restricted stock issuances.

A&F repurchased approximately 3.6 million and 1.8 million shares of

A&F’s Common Stock during Fiscal 2007 and Fiscal 2005, respectively.

A&F did not repurchase any shares of A&F’s Common Stock during

Fiscal 2006. Both the Fiscal 2007 and the Fiscal 2005 repurchases

were pursuant to A&F Board of Directors’ authorizations. In August

2005, the A&F Board of Directors authorized A&F to repurchase 6.0

million shares of A&F’s Common Stock. In November 2007, the A&F

Board of Directors authorized the repurchase of 10.0 million shares of

A&F’s Common Stock, in addition to the approximately 2.0 million

shares of A&F’s Common Stock which then remained available under

the August 2005 repurchase authorization.

As of February 2, 2008, A&F had approximately 12.0 million shares

remaining available to repurchase under the 6.0 million share authorization

by the A&F Board of Directors in August 2005 and the 10.0 million share

authorization by the Board of Directors in November 2007.

Subsequent to February 2, 2008, A&F repurchased approximately 0.7

million shares of A&F’s Common Stock with a value of approximately

$50.0 million from the approximately 12.0 million shares of Common

Stock remaining authorized for repurchase at February 2, 2008.

On December 15, 2004, the Company entered into an amended

and restated $250 million syndicated unsecured credit agreement

(the “Amended Credit Agreement”) with Abercrombie & Fitch

Management Co., as borrower, and with A&F and its other domestic

subsidiaries, as guarantors. The primary purposes of the Amended

Credit Agreement are for financial support of trade and stand-by

letters of credit and working capital. The Amended Credit Agreement

has several borrowing options, including an option where interest

rates are based on the agent bank’s “Alternate Base Rate,” and

another using the London Interbank Offered Rate. The facility fees

payable under the Amended Credit Agreement are based on the

ratio of the Company’s leveraged total debt plus 600% of forward

minimum rent commitments to consolidated earnings before inter-

est, taxes, depreciation, amortization and rent for the trailing four

fiscal quarter periods. The facility fees are projected to accrue at

either 0.15% or 0.175% on the committed amounts per annum. The

Amended Credit Agreement contains limitations on indebtedness,

liens, sale-leaseback transactions, significant corporate changes

including mergers and acquisitions with third parties, investments,

restricted payments (including dividends and stock repurchases)

and transactions with affiliates. The Amended Credit Agreement

will mature on December 15, 2009. Trade letters of credit totaling

approximately $61.6 million and $48.8 million were outstanding

under the Amended Credit Agreement on February 2, 2008 and

February 3, 2007, respectively. No borrowings were outstanding

under the Amended Credit Agreement on February 2, 2008 or on

February 3, 2007.

Standby letters of credit totaling approximately $14.5 million and

$4.9 million were outstanding on February 2, 2008 and February 3, 2007,

respectively. The standby letters of credit are set to expire during the

fourth quarter of Fiscal 2008. The beneficiary, a merchandise supplier,

has the right to draw upon the standby letters of credit if the Company

authorizes or files a voluntary petition in bankruptcy. To date, the

beneficiary has not drawn upon the standby letters of credit.

OFF-BALANCE SHEET ARRANGEMENTS The Company

does not have any off-balance sheet arrangements or debt obligations.

CONTRACTUAL OBLIGATIONS As of February 2, 2008, the

Company’s contractual obligations were as follows:

PAYMENTS DUE BY PERIOD (THOUSANDS)

Contractual Less than More than

Obligations Total 1 year 1-3 years 3-5 years 5 years

Operating

Lease $2,173,795 $254,456 $515,928 $449,994 $953,417

Obligations

Purchase

Obligations $ 245,599 $245,599 – – –

Other

Obligations $ 115,044 $ 90,943 $ 24,075 $ 26 –

Totals $2,534,438 $590,998 $540,003 $450,020 $953,417

Operating lease obligations consist primarily of future minimum

lease commitments related to store operating leases. See Note 7,

“Leased Facilities and Commitments”, of the Notes to Consolidated

Financial Statements, for further discussion. Operating lease obligations

18 19