Abercrombie & Fitch 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW The Company’s fiscal year ends on the Saturday closest

to January 31, typically resulting in a fifty-two week year, but occasionally

giving rise to an additional week, resulting in a fifty-three week year. A

store is included in comparable store sales when it has been open as the

same brand at least one year and its square footage has not been expanded

or reduced by more than 20% within the past year.

Fiscal 2007 includes fifty-two weeks and Fiscal 2006 includes fifty-

three weeks. For purposes of MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS, the thirteen and fifty-two week periods ended

February 2, 2008 are compared to the fourteen and fifty-three week

periods ended February 3, 2007. For Fiscal 2007, comparable store sales

compare the thirteen and fifty-two week periods ended February 2,

2008 to the thirteen and fifty-two week periods ended February 3,

2007. For Fiscal 2006, comparable store sales compare the fourteen

and fifty-three week periods ended February 3, 2007 to the fourteen

and fifty-three week periods ended February 4, 2006.

The Company had net sales of $3.750 billion for the fifty-two

weeks ended February 2, 2008, up 13.0% from $3.318 billion for the

fifty-three weeks ended February 3, 2007. Operating income for

Fiscal 2007 increased 12.5% to $740.5 million from $658.1 million for

Fiscal 2006. Net income was $475.7 million in Fiscal 2007, up 12.7%

from $422.2 million in Fiscal 2006. Net income per diluted weighted-

average share was $5.20 for Fiscal 2007 compared to $4.59 in Fiscal

2006, an increase of 13.3%.

The Company generated cash from operations of $817.8 million in

Fiscal 2007 versus $582.2 million in Fiscal 2006, resulting primarily

from a reduction in inventory and sales and earnings growth. During

Fiscal 2007, the Company used cash from operations to finance its

growth strategy, including the opening of 58 new Hollister stores, 25 new

abercrombie stores, seven new RUEHL stores, six new Abercrombie &

Fitch stores and three new Gilly Hicks stores, as well as the remodeling,

converting or refreshing of existing Abercrombie & Fitch, abercrombie,

Hollister and RUEHL stores.

The Company also used excess cash in Fiscal 2007 to pay dividends

of $0.70 per share, for a total of $61.3 million and to repurchase

approximately 3.6 million shares of A&F Common Stock with a value

of approximately $287.9 million. The Company believes that share

repurchases and dividends are an important way for the Company to

deliver shareholder value, but the Company’s priority will be to invest

in the business to support its domestic and international growth plans.

The Company continues to be committed to maintaining sufficient

cash on the balance sheet to support daily operations, fund growth

initiatives and provide a degree of protection against unanticipated

business volatility. In addition, the Company has $250 million avail-

able, less outstanding letters of credit, under its unsecured credit

agreement to support operations.

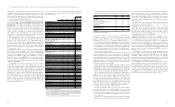

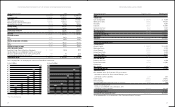

FINANCIAL SUMMARY The following summarized financial

and operational data compares Fiscal 2007 to Fiscal 2006 and Fiscal

2006 to Fiscal 2005:

% Change

2007- 2006-

2007 2006* 2005 2006 2005

Net sales (thousands) $3,749,847 $ 3,318,158 $ 2,784,711 13% 19%

Net sales by brand (thousands)

Abercrombie & Fitch $ 1,638,929 $ 1,515,123 $1,424,013 8% 6%

abercrombie $ 471,045 $ 405,820 $ 344,938 16% 18%

Hollister $1,589,452 $ 1,363,233 $ 999,212 17% 36%

RUEHL $ 50,191 $ 33,982 $ 16,548 48% 105%

Gilly Hicks*** $ 230 n / a n / a n / a n / a

Increase (decrease) in

comparable store sales** (1)% 2 % 26%

Abercrombie & Fitch 0 % (4)% 18%

abercrombie 0 % 10 % 54%

Hollister (2)% 5 % 29%

RUEHL (9)% 14 % n / a

Net retail sales increase attributable

to new and remodeled stores,

websites and catalogue 14 % 17% 12%

Net retail sales per

average store (thousands) $ 3,470 $ 3,533 $ 3,284 (2)% 8 %

Abercrombie & Fitch $ 4,073 $ 3,945 $ 3,784 3 % 4 %

abercrombie $ 2,230 $ 2,251 $ 1,957 (1)% 15 %

Hollister $ 3,550 $ 3,732 $ 3,442 (5)% 8 %

RUEHL $ 2,602 $ 3,248 $ 2,903 (20)% 12 %

Net retail sales per average

gross square foot $ 489 $ 500 $ 464 (2) % 8 %

Abercrombie & Fitch $ 463 $ 450 $ 432 3 % 4 %

abercrombie $ 493 $ 513 $ 446 (4)% 15 %

Hollister $ 531 $ 568 $ 528 (7)% 7 %

RUEHL $ 282 $ 363 $ 315 (22)% 15 %

Transactions per average retail store 53,152 55,142 50,863 (4)% 8 %

Abercrombie & Fitch 49,915 51,704 49,685 (3)% 4 %

abercrombie 33,907 34,786 30,356 (3)% 15 %

Hollister 65,564 68,740 64,913 (5)% 6 %

RUEHL 31,880 38,554 26,215 (17)% 47 %

Average retail transaction value $ 65.29 $ 64.07 $ 64.56 2 % (1)%

Abercrombie & Fitch $ 81.59 $ 76.30 $ 76.16 7 % 0 %

abercrombie $ 65.76 $ 64.72 $ 64.47 2 % 0 %

Hollister $ 54.15 $ 54.30 $ 53.03 0 % 2 %

RUEHL $ 81.61 $ 84.24 $ 110.74 (3)% (24)%

Average units per retail transaction 2.42 2.35 2.25 3 % 4 %

Abercrombie & Fitch 2.37 2.26 2.18 5 % 4 %

abercrombie 2.82 2.78 2.66 1 % 5 %

Hollister 2.36 2.32 2.21 2 % 5 %

RUEHL 2.48 2.57 2.28 (4)% 13 %

Average unit retail sold $ 26.98 $ 27.26 $ 28.69 (1)% (5)%

Abercrombie & Fitch $ 34.43 $ 33.76 $ 34.94 2 % (3)%

abercrombie $ 23.32 $ 23.28 $ 24.24 0 % (4)%

Hollister $ 22.94 $ 23.41 $ 24.00 (2)% (2)%

RUEHL $ 32.91 $ 32.78 $ 48.57 0 % (33)%

*Fiscal 2006 was a fifty-three week year.

**A store is included in comparable store sales when it has been open as the same brand at least one

year and its square footage has not been expanded or reduced by more than 20% within the past year.

Note Fiscal 2007 comparable store sales are compared to store sales for the comparable fifty-two

weeks ended February 3, 2007. Note that Fiscal 2006 comparable store sales are compared to store

sales for the comparable fifty-three weeks ended February 4, 2006.

*** Net sales for Gilly Hicks during Fiscal 2007 reflect the activity of 3 stores opened in January 2008.

to open in Spring 2009. The Company anticipates the Hollister flag-

ship to fortify the iconic status of the brand in order to support its

international growth. Construction is also currently underway for the

Abercrombie & Fitch flagship in Tokyo’s Ginza district, with a planned

opening in late 2009. Opportunities are also being assessed for the

Abercrombie & Fitch and Hollister brands in continental Europe and

other sites in Japan.

In addition to a focus on the domestic and international expansion

of existing iconic brands, the Company also views new concepts as an

integral part of its long-term strategy.

In January 2008, the Company launched its fifth concept, Gilly

Hicks. This concept provides the opportunity to expand the existing

emotional connection with the Company’s female customers by offering

bras, underwear, personal care products, sleepwear and at-home products.

The Company operated three Gilly Hicks stores at the end of Fiscal

2007 and plans to open 15 stores in Fiscal 2008.

Although profitability was not achieved as originally expected,

RUEHL made significant progress in Fiscal 2007 with improvements to

gross margin and reductions in store operating and store construction

costs. In Fiscal 2008, the Company will continue to focus on improving

the quality level of the merchandise in order to be consistent with the

brand’s positioning and pricing strategy. The Company expects brand

awareness to grow from the RUEHL website which has offered a full

product assortment since January 2008. However, the Company will

moderate the pace of new store openings until RUEHL can be estab-

lished as a proven concept.

The Company also views product line expansion through its existing

brands as another promising growth opportunity. In October 2007, the

Company launched a body care line in 93 Hollister stores for both Dudes

and Bettys. Holiday purchases of body care products were primarily

incremental transaction units indicating the product line is a way to help

fuel organic sales growth. As a result, the Company has decided to expand

the body care products to all Hollister stores in Fiscal 2008.

The Company is in the midst of an investment and expansion phase

targeted at driving consistent and sustainable long-term value growth.

The Company believes strongly in its brands and in the potential for its

international expansion plan, and will continue to invest during economic

cycles. If the current general macro-economic downturn persists and

negatively impacts sales, the Company’s cost structure will be aligned

accordingly, but resource cuts that could jeopardize the ability to implement

the Company’s long-term growth initiatives will be avoided.

12 13

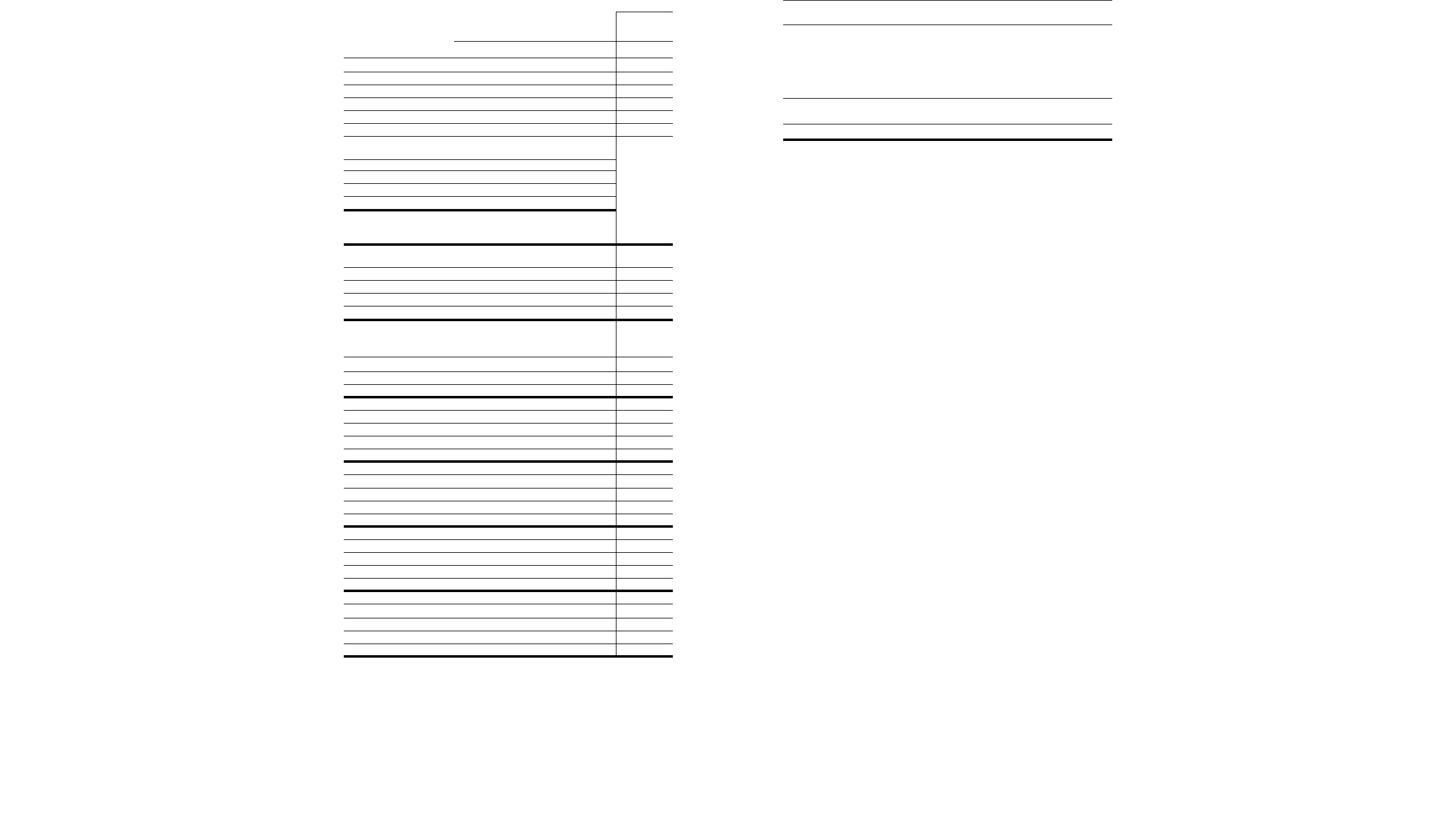

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

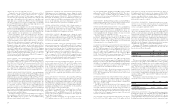

The following data represents the Company’s Consolidated Statements of

Net Income for the last three fiscal years, expressed as a percentage of net sales:

2007 2006* 2005

Net Sales 100.0% 100.0% 100.0%

Cost of Goods Sold 33.0 33.4 33.5

Gross Profit 67.0 66.6 66.5

Stores and Distribution Expense 37.0 35.8 35.9

Marketing, General and Administrative Expense 10.6 11.3 11.3

Other Operating Income, Net (0.3) (0.3) (0.2)

Operating Income 19.7 19.8 19.5

Interest Income, Net (0.5) (0.4) (0.2)

Income Before Income Taxes 20.2 20.3 19.7

Provision for Income Taxes 7.6 7.5 7.7

Net Income 12.7% 12.7% 12.0%

*Fiscal 2006 was a fifty-three week year.

CURRENT TRENDS AND OUTLOOK In Fiscal 2007, the

Company once again produced record sales and earnings, driven by

an increased gross profit rate and a lower marketing, general and

administrative expense rate. The Company maintained high store

sales productivity and a high operating margin, even as the Company

continued to invest in the long-term positioning of its brands. The Company

believes its ability to maintain the sale of full-priced merchandise and

consistent high store sales productivity is a result of its commitment to

offer trend-right merchandise, with the highest level of quality, and to

create an exceptional in-store experience, which establishes an emo-

tional connection with its customers.

The Company’s commitment to its brands is demonstrated by strategic

investments made in the areas of stores, merchandise development and

home office infrastructure, which the Company believes will enhance

quality, improve productivity and support future growth. Specifically,

major implementations in planning, merchandising and allocation

information systems over the next year should generate supply chain

improvements and serve as a platform for future growth and expansion,

both domestically and internationally.

The Company believes it has significant growth potential both domesti-

cally and internationally. Domestically, the Company believes its growth

potential will come from proven brands like Hollister and developing concepts

like Gilly Hicks. Internationally, the Company believes its growth will

come from its Abercrombie & Fitch, abercrombie and Hollister brands.

Recent international performance highlights the opportunity for

expansion. In Fiscal 2007, the three Abercrombie & Fitch and three

Hollister stores located in Canada continued to generate more than

three times the sales productivity of the average U.S. counterpart and

the Abercrombie & Fitch London flagship generated substantial sales

per selling square foot similar to the strong performance of the Fifth

Avenue flagship. “Tourist” stores, such as Fifth Avenue in New York,

Ala Moana in Hawaii and Aventura Mall in Miami, are among the top

performing stores in the chain. Additionally, international direct-to-

consumer sales increased 72.4% from Fiscal 2006.

In 2008, the Company plans to open one Abercrombie & Fitch

store, three abercrombie stores and three Hollister stores in Canada.

The Company also plans to enter the U.K. market with Hollister with

the opening of four shopping center-based stores in 2008. The first

store is scheduled to open in October at Brent Cross Shopping Centre,

outside of London.

Construction is currently underway for the first Hollister flagship

in the SoHo area of New York City. The multi-level flagship is scheduled