Abercrombie & Fitch 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in A&F’s stock purchase plan, and associates who own shares through

A&F-sponsored retirement plans, A&F estimates that there are

approximately 102,000 stockholders.

During Fiscal 2007, A&F repurchased approximately 3.6 million

shares of A&F’s Common Stock with a value of approximately $287.9

million. A&F did not repurchase any shares of A&F’s Common Stock

during Fiscal 2006. During Fiscal 2005, A&F repurchased approxi-

mately 1.8 million shares of A&F’s Common Stock with a value of

approximately $103.3 million. Both the Fiscal 2007 and Fiscal 2005

repurchases were pursuant to A&F Board of Directors’ authorizations.

A&F did not repurchase any shares of A&F’s Common Stock during

the fiscal quarter ended February 2, 2008.

Subsequent to February 2, 2008, A&F repurchased approximately 0.7

million shares of A&F’s Common Stock with a value of approximately

$50.0 million from the approximately 12.0 million shares of Common

Stock remaining authorized for repurchase at February 2, 2008.

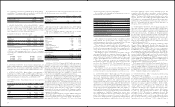

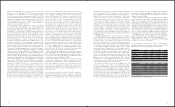

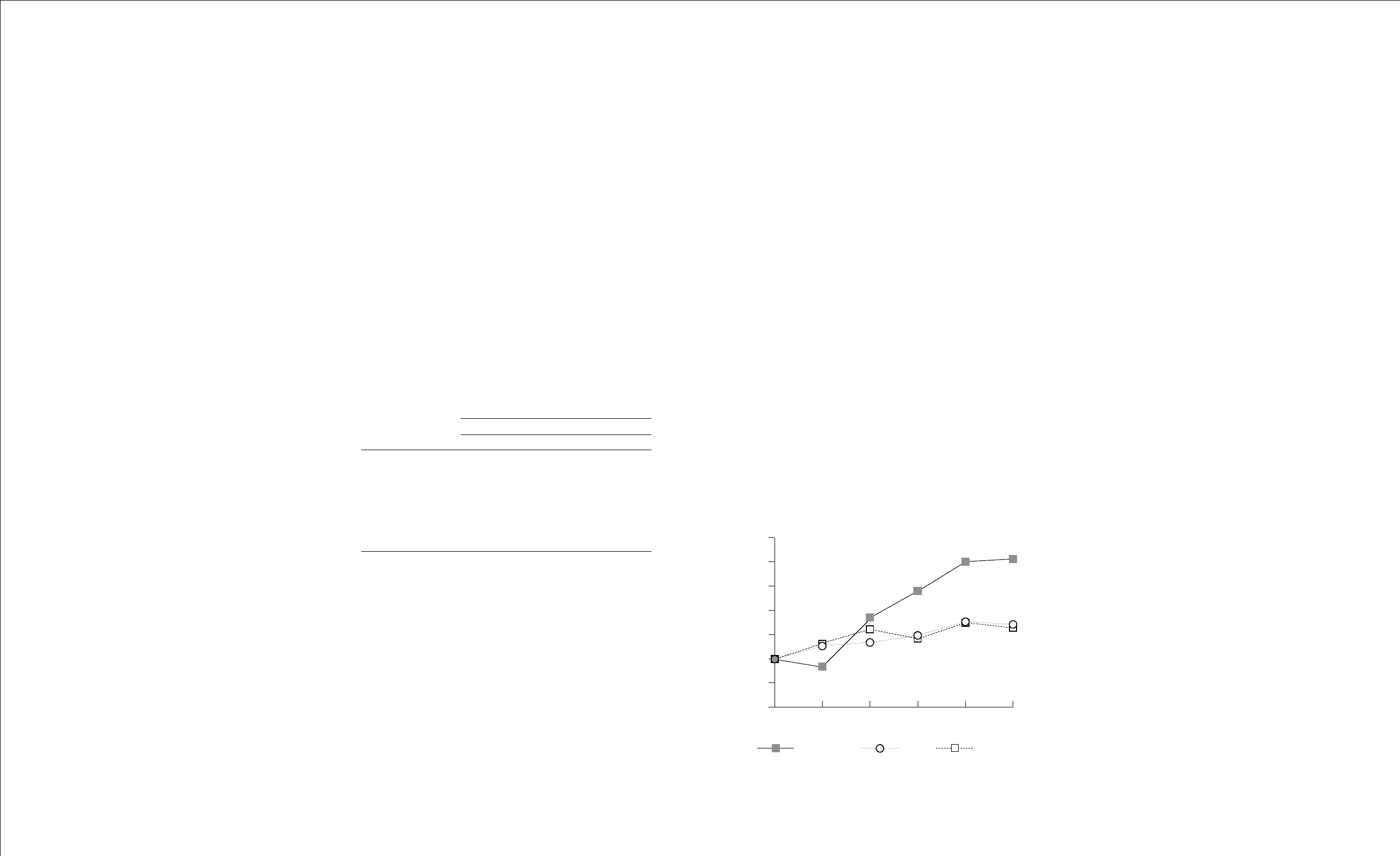

COMPARISON OF 5 YEAR

CUMULATIVE TOTAL RETURN*

The following graph shows the changes, over the five-year period

ended February 2, 2008 (the last day of A&F’s 2007 fiscal year), in the

value of $100 invested in (i) shares of A&F’s Common Stock; (ii) the

Standard & Poor’s 500 Stock Index (the “S&P 500 Index”) and (iii)

the Standard & Poor’s Apparel Retail Composite Index (the “S&P

Apparel Retail Index”), including reinvestment of dividends. The

plotted points represent the closing price on the last day of the fiscal

year indicated (and if such day was not a trading day, the closing price

on the last day immediately preceding the trading day).

Among Abercrombie & Fitch Co., The S&P 500 Index, and

The S&P Apparel Retail Index

16. SUBSEQUENT EVENTS

AUCTION RATE SECURITIES At February 2, 2008, the

Company’s investments in marketable securities consisted of investment

grade auction rate securities (“ARS”), all classified as available-for-sale

and reported at fair value based on the Dutch auction market as of

February 2, 2008, with maturities that range from eight to 34 years.

Despite the underlying long-term maturity of ARS, such securi-

ties were priced and subsequently traded as short-term investments

because of the interest rate reset feature. Interest rates reset through

a Dutch auction process at predetermined periods ranging from

seven to 35 days. If there are insufficient buyers, the auction is

said to “fail” and the holders are unable to liquidate the investments

through auction. A failed auction does not result in a default of the

debt instrument. The securities will continue to accrue interest and

be auctioned until the auction succeeds, the issuer calls the securities

or the securities mature.

On February 13, 2008, the Company began to experience failed

auctions on some of its ARS. At March 27, 2008, the Company held

approximately $365.9 million in ARS classified as marketable securi-

ties, of which $326.9 million were also held as of February 2, 2008.

As of March 27, 2008, approximately 89% of the Company’s ARS are

“AAA” rated and the remaining ARS have ratings that range from A1

to A3 by one or more major credit rating agencies. The ratings take

into account insurance policies which guarantee both the principal

and accrued interest. The Company believes that it will fully collect

the principal and interest of the securities. Approximately $101.5 mil-

lion of these securities were invested in closed end municipal bond

funds and approximately $264.4 million were invested in securities

issued by state agencies which issue student loans, substantially all of

which are guaranteed by the United States government.

At March 27, 2008, the ARS market remains uncertain. However, the

Company believes that it currently has adequate working capital to fund

operations based on access to cash and cash equivalents and expected

operating cash flows. The Company also has $250 million available, less

outstanding letters of credit, under its unsecured credit agreement.

REPURCHASE OF COMMON STOCK Subsequent to

February 2, 2008, A&F had repurchased approximately 0.7 million

shares of A&F’s Common Stock with a value of approximately $50.0

million from the approximately 12.0 million shares of Common Stock

remaining authorized for repurchase at February 2, 2008.

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING The management of A&F

is responsible for establishing and maintaining adequate internal

control over financial reporting. A&F’s internal control over finan-

cial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under

the Exchange Act) is a process designed to provide reasonable

assurance regarding the reliability of financial reporting and the

preparation of financial statements for external purposes in accor-

dance with accounting principles generally accepted in the United

States of America.

Because of its inherent limitations, internal control over financial

reporting may not prevent or detect misstatements. Also, projections

of any evaluations of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes

in conditions, or that the degree of compliance with the policies or

procedures may deteriorate. Accordingly, even an effective system of

internal control over financial reporting will provide only reasonable

assurance with respect to financial statement preparation.

With the participation of the Chairman and Chief Executive Officer

of A&F and the Executive Vice President and Chief Financial Officer

of A&F, management evaluated the effectiveness of A&F’s internal

control over financial reporting as of February 2, 2008 using criteria

established in the Internal Control-Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway

Commission (“COSO”). Based on the assessment of A&F’s internal

control over financial reporting, under the criteria described in the

preceding sentence, management has concluded that, as of February

2, 2008, A&F’s internal control over financial reporting was effective.

A&F’s independent registered public accounting firm,

PricewaterhouseCoopers LLP, has issued an audit report on the effec-

tiveness of A&F’s internal control over financial reporting as of February

2, 2008 as stated in their report, which is included herein.

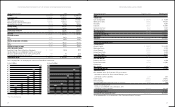

MARKET FOR REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES A&F’s Class A

Common Stock (the “Common Stock”) is traded on the New York

Stock Exchange under the symbol “ANF.” The table below sets forth

the high and low sales prices of A&F’s Common Stock on the New

York Stock Exchange for Fiscal 2007 and Fiscal 2006:

SALES PRICE

High Low

Fiscal 2007

4th Quarter $84.54 $66.05

3rd Quarter $85.77 $67.91

2nd Quarter $84.16 $67.72

1st Quarter $84.92 $71.75

Fiscal 2006

4th Quarter $81.70 $65.75

3rd Quarter $79.42 $51.76

2nd Quarter $65.19 $49.98

1st Quarter $70.94 $54.50

Beginning in Fiscal 2004, the Board of Directors of A&F voted

to initiate a cash dividend at an annual rate of $0.50 per share. A

quarterly dividend of $0.125 per share was paid in March and June

2005. In August 2005, the A&F Board of Directors increased the quar-

terly dividend to $0.175 per share, which was paid in September and

December of Fiscal 2005. A quarterly dividend, of $0.175 per share,

was paid in March, June, September and December of Fiscal 2006 and

Fiscal 2007. A&F expects to continue to pay a dividend, subject to the

Board of Directors’ review of the Company’s cash position and results

of operations.

As of March 21, 2008, there were approximately 4,929 stockhold-

ers of record. However, when including investors holding shares in

broker accounts under street name, active associates who participate

38 39

*$100 invested on 2/1/03 in stock or on 1/31/03 in index-including reinvestment of

dividends. Indexes calculated on month-end basis.

S&P Apparel Retail

S&P 500

Abercrombie & Fitch

2/1/03 1/31/04 1/29/05 1/28/06 2/3/07 2/2/08

$0

$50

$100

$150

$200

$250

$300

$350