Abercrombie & Fitch 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

RESULTS OF OPERATIONS During the 2004 fiscal year, the

Company made solid progress in executing its strategic priority to build

and maintain the aspirational positioning of its brands. An integral

part of this strategy was to reduce the overall level of promotions to

emphasize the superior quality of its brands. In addition, the Company

increased its spending in its retail stores to improve the overall customer

experience and reduce the level of shrink.

The Company had net sales of $2.021 billion in fiscal 2004, up

18.3% versus net sales in the fiscal 2003 period. Net income was $216.4

million in fiscal 2004, up 5.7% versus the 2003 fiscal year. Operating

income for the 2004 fiscal year increased 5.0% to $347.6 million

from $331.2 million for the 2003 fiscal year. Operating income

included a $40.9 million accrual for the expected settlement of three

related class action employment discrimination lawsuits. Net income

per weighted-average diluted share was $2.28 for the 2004 fiscal year

compared to $2.06 in the 2003 fiscal year, an increase of 10.7%.

The Company generated cash from operations of $426.1 million

in fiscal 2004 versus $342.5 million in fiscal 2003 resulting primarily

from strong earnings coupled with disciplined inventory management.

The Company used cash from operations to finance its growth strat-

egy, opening 84 Hollister stores, 16 Abercrombie & Fitch stores, 9

abercrombie stores and 4 RUEHL stores, and remodeling 14

Abercrombie & Fitch stores.

Further, the Company used excess cash to repurchase 11.2 mil-

lion shares of common stock for $434.7 million and pay dividends of

$0.50 per share. Cash distributions to shareholders will continue to

be an important way to deliver shareholder value, but the Company’s

first priority will be to invest in the business to support its domestic

and international growth plans. Further, the Company is committed

to maintaining sufficient cash on the balance sheet to support the

needs of the business and withstand unanticipated business volatility.

Therefore, the Company plans to retain approximately $300 to $350

million of cash and marketable securities, subject to a variety of factors

including inventory purchases and the timing of certain payments.

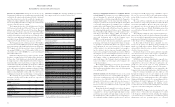

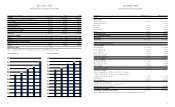

The following data represent the Company’s consolidated

statements of income for the last three fiscal years, expressed as a

percentage of net sales:

2004 2003 2002

Net Sales 100.0% 100.0% 100.0%

Cost of Goods Sold, Occupancy

and Buying Costs 55.0 58.0 58.9

Gross Income 45.0 42.0 41.1

General, Administrative

and Store Operating Expenses 27.8 (1) 22.6 21.5

Operating Income 17.2 19.4 19.6

Interest Income, Net (0.3) (0.2) (0.2)

Income Before Income Taxes 17.5 19.6 19.8

Provision for Income Taxes 6.8 7.6 7.6

Net Income 10.7 12.0 12.2

(1) Includes 2.0% related to the settlement of the class action diversity lawsuits.

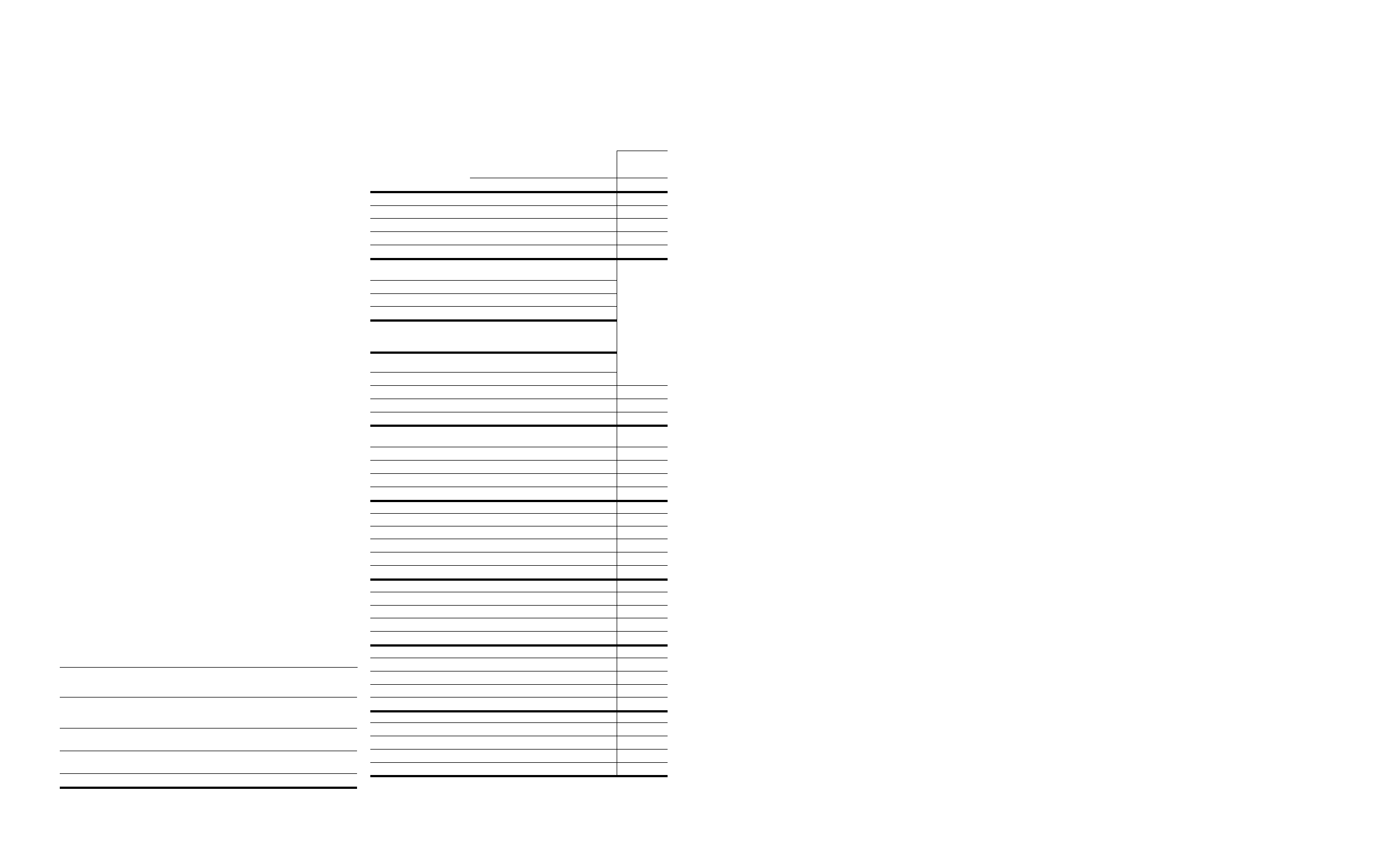

FINANCIAL SUMMARY The following summarized operational

data compares fiscal 2004 to fiscal 2003 and fiscal 2002:

% Change

2003- 2002-

2004 2003 2002 2004 2003

Net sales (thousands) $2,021,253 $1,707,810 $1,595,757 18% 7%

Net sales by brand

Abercrombie & Fitch $1,210,222 $1,180,646 $1,238,498 3% (5)%

abercrombie $ 227,204 $ 212,276 $ 207,537 7% 2%

Hollister $ 579,687 $ 314,888 $ 149,722 84% 110%

RUEHL* $ 4,140 ————————

Increase (decrease) in

comparable store sales

Abercrombie & Fitch (1)% (11)% (6)%

abercrombie 1% (6)% (4)%

Hollister 13% 7% 10%

Retail sales increase attributable

to new and remodeled stores,

magazine, catalogue and web sites 16% 16% 22%

Retail sales per average

gross square foot

Abercrombie & Fitch $ 352 $ 358 $ 407 (2)% (12)%

abercrombie $ 282 $ 270 $ 286 4% (6)%

Hollister $ 423 $ 404 $ 385 5% 5%

RUEHL* $ 136 ————————

Retail sales per average

store (thousands)

Abercrombie & Fitch $ 3,103 $ 3,184 $ 3,652 (3)% (13)%

abercrombie $ 1,241 $ 1,194 $ 1,271 4% (6)%

Hollister $ 2,740 $ 2,594 $ 2,450 6% 6%

RUEHL* $ 1,255 ————————

Sales statistics per average store

Number of transactions

Abercrombie & Fitch 45,941 51,234 59,832 (10)% (14)%

abercrombie 21,740 22,128 23,210 (2)% (5)%

Hollister 56,687 57,593 58,648 (2)% (2)%

RUEHL* 12,913 ————————

Average transaction value

Abercrombie & Fitch $ 67.54 $ 62.15 $ 61.04 9% 2%

abercrombie $ 57.10 $ 53.98 $ 54.77 6% (1)%

Hollister $ 48.33 $ 45.04 $ 41.78 7% 8%

RUEHL* $ 97.16 —— ——————

Units per transaction

Abercrombie & Fitch 2.22 2.24 2.22 (1)% 1%

abercrombie 2.68 2.68 2.70 —— (1)%

Hollister 2.18 2.14 2.00 2% 7%

RUEHL* 2.17 —— —— ————

Average unit value

Abercrombie & Fitch $ 30.42 $ 27.75 $ 27.50 10% 1%

abercrombie $ 21.31 $ 20.14 $ 20.29 6% (1)%

Hollister $ 22.17 $ 21.05 $ 20.89 5% 1%

RUEHL* $ 44.77 —— —— —— ——

* Net sales for RUEHL, and the related statistics, reflect the activity of three stores opened

in September 2004 and one store opened in December 2004.

FISCAL 2004 COMPARED TO FISCAL 2003: CURRENT TRENDS

AND OUTLOOK The Company’s focus is on building, maintain-

ing and managing the aspirational positioning of its brands.

Management believes that this strategy will allow the Company to

maintain high margins over the long-term while driving the

Company’s growth in sales and profits through the development

of new brands. Management expects Hollister to be a significant

growth vehicle for the Company domestically, while it continues to

differentiate the Abercrombie & Fitch brand from the competition

by emphasizing high-quality and fashion content. Management

believes that Abercrombie & Fitch’s success will continue to favor-

ably impact abercrombie’s business. While the Company is

encouraged by the results of the RUEHL launch, the brand is still

in its early development and as such the Company expects

RUEHL to sustain operating losses in 2005 and 2006.

In order to achieve and, thereafter, maintain the aspirational

positioning of the brands, the Company will continue to manage

its expenditures to maintain and enhance the current store base

and complement the new stores being opened. The Company

will also continue its store investment program to focus on improv-

ing the customer’s in-store experience through enhanced cus-

tomer service and improved merchandise presentation. Further,

the Company expects to invest in higher inventories to ensure in-

stock size and color assortments. While these initiatives will increase

the Company’s selling costs, management believes the enhanced

aspirational image of the Company’s brands and improved cus-

tomer service will have a positive impact on the Company’s sales

and profit performance.

The Company is planning to open up to five stores in Canada

during fiscal 2005. Further, in February 2005, the Company estab-

lished two European subsidiaries that are expected to begin opening

stores in Europe by 2006.

FOURTH QUARTER 2004: NET SALES Net sales for the fourth

quarter of the 2004 fiscal year were $687.3 million, up 22.6% ver-

sus last year’s fourth quarter net sales of $560.4 million. The net

sales increase was attributable to the net addition of 88 stores

during the 2004 fiscal year, a comparable store sales increase of

9% for the quarter and an increase in the direct-to-consumer

business net sales of $11.1 million versus the comparable period

in the 2003 fiscal year.

By merchandise brand, comparable store sales for the quarter

were as follows: Abercrombie & Fitch increased 4% with men’s

comparable store sales increasing by a high-single digit percentage

and women’s increasing by a low-single digit percentage. abercrom-

bie, the kids’ business, achieved a 16% increase in comparable store

sales with girls attaining a high-teen positive increase and boys

increasing by a low double-digit percentage. In Hollister, compara-

ble store sales increased by 19% for the fourth quarter with guys

posting a high-teen increase and girls realizing an increase in the

low-twenties.

On a regional basis, comparable store sales results across all

three brands were strongest along the East Coast and in the West

and weakest in the Midwest. However, all regions reported posi-

tive comparable store sales for the quarter. Stores located in New

York City metropolitan area, Florida, Philadelphia metropolitan

area and Southern California had the best comparable store sales

performance.

The Company committed to a more aspirational and less pro-

motional strategy in early 2004 which it maintained throughout

the year. As such, the Company did not anniversary the direct mail

promotions used during the fourth quarter of the 2003 fiscal year

to drive business between Thanksgiving and Christmas.

In Abercrombie & Fitch, the men’s comparable store sales

increase for the quarter was driven by strong performances in

graphic tees, denim, and woven shirts. Women’s comparable store

sales growth was driven by an increase in polos, denim and fleece,

offset by a decrease in sweaters.

In the kid’s business, for the quarter, girls had comparable

store sales increases across most of the categories, especially polos,

denim and graphic tees. Boys’ comparable store sales increase was

driven by graphic tees, denim and fleece.

In Hollister, girls achieved a slightly higher comparable store

sales increase than guys. In girls, polos, denim and fleece had strong

comparable store sales increases. The increase in the guys’ com-

parable store sales was the result of a strong performance in

graphic tees, denim and woven shirts categories for the quarter.

The impact of the four RUEHL stores was immaterial to the

Company’s total net sales for the fourth quarter of the 2004 fiscal year.

Direct-to-consumer merchandise net sales, which are sold

through the Company’s web sites and catalogue, in the fourth

quarter of the 2004 fiscal year, were $40.1 million, an increase of

29.4% versus last year’s fourth quarter net sales of $31.0 million.

Shipping and handling revenue for the corresponding periods was

$5.5 million in 2004 and $3.5 million in 2003. The direct-to-con-

sumer business, including shipping and handling revenue,

accounted for 6.6% of net sales in the fourth quarter of fiscal 2004

compared to 6.2% in the fourth quarter of fiscal 2003.

GROSS INCOME The Company’s gross income may not be com-

parable to those of other retailers since all significant costs related

to the Company’s distribution network, excluding direct shipping

costs related to direct-to-consumer sales, are included in general,

administrative and store operating expenses (see “General,

Abercrombie &Fitch

12 13

MANAGEMENT’S DISCUSSION AND ANALYSIS