Abercrombie & Fitch 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Abercrombie &Fitch

27

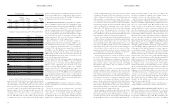

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Thousands)2004 2003 2002

Operating Activities

Net Income $ 216,376 $ 204,830 $ 194,754

Impact of Other Operating Activities on Cash Flows

Depreciation and Amortization 105,814 89,539 75,951

Amortization of Deferred Lease Credits (32,794) (24,774) (21,061)

Non-cash Charge for Deferred Compensation 10,372 5,310 2,295

Deferred Taxes 3,942 7,126 21,092

Non-cash Charge for Asset Impairment 1,190 – 1,251

Loss on Disposal of Assets 4,664 ––

Lessor Construction Allowances 55,009 60,649 52,686

Changes in Assets and Liabilities

Inventories (34,445) (27,397) (34,430)

Accounts Payable and Accrued Expenses 105,524 8,054 43,301

Income Taxes 18,967 10,459 17,022

Other Assets and Liabilities (28,494) 8,749 (7,029)

Net Cash Provided by Operating Activities 426,125 342,545 345,832

Investing Activities

Capital Expenditures (185,065) (159,777) (145,662)

Purchases of Marketable Securities (4,314,070) (3,849,077) (2,729,271)

Proceeds from Sales of Marketable Securities 4,788,770 3,771,085 2,418,661

Collection of Note Receivable –– 4,954

Net Cash Provided by (Used for) Investing Activities 279,635 (237,769) (451,318)

Financing Activities

Change in Outstanding Checks 20,404 4,145 4,047

Purchases of Treasury Stock (434,658) (115,670) (42,691)

Stock Option Excercises and Other 48,927 19,767 (282)

Dividends Paid (46,438) ––

Net Cash Used For Financing Activities (411,765) (91,758) (38,926)

Net Increase in Cash and Equivalents 293,995 13,018 (144,412)

Cash and Equivalents, Beginning of Year 56,373 43,355 187,767

Cash and Equivalents, End of Year $ 350,368 $ 56,373 $ 43,355

Significant Non-Cash Investing Activities

Change in Accrual for Construction in Progress $ (15,513) $ 18,589 $ (12,658)

The accompanying Notes are an integral part of these Consolidated Financial Statements.

Abercrombie &Fitch

26

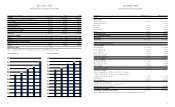

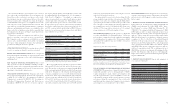

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Stock Treasury Stock

Total

Shares Par Paid-In Retained At Average Shareholders’

(Thousands)Outstanding Value Capital Earnings Shares Cost Equity

Balance, February 2, 2002 98,873 $1,033 $141,394 $ 506,501 4,426 $ (66,533) $582,395

Purchase of Treasury Stock (1,850) – – – 1,850 (42,691) (42,691)

Net Income – – – 194,754 – – 194,754

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 164 – – – 164

Stock Options, Restricted Stock and Other 246 – 1,019 – (245) 666 1,685

Balance, February 1, 2003 97,269 $1,033 $142,577 $ 701,255 6,031 $(108,558) $736,307

Purchase of Treasury Stock (4,401) – – – 4,401 (115,670) (115,670)

Net Income – – – 204,830 – – 204,830

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 9,505 – – – 9,505

Stock Options, Restricted Stock and Other 1,739 – (12,943) – (1,740) 35,736 22,793

Balance, January 31, 2004 94,607 $1,033 $139,139 $ 906,085 8,692 $(188,492) $857,765

Purchase of Treasury Stock (11,151) – – – 11,151 (434,658) (434,658)

Net Income – – – 216,376 – – 216,376

Dividends ($0.50 per share) – – – (46,438) – – (46,438)

Tax Benefit from Exercise of Stock

Options and Vesting of Restricted Stock – – 17,308 – – – 17,308

Stock Options, Restricted Stock and Other 2,580 – (16,196) – (2,580) 75,169 58,973

Balance, January 29, 2005 86,036 $1,033 $140,251 $1,076,023 17,263 $(547,981) $669,326

The accompanying Notes are an integral part of these Consolidated Financial Statements.

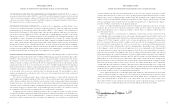

Shareholders’ Equity ($ in Millions) Net Income per Diluted Share

2000 2001 2002 2003 2004

$100

$200

$300

$400

$500

$600

$700

$800

$900

$412

2000 2001 2002 2003 2004

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

$2.00

$2.20

$2.40

$1.54 $1.62

$1.94

$2.06

$2.28

$736

$669

$858

$582