Abercrombie & Fitch 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to $215 million is planned to be for the construction of approxi-

mately 87 new stores as well as the remodeling of 25 to 35 existing

stores. The balance of the capital expenditures will primarily relate

to a new home office building and other miscellaneous home office

and distribution center projects.

The Company intends to add approximately 520,000 gross

square feet of stores in the 2005 fiscal year, which will represent a

9% increase over year-end 2004. Management anticipates the

increase during fiscal 2005 will be due to the net addition of

approximately 67 new Hollister stores, 5 RUEHL stores and 5

international stores. Additionally, the Company plans to remodel

25 to 35 Abercrombie & Fitch stores and convert a total of 9

Abercrombie & Fitch and abercrombie stores to 8 Hollister stores

and one RUEHL store. In addition the Company plans to open a

new 34,000 gross square foot flagship store on the corner of Fifth

Avenue and 56th Street in Manhattan, New York and expand its

store in The Grove in Los Angeles by approximately 14,000 gross

square feet.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for new Abercrombie &

Fitch stores, excluding the above mentioned New York and Los

Angeles flagship stores, opened during the 2005 fiscal year will

approximate $618,000 per store, net of construction allowances. In

addition, initial inventory purchases for the stores are expected to

average approximately $270,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for new abercrombie

stores opened during the 2005 fiscal year will approximate

$581,000, net of construction allowances, per store. In addition,

initial inventory purchases are expected to average approximately

$130,000 per store.

The Company estimates that the average cost for leasehold

improvements and furniture and fixtures for new Hollister stores

opened during the 2005 fiscal year will approximate $613,000, net

of construction allowances, per store. In addition, initial inventory

purchases are expected to average approximately $190,000 per store.

Although the Company opened four RUEHL stores during

the 2004 fiscal year, it believes that the costs it has incurred to-

date for the stores are not representative of the future average cost

of opening a store.

The Company expects that substantially all future capital

expenditures will be funded with cash from operations. In addi-

tion, the Company has $250 million available (less outstanding

letters of credit) under its Credit Agreement to support operations.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES The

Company’s discussion and analysis of its financial condition and

results of operations are based upon the Company’s consolidated

financial statements, which have been prepared in accordance with

accounting principles generally accepted in the United States

(“GAAP”). The preparation of these financial statements requires

the Company to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenues and expenses. Since

actual results may differ from those estimates, the Company revises

its estimates and assumptions as new information becomes available.

The Company’s significant accounting policies can be found

in the Notes to Consolidated Financial Statements (see Note 2 of

the Notes to Consolidated Financial Statements). The Company

believes that the following policies are most critical to the portray-

al of the Company’s financial condition and results of operations.

Revenue Recognition - The Company recognizes retail sales at

the time the customer takes possession of the merchandise and pur-

chases are paid for, primarily with either cash or credit card.

Catalogue and e-commerce sales are recorded upon customer

receipt of merchandise. Amounts relating to shipping and handling

billed to customers are classified as revenue and the direct shipping

costs are classified as cost of goods sold. Employee discounts are

classified as a reduction of revenue. The Company reserves for sales

returns through estimates based on historical experience and vari-

ous other assumptions that management believes to be reasonable.

The Company accounts for gift cards by recognizing a liabili-

ty at the time when a gift card is sold. Revenue is recognized when

the gift card is redeemed for merchandise. The Company reviews

its gift card liability at least annually and adjusts the liability based

on historical redemption patterns as required.

Inventory Valuation - Inventories are principally valued at the

lower of average cost or market, on a first-in first-out basis, utiliz-

ing the retail method. The retail method of inventory valuation is

an averaging technique applied to different categories of inventory.

At the Company, the averaging is determined at the stock keeping

unit (“SKU”) level by averaging all costs for each SKU. An initial

markup is applied to inventory at cost in order to establish a cost-

to-retail ratio. Permanent markdowns, when taken, reduce both

the retail and cost components of inventory on hand so as to main-

tain the already established cost-to-retail relationship. The use of

the retail method and the recording of markdowns effectively val-

ues inventory at the lower of cost or market. The Company fur-

ther reduces inventory by recording an additional markdown

reserve using the retail carrying value of inventory from the season

just passed. Markdowns on this carryover inventory represent esti-

mated future anticipated selling price declines.

Additionally, as part of inventory valuation, an inventory

shrinkage estimate is made each period that reduces the value of

inventory for lost or stolen items. Inherent in the retail method

Abercrombie &Fitch

21

Abercrombie &Fitch

$42.8 million were outstanding under the Credit Agreement at

January 29, 2005 and January 31, 2004, respectively. No borrowings

were outstanding under the Credit Agreement at January 29, 2005

or January 31, 2004.

The Company has standby letters of credit in the amount of $4.7

million that are set to expire during the fourth quarter of the 2005 fis-

cal year. The beneficiary, a merchandise supplier, has the right to

draw upon the standby letters of credit if the Company authorizes or

files a voluntary petition in bankruptcy. To date, the beneficiary has

not drawn upon the standby letters of credit.

OFF-BALANCE SHEET ARRANGEMENTS The Company does

not have any off-balance sheet arrangements or debt obligations.

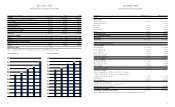

CONTRACTUAL OBLIGATIONS As of January 29, 2005, the

Company’s contractual obligations were as follows:

Payments due by period (thousands):

Contractual Less than More than

Obligations Total 1 year 1-3 years 3-5 years 5 years

Operating

Lease $1,256,107 $164,577 $323,255 $282,525 $485,750

Obligations

Purchase

Obligations $ 222,404 $215,971 $ 6,433 – –

Other

Obligations $ 65,167 $ 64,372 $ 795 – –

Totals $1,543,678 $444,920 $330,483 $282,525 $485,750

The majority of the Company’s contractual obligations are

made up of operating leases for its stores (see Note 5 of the Notes

to Consolidated Financial Statements). The purchase obligations

category represents purchase orders for merchandise to be deliv-

ered during Spring 2005 and commitments for fabric to be used

during the next several seasons. Other obligations represent pre-

ventive maintenance contracts for the 2005 fiscal year and letters of

credit outstanding as of January 29, 2005 (see Note 8 of the Notes

to Consolidated Financial Statements). The Company expects to

fund all of these obligations with cash provided from operations.

STORES AND GROSS SQUARE FEET Store count and gross

square footage by brand were as follows:

Number of Stores January 29, 2005 January 31, 2004

Abercrombie & Fitch 357 357

abercrombie 171 171

Hollister 256 172

RUEHL 4 –

Total 788 700

Gross square feet at

period-end (thousands) January 29, 2005 January 31, 2004

Abercrombie & Fitch 3,138 3.152

abercrombie 752 753

Hollister 1,663 1,111

RUEHL 37 –

Total 5,590 5,016

Average store size at

period-end (gross square feet) January 29, 2005 January 31, 2004

Abercrombie & Fitch 8,790 8,828

abercrombie 4,399 4,401

Hollister 6,495 6,461

RUEHL 9,350 –

Total 7,094 7,165

CAPITAL EXPENDITURES AND LESSOR CONSTRUCTION

ALLOWANCES Capital expenditures totaled $185.1 million, $159.8

million and $145.7 million for the 2004, 2003 and 2002 fiscal years,

respectively. Additionally, the non-cash accrual for construction in

progress decreased $15.5 million and $12.7 million in fiscal 2004 and

fiscal 2002, respectively, and increased $18.6 million in fiscal 2003.

Capital expenditures in the 2004 fiscal year related primarily to new

store construction in addition to approximately $15.4 million invested

in information technology, home office expansion and distribution

center projects. Capital expenditures in the 2003 fiscal year related

primarily to new store construction with approximately $35.0 mil-

lion invested in home office expansion, information technology,

including a new point-of-sale system and distribution center projects.

Capital expenditures in the 2002 fiscal year related primarily to new

store construction with approximately $20.0 million invested in

information technology and distribution center projects.

Lessor construction allowances are an integral part of the deci-

sion making process for assessing the viability of new store leases.

In making the decision whether to invest in a store location, the

Company calculates the estimated future return on its investment

based on the cost of construction, less any construction allowances

to be received from the landlord. The Company received $55.0

million, $60.6 million and $52.7 million in construction

allowances during the 2004, 2003 and 2002 fiscal years, respective-

ly. For accounting purposes, the Company treats construction

allowances as a deferred lease credit which is amortized to reduce

rent expense on a straight-line basis over the life of the leases in

accordance with Statement of Financial Accounting Standards

No.13, “Accounting for Leases” and Financial Accounting

Standards Board Technical Bulletin No. 88-1, “Issues Relating to

Accounting for Leases”.

The Company anticipates spending $240 million to $250 million

in the 2005 fiscal year for capital expenditures, of which $205 million

20